STOCKS, BONDS, OR GOLD

WHICH WILL GAIN THE MOST AFTER RATE CUTS?

Why are Fed rate cuts relevant to you?

Yield Decline

As rates drop, cash yields above 5% will vanish.

Assets up

Bonds and stocks, which usually rise as interest rates fall, are poised for gains.

Portfolio Tuning

Enhance returns by adjusting your stock-to-bond ratio and lowering cash holdings.

Assets deserve attention

Ride the wave of opportunity

Big Tech

Strong earnings, volatile prices

Earnings Stability: Exhibits robust earnings, though impacted by greater price volatility.

Risk: Be prepared for market-driven fluctuations.

Strategy: Consider regular investments in diversified tech ETFs like QQQ, balancing potential long-term gains against short-term volatility.

Learn more

Small-Cap

Advantageous in low-rate environments

Rate Sensitivity: Typically outperforms larger companies during periods of declining interest rates.

Diverse Sectors: Spreads across finance, healthcare, industrials, tech, and consumer goods.

Low Barrier: Russell 2000 ETF (IWM), VB, DFSV allow easy access to nearly 2000 small-cap companies.

Learn more

US Treasuries

High yields won’t last

Opportunity: High current yields are temporary; ideal for timely investment.

Security: Offers significant security with low risk, suitable for large-volume investments.

Long-Term: The 20- year bond ETF(TLT)has a big potential.*

*Based on the September 4, 2024 price of $97.75, with a historical high of $179.7.

Learn more

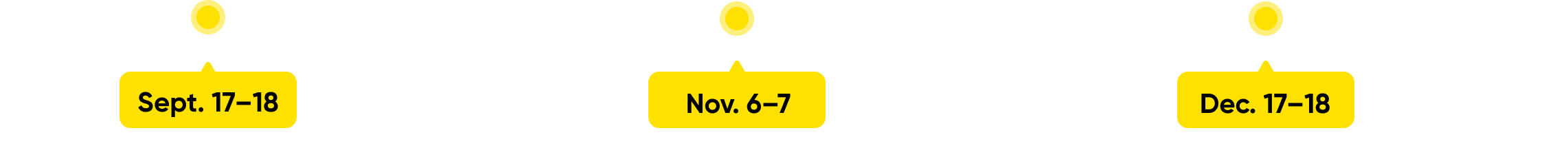

2024 FOMC Meetings

Watch stream live

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Trading special

*Please go to the Tiger Trade APP - "Rewards Center" to view the instructions and requirements for using rewards.

Not financial advice. All investment involves risk.

Investment opportunities

Big Tech

Small-Cap

US Treasuries

*T&Cs apply. This is not financial advice. The information provided is for reference only. The content may refer to financial advice provided by third parties, and such advice has not been assessed or endorsed by Tiger. Investing carries risk. Please visit tigerbrokers.nz for further details.