ABG to Acquire Herb Chambers: Is the Stock Worth Buying Now?

Asbury Automotive Group ABG has inked a deal to acquire several automotive dealerships from The Herb Chambers Companies, one of the largest private dealership groups in the country.

The deal includes 33 dealerships, 52 car franchises and three repair centers. The sale is expected to be completed by late second quarter of 2025, subject to customary closing conditions. Asbury will finance the $1.34 billion acquisition via a mix of loans, mortgage funds and cash.

This acquisition will significantly expand ABG’s presence in the New England market, strengthen its position as a leading auto retailer in the United States, and is also likely to boost the company’s top-line growth.

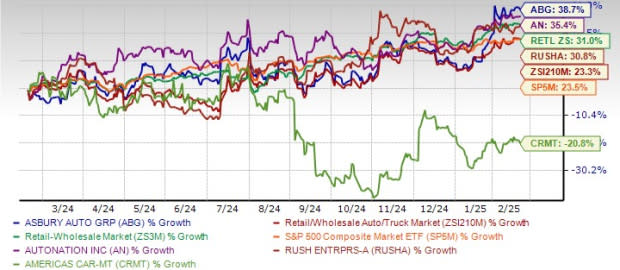

In the trailing 12-month period, ABG shares have surged 38.7%, outperforming the Zacks Retail and Wholesale sector’s appreciation of 31% and the Zacks Automotive – Retail and Whole Sales industry’s return of 23.3%. The S&P 500 index has gained 23.5% in the same time frame.

Asbury shares have also outperformed industry peers like AutoNation AN, Rush Enterprises RUSHA and America’s CarMart CRMT in the trailing 12-month period.

While AN and RUSHA shares have surged 35.4% and 30.8%, respectively, CRMT shares have plunged 20.8%.

ABG’s exceptional performance can be attributed to its strong new vehicle sales, solid Parts & Service growth and rapid digital and technological advancements.

One Year Performance

Image Source: Zacks Investment Research

So is this the right time for investors to start accumulating the stock? Let us dig deep to find out.

Robust Sales Growth Bodes Well for Asbury

ABG is benefiting from solid growth in its new vehicle sales and profitability. In the fourth quarter of 2024, same-store new vehicle sales increased 7% year over year and 12% sequentially, with strong demand for its luxury brands as well as Hyundai, Kia, General Motors and Ford. The average new vehicle gross profit per unit was $3,661, helping sustain overall profitability.

Asbury’s Parts & Service segment has been delivering impressive results, with same-store gross profit rising 11% and the high-margin Customer Pay segment up 13% in the fourth quarter of 2024. This segment provides recurring revenues to ABG, making the business more resilient.

ABG’s Clicklane is allowing the company to differentiate itself by selling both new and used vehicles online. It has been seeing rapid growth, with 51,000 units sold in 2024, a 13% increase from 2023.

ABG Shares Undervalued

Asbury’s shares are undervalued, as suggested by the Value Score of A. In terms of the forward 12-month price/sales, the stock is currently trading at 0.34x, lower than the broader sector’s 1.68x.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

The stock is trading above the 50-day and 200-day moving averages, indicating a bullish trend.

ABG Shares Trade Above 50-Day & 200-Day SMA

Image Source: Zacks Investment Research

Key Headwinds for Asbury

Despite the strong performance, ABG is facing several challenges that are likely to pressure its stock. Inventory constraints, especially in the used vehicle segment, remain a concern. The company expects supply challenges to continue throughout 2025, limiting volume growth. The rising new vehicle incentives are also creating downward pressure on used vehicle pricing and are likely to reduce ABG’s margins.

Macroeconomic risks, including interest rate fluctuations, tariff hikes and consumer demand uncertainty, are also posing challenges for Asbury. The huge planned capital expenditures for 2025 and 2026 can limit ABG’s short-term flexibility and weigh on investor sentiment.

ABG’s 2025 Earnings Estimates Trend Downward

The Zacks Consensus Estimate for ABG’s first-quarter 2025 revenues is pegged at $4.3 billion, indicating year-over-year growth of 2.44%. The consensus mark for first-quarter EPS is currently pegged at $6.76, down 4.1% over the past 30 days and indicating a decline of 6.24% on a year-over-year basis.

The Zacks Consensus Estimate for ABG’s full-year 2025 revenues is pegged at $17.21 billion, indicating year-over-year growth of 0.13%. The consensus mark for 2025 EPS is currently pegged at $26.80, down 0.7% over the past 30 days and indicating a decline of 1.62% on a year-over-year basis.

Asbury beat the Zacks Consensus Estimate for earnings in just one of the trailing four quarters and missed thrice, the average negative surprise being 1.17%.

What Should Investors Do With ABG Stock?

While Asbury’s acquisition of The Herb Chambers Companies and strong sales are making the company poised for long-term growth, its ongoing inventory constraints and macroeconomic risks may create headwinds for the stock in the near term.

ABG currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Rush Enterprises, Inc. (RUSHA) : Free Stock Analysis Report

America's Car-Mart, Inc. (CRMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10