Unveiling the Dividend Prospects of Kayne Anderson NextGen Energy and Infrastructure Inc

An In-depth Analysis of KMF's Dividend Performance and Sustainability

Kayne Anderson NextGen Energy and Infrastructure Inc(NYSE:KMF) recently announced a dividend of $0.16 per share, payable on 2023-10-10, with the ex-dividend date set for 2023-09-29. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's deep dive into Kayne Anderson NextGen Energy and Infrastructure Incs dividend performance and assess its sustainability.

What Does Kayne Anderson NextGen Energy and Infrastructure Inc Do?

- Warning! GuruFocus has detected 2 Warning Sign with KMF. Click here to check it out.

- High Yield Dividend Stocks in Gurus' Portfolio

- This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

- How to calculate the intrinsic value of a stock?

Kayne Anderson NextGen Energy and Infrastructure Inc is a non-diversified, closed-end fund. The company's investment objective is to provide a high level of total return with an emphasis on making cash distributions to the stockholders. The company seeks to achieve its investment objective by investing at least 80% of the total assets in the securities of Energy Companies and Infrastructure Companies. It invests in public MLPs, midstream C-corporations, and energy-related debt.

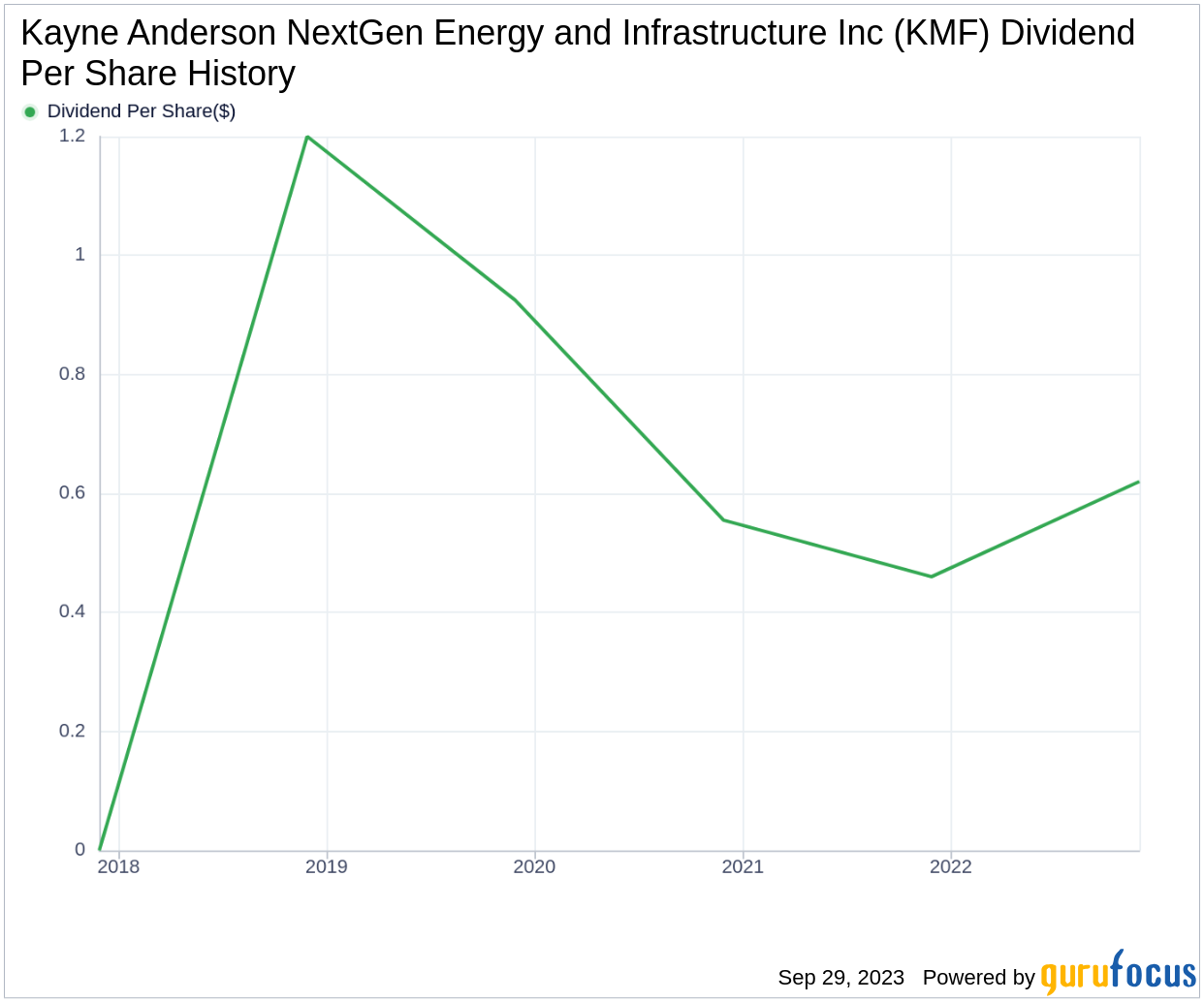

A Glimpse at Kayne Anderson NextGen Energy and Infrastructure Inc's Dividend History

Kayne Anderson NextGen Energy and Infrastructure Inc has maintained a consistent dividend payment record since 2017. Dividends are currently distributed on a quarterly basis. Below is a chart showing annual Dividends Per Share for tracking historical trends.

Breaking Down Kayne Anderson NextGen Energy and Infrastructure Inc's Dividend Yield and Growth

As of today, Kayne Anderson NextGen Energy and Infrastructure Inc currently has a 12-month trailing dividend yield of 8.79% and a 12-month forward dividend yield of 8.79%. This suggests an expectation of same dividend payments over the next 12 months.

Over the past three years, Kayne Anderson NextGen Energy and Infrastructure Inc's annual dividend growth rate was -12.50%. Based on Kayne Anderson NextGen Energy and Infrastructure Inc's dividend yield and five-year growth rate, the 5-year yield on cost of Kayne Anderson NextGen Energy and Infrastructure Inc stock as of today is approximately 8.79%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-05-31, Kayne Anderson NextGen Energy and Infrastructure Inc's dividend payout ratio is 0.00.

Kayne Anderson NextGen Energy and Infrastructure Inc's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks Kayne Anderson NextGen Energy and Infrastructure Inc's profitability 2 out of 10 as of 2023-05-31, suggesting the dividend may not be sustainable. The company has reported net profit in 2 years out of past 10 years.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. Kayne Anderson NextGen Energy and Infrastructure Inc's growth rank of 2 out of 10 suggests that the company has poor growth prospects and thus, the dividend may not be sustainable.

Next Steps

In conclusion, while Kayne Anderson NextGen Energy and Infrastructure Inc has a consistent dividend payment record, its growth and profitability metrics raise concerns about the sustainability of its dividends. Investors must tread carefully and consider these factors before making investment decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10