Highest And Lowest Country ETF Dividend Yields

- US equities have outperformed the rest of the world for a long time now.

- While the US is up 58% on a total return basis during the current bull market, the rest of the world is up 13.5 percentage points less at +44.5%.

- Looking at the international dividend ETF over a longer time frame, over the last five years, it's up 20.6% in price and more than double that on a total return basis.

Henrik5000

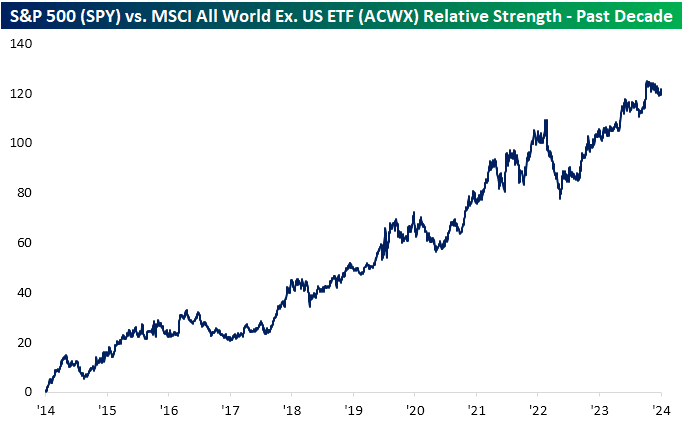

US equities have outperformed the rest of the world for a long time now. Over the past decade, the US, proxied by the S&P 500 ETF (SPY), has returned 228% compared to a 48% total return for the rest of the world as measured by the MSCI All World Ex. US ETF (ACWX). On a relative basis, US outperformance has been nearly uninterrupted over this period.

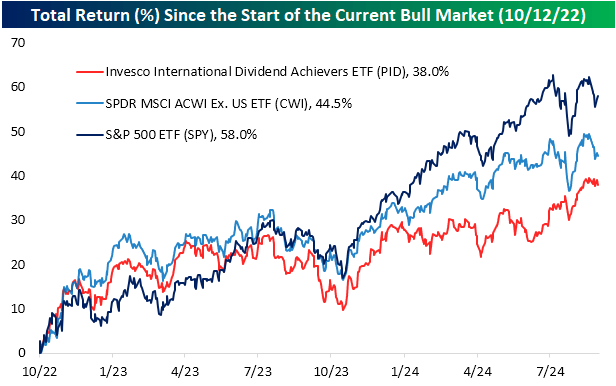

Below is a look at the performance of the US versus the rest of the world since the current bull market for global equities began on 10/12/22. In this chart, we include the S&P 500 ETF [SPY], another All World Ex. US ETF (CWI), and the Invesco International Dividend Achievers ETF (PID) which holds international stocks with higher dividend yields.

While the US [SPY] is up 58% on a total return basis during the current bull market, the rest of the world [CWI] is up 13.5 percentage points less at +44.5%. The international dividend stock ETF [PID] is up even less at just 38%.

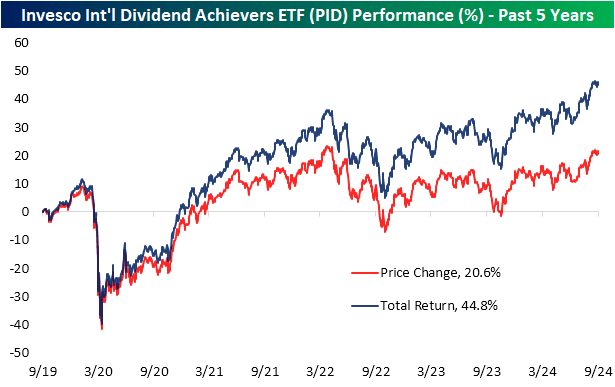

Looking at the international dividend ETF [PID] over a longer time frame, over the last five years, it's up 20.6% in price and more than double that on a total return basis. So dividends re-invested have accounted for more than half of PID's total return since late 2019.

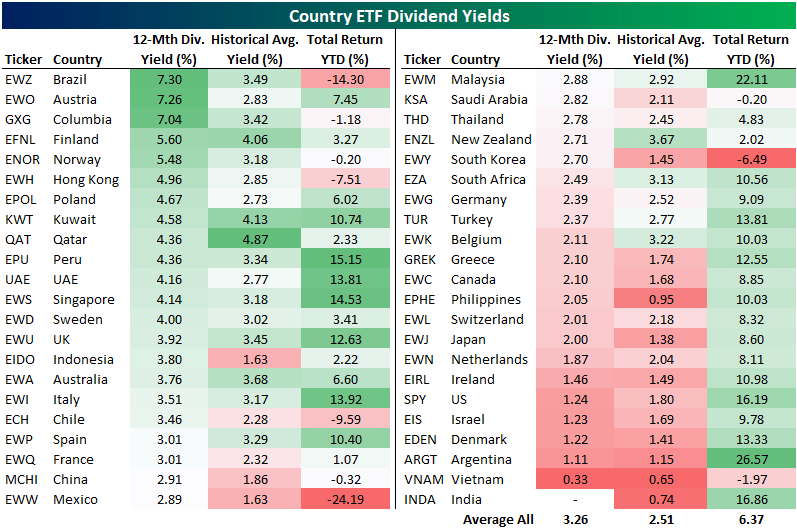

So, which country ETFs available to US investors offer the highest and lowest dividend yields? Below is a list of as many country-specific stock market ETFs that we could find along with their yield over the past 12 months, their historical average yield, and their year-to-date total return. The list is sorted from the highest 12-month dividend yield to the lowest. (It's important to understand how ETF dividends and dividends of international equities are taxed based on whether they are qualified or non-qualified. In non-taxable accounts, investors do not have to worry about the tax rate on dividends received, but in taxable accounts, international dividends are usually considered non-qualified. You can read more about dividend taxes on ETFs here.)

As shown at the bottom of the table, the average 12-month dividend yield of all country ETFs shown is 3.26%. That compares to SPY's 12-month dividend yield of just 1.24%. Currently, the US ranks near the very bottom of the list when it comes to dividend yields. There are a good chunk of country ETFs that currently yield more than the 2-year and 10-year Treasury notes.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10