Dongjiang Environmental Company Limited's (HKG:895) biggest owners are individual investors who got richer after stock soared 16% last week

Key Insights

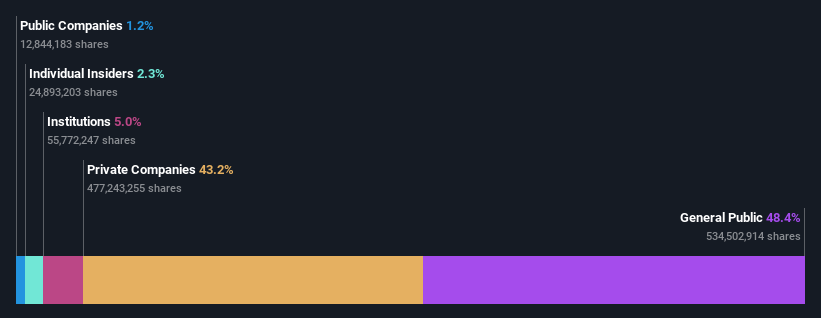

- Significant control over Dongjiang Environmental by individual investors implies that the general public has more power to influence management and governance-related decisions

- A total of 7 investors have a majority stake in the company with 51% ownership

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

To get a sense of who is truly in control of Dongjiang Environmental Company Limited (HKG:895), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are individual investors with 48% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

Clearly, individual investors benefitted the most after the company's market cap rose by HK$243m last week.

Let's take a closer look to see what the different types of shareholders can tell us about Dongjiang Environmental.

Check out our latest analysis for Dongjiang Environmental

What Does The Institutional Ownership Tell Us About Dongjiang Environmental?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

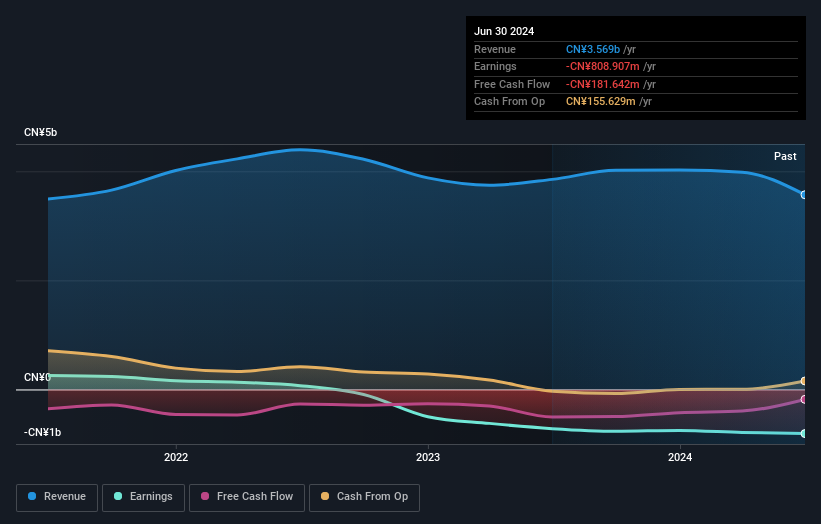

We can see that Dongjiang Environmental does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Dongjiang Environmental's historic earnings and revenue below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Dongjiang Environmental. Our data shows that Guangdong Rising Holdings Group Co.,Ltd is the largest shareholder with 26% of shares outstanding. In comparison, the second and third largest shareholders hold about 11% and 4.5% of the stock.

On further inspection, we found that more than half the company's shares are owned by the top 7 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Our information suggests that there isn't any analyst coverage of the stock, so it is probably little known.

Insider Ownership Of Dongjiang Environmental

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own some shares in Dongjiang Environmental Company Limited. In their own names, insiders own HK$92m worth of stock in the HK$4.1b company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 48% stake in Dongjiang Environmental. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

It seems that Private Companies own 43%, of the Dongjiang Environmental stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Dongjiang Environmental better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Dongjiang Environmental .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10