Shareholders May Be More Conservative With Auckland International Airport Limited's (NZSE:AIA) CEO Compensation For Now

Key Insights

- Auckland International Airport to hold its Annual General Meeting on 17th of October

- Salary of NZ$1.25m is part of CEO Carrie Hurihanganui's total remuneration

- Total compensation is 241% above industry average

- Auckland International Airport's EPS declined by 78% over the past three years while total shareholder loss over the past three years was 1.6%

As many shareholders of Auckland International Airport Limited (NZSE:AIA) will be aware, they have not made a gain on their investment in the past three years. Per share earnings growth is also poor, despite revenues growing. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 17th of October, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

View our latest analysis for Auckland International Airport

How Does Total Compensation For Carrie Hurihanganui Compare With Other Companies In The Industry?

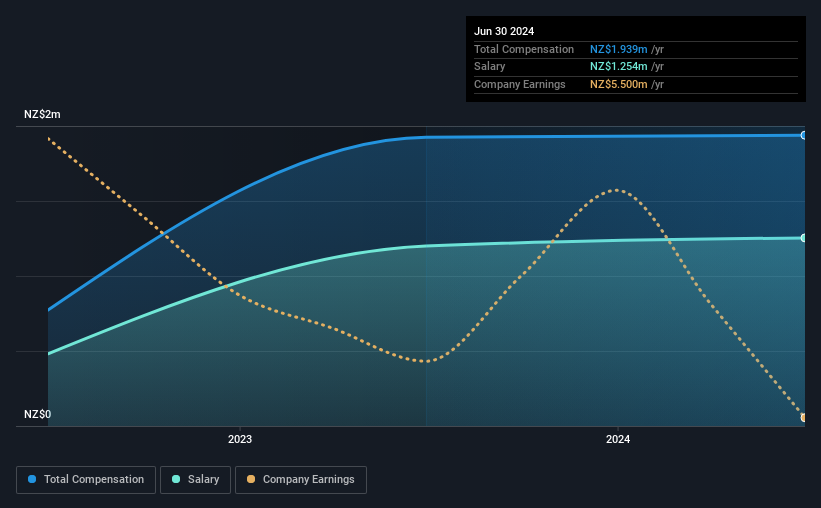

Our data indicates that Auckland International Airport Limited has a market capitalization of NZ$12b, and total annual CEO compensation was reported as NZ$1.9m for the year to June 2024. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is NZ$1.25m, represents most of the total compensation being paid.

For comparison, other companies in the New Zealand Infrastructure industry with market capitalizations ranging between NZ$6.6b and NZ$20b had a median total CEO compensation of NZ$569k. This suggests that Carrie Hurihanganui is paid more than the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | NZ$1.3m | NZ$1.2m | 65% |

| Other | NZ$685k | NZ$725k | 35% |

| Total Compensation | NZ$1.9m | NZ$1.9m | 100% |

On an industry level, roughly 65% of total compensation represents salary and 35% is other remuneration. Although there is a difference in how total compensation is set, Auckland International Airport more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Auckland International Airport Limited's Growth Numbers

Auckland International Airport Limited has reduced its earnings per share by 78% a year over the last three years. Its revenue is up 42% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Auckland International Airport Limited Been A Good Investment?

Since shareholders would have lost about 1.6% over three years, some Auckland International Airport Limited investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for Auckland International Airport that investors should be aware of in a dynamic business environment.

Switching gears from Auckland International Airport, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10