3 SGX Stocks Estimated To Be Trading At Discounts Of Up To 41.3%

The Singapore stock market has been navigating a landscape of global economic uncertainties, with investors keenly observing how these factors influence the Straits Times Index and broader market sentiment. In this environment, identifying undervalued stocks can be particularly appealing as they offer potential opportunities for growth when priced below their intrinsic value.

Top 3 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.67 | SGD7.31 | 36.1% |

| Digital Core REIT (SGX:DCRU) | US$0.595 | US$0.82 | 27.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.84 | SGD1.43 | 41.3% |

| Seatrium (SGX:5E2) | SGD2.02 | SGD3.06 | 34% |

Click here to see the full list of 4 stocks from our Undervalued SGX Stocks Based On Cash Flows screener.

Here's a peek at a few of the choices from the screener.

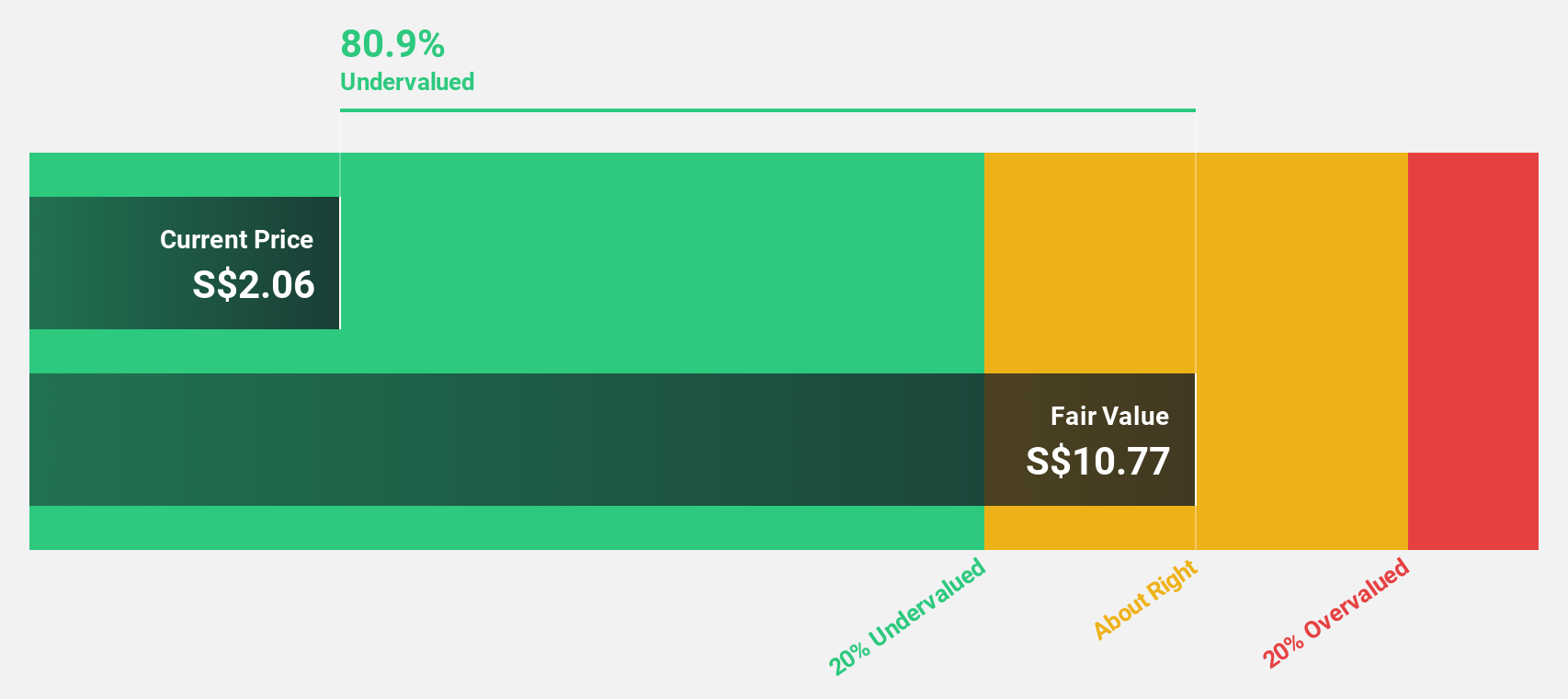

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD6.86 billion.

Operations: The company's revenue primarily comes from its Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding segment, which generated SGD8.39 billion, while Ship Chartering contributed SGD24.71 million.

Estimated Discount To Fair Value: 34%

Seatrium's valuation appears compelling, trading at S$2.02, significantly below its estimated fair value of S$3.06, and 34% under analysts' consensus targets. The company's revenue is projected to grow faster than the Singapore market at 7.1% annually, with profitability expected within three years. Recent successful project completions and a return to profitability in H1 2024 underscore its operational strength and potential for improved cash flows moving forward.

- Our expertly prepared growth report on Seatrium implies its future financial outlook may be stronger than recent results.

- Take a closer look at Seatrium's balance sheet health here in our report.

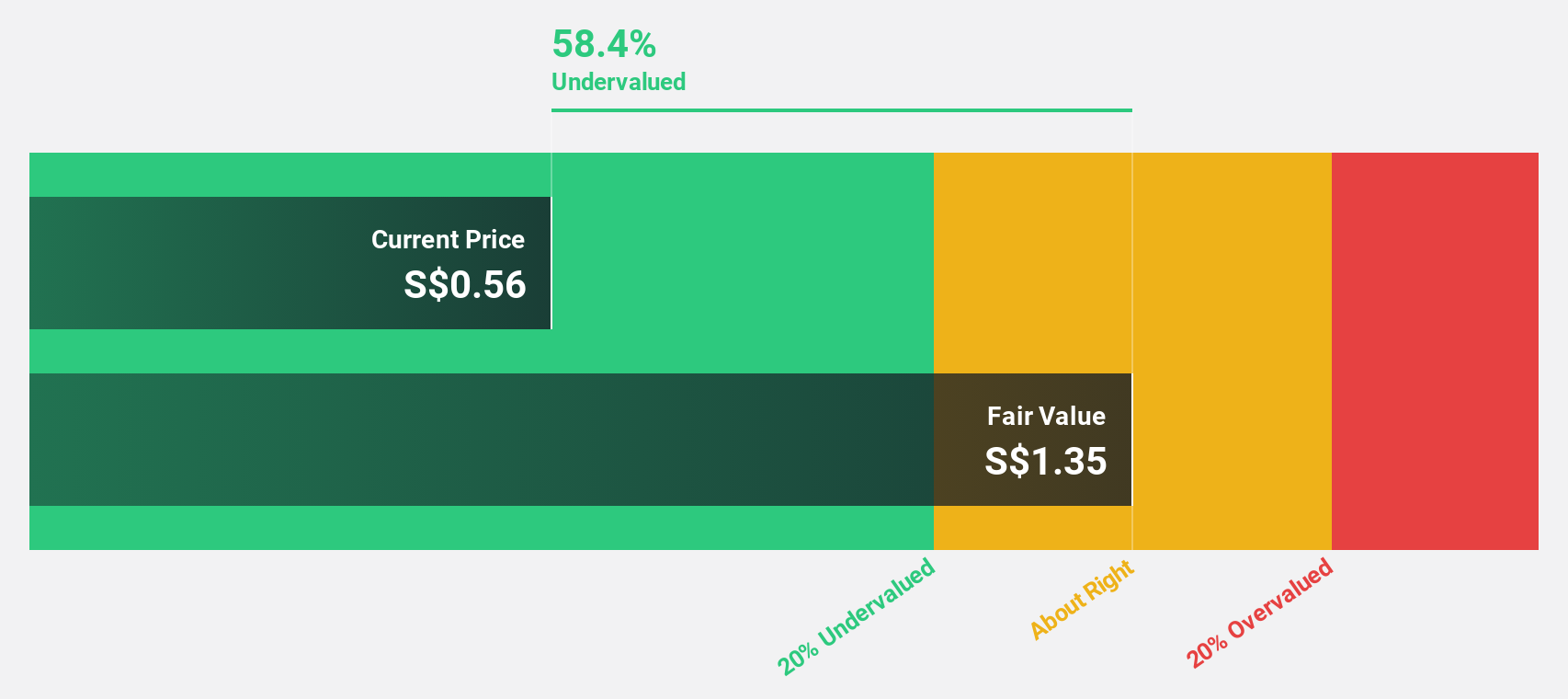

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited offers nanotechnology solutions across Singapore, China, Japan, and Vietnam with a market capitalization of SGD546.91 million.

Operations: The company's revenue segments consist of Advanced Materials at SGD153.32 million, Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen at SGD1.40 million.

Estimated Discount To Fair Value: 41.3%

Nanofilm Technologies International is trading at S$0.84, significantly below its estimated fair value of S$1.43, suggesting undervaluation based on cash flows. Despite a net loss of S$3.74 million in H1 2024, the company projects earnings growth exceeding market averages over the next three years. However, profit margins have declined from 8.7% to 3.8%. Recent executive changes and confirmed guidance for improved revenue highlight potential for future financial stability and growth.

- In light of our recent growth report, it seems possible that Nanofilm Technologies International's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Nanofilm Technologies International's balance sheet health report.

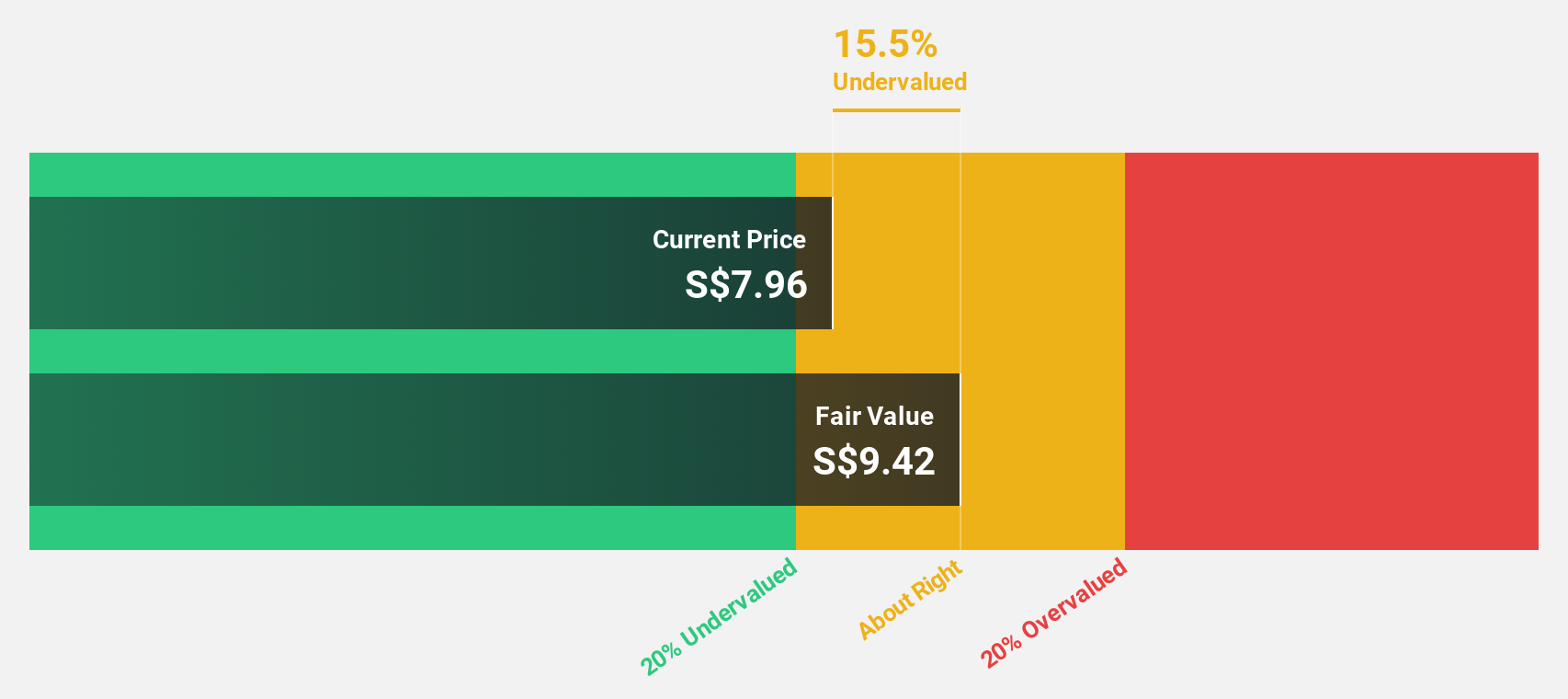

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD14.68 billion.

Operations: The company's revenue is derived from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

Estimated Discount To Fair Value: 36.1%

Singapore Technologies Engineering is trading at S$4.67, well below its estimated fair value of S$7.31, highlighting potential undervaluation based on cash flows. Recent strategic alliances in quantum-secure communications could enhance future revenue streams. Although earnings are forecast to grow faster than the Singapore market average, debt coverage by operating cash flow remains a concern. The company's recent earnings report showed increased sales and net income for H1 2024, reinforcing its growth trajectory despite dividend sustainability issues.

- The analysis detailed in our Singapore Technologies Engineering growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Singapore Technologies Engineering.

Make It Happen

- Access the full spectrum of 4 Undervalued SGX Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10