Aptos (APT) Soars to Seven-Month High, Prepares for 94% Upswing

- APT has surged 17% to $10.05, reaching a seven-month high and signaling potential for a 94% rally to $19.35.

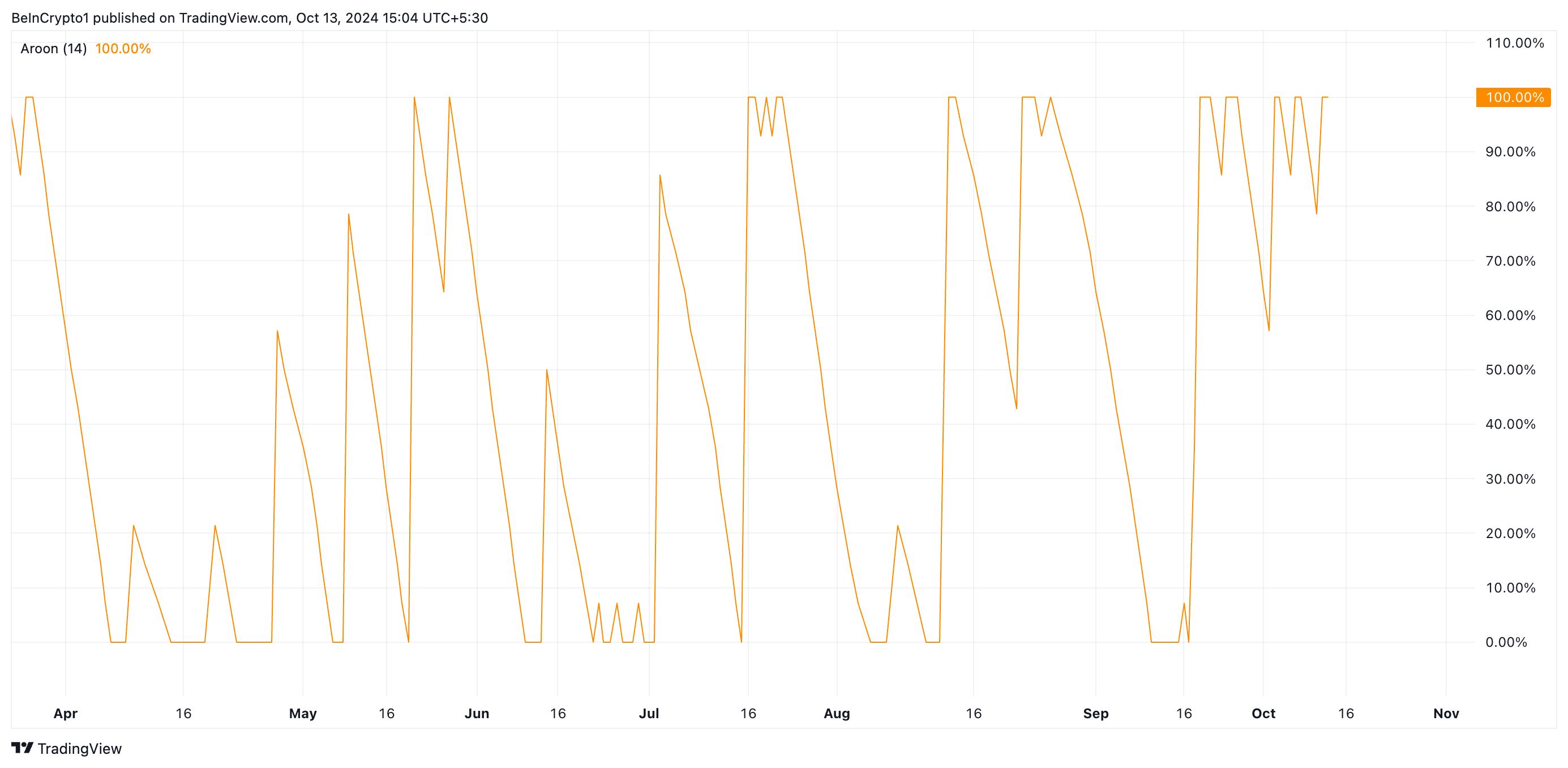

- Aroon Up Line at 100% and bullish Parabolic SAR suggest strong upward momentum and trend continuation.

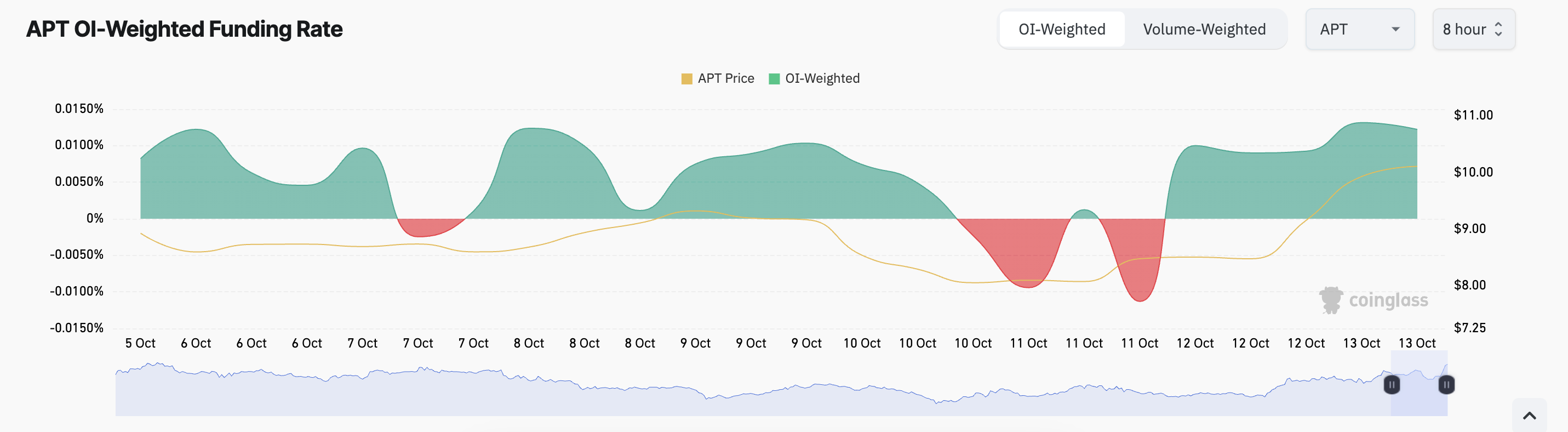

- A positive funding rate aligns with traders’ bullish sentiment, but profit-taking could trigger a pullback to $7.54.

APT, the governance token of the Layer-1 blockchain network Aptos, has witnessed a 17% uptick over the past 24 hours. It currently trades at $10.05, making it the top performer among the top 100 cryptocurrencies by market capitalization during that period.

With sustained buying pressure, APT is well-positioned to continue its upward trend. If it successfully rallies past a long-term critical resistance level, the path is clear for a double-digit rally.

APT Is the Talk Of the Town

As of this writing, APT’s Aroon Up Line sits at 100%, confirming the strength of its uptrend. The Aroon indicator, which measures trend direction and strength, shows a reading of 100% when an asset has recently reached a new high.

This holds true for APT, currently trading at $10.05, its highest price in seven months.

Read more: Aptos Crypto (APT): A Guide to What it Is and How it Works

A 100% Aroon reading is considered a strong bullish signal, indicating robust upward momentum. Traders view this as confirmation of an uptrend, suggesting buyers are in control and the price is likely to continue rising in the near term.

Additionally, the Parabolic Stop and Reverse (SAR) indicator further supports this bullish sentiment. At press time, the indicator’s dots, which signal trend direction and potential reversals, remain below APT’s price.

When the Parabolic SAR dots are positioned under an asset’s price, it suggests that the asset is enjoying upward pressure and the trend is bullish. Traders interpret this as a signal to go long and exit short positions.

According to APT’s funding rate, many of its futures traders are aligned with this bullish strategy. At press time, the coin’s funding rate is positive at 0.012%. When an asset’s funding rate is positive, many traders expect the price to continue rising, increasing demand for long positions.

APT Price Prediction: 94% Uptick on the Horizon

If APT’s price maintains this uptrend, it will rally past the long-term resistance, which it currently trades under. A successful rally past this level would position APT for a potential climb of 94%, reaching $19.35, a high it last touched in March.

Read more: Where To Buy Aptos (APT): 5 Best Platforms for 2024

However, if profit-taking activity spikes and buying pressure declines, APT’s price may shed its recent gains. It may trade down to $7.54 and potentially drop to its August 5 low of $4.32.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10