Exploring 3 Undervalued Small Caps In Hong Kong With Insider Buying

As global markets experience fluctuations, Hong Kong's small-cap sector has garnered attention amid broader market sentiment and economic changes. In light of these dynamics, identifying promising stocks often involves looking at companies with strong fundamentals and potential insider confidence, which can be key indicators in the current environment.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.6x | 41.28% | ★★★★★☆ |

| Vesync | 7.4x | 1.1x | -6.60% | ★★★★☆☆ |

| Lion Rock Group | 5.4x | 0.4x | 49.96% | ★★★★☆☆ |

| Ferretti | 10.7x | 0.7x | 47.91% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.3x | 40.43% | ★★★★☆☆ |

| China Lesso Group Holdings | 6.1x | 0.4x | -538.15% | ★★★☆☆☆ |

| Skyworth Group | 6.0x | 0.1x | -319.51% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 7.4x | 0.4x | -51.58% | ★★★☆☆☆ |

| FriendTimes | NA | 1.4x | -229.07% | ★★★☆☆☆ |

| Emperor International Holdings | NA | 0.9x | 21.61% | ★★★☆☆☆ |

Click here to see the full list of 10 stocks from our Undervalued SEHK Small Caps With Insider Buying screener.

Underneath we present a selection of stocks filtered out by our screen.

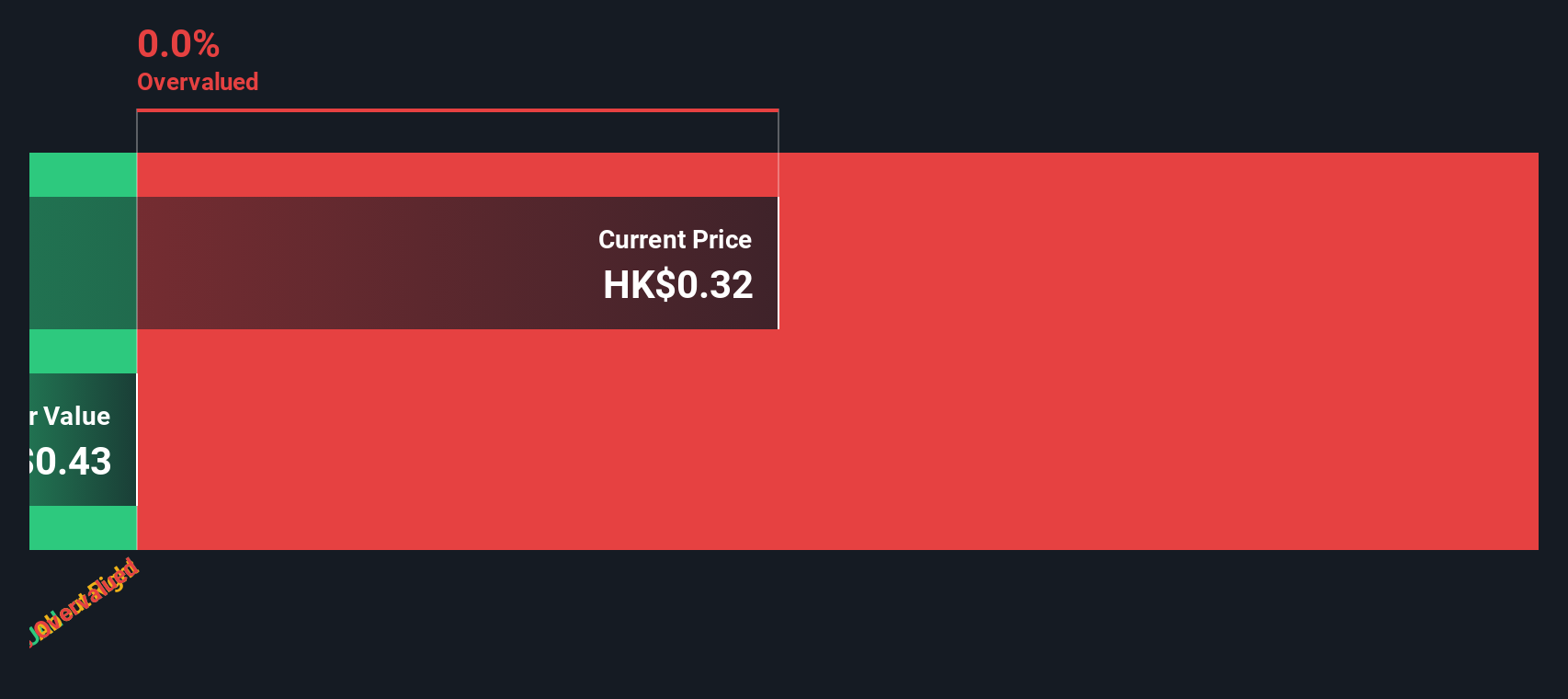

Vesync (SEHK:2148)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vesync is a company that specializes in the design, development, and sale of smart home appliances and tools, with a market capitalization of approximately HK$3.87 billion.

Operations: The company's revenue has shown a rising trend, reaching $604.75 million recently, with a significant portion of costs attributed to COGS at $311.70 million and operating expenses at $180.14 million. The gross profit margin has increased over time, reaching 48.46%.

PE: 7.4x

Vesync, a player in the Hong Kong small-cap space, recently reported strong financial performance with half-year sales reaching US$296.19 million and net income climbing to US$44.86 million from the previous year. This growth is driven by increased sales outside Amazon and improved operational efficiency. Insider confidence is evident as Zhaojun Chen purchased 200,000 shares valued at approximately HK$828,979 in August 2024. Additionally, Vesync's inclusion in the S&P Global BMI Index highlights its growing market recognition. However, reliance on external borrowing poses some risk to its funding structure.

- Delve into the full analysis valuation report here for a deeper understanding of Vesync.

Understand Vesync's track record by examining our Past report.

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment focuses on property development and property investment and management, with a market capitalization of approximately HK$5.68 billion.

Operations: The company's primary revenue streams are from Property Development, generating CN¥17.26 billion, and Property Investment and Management, contributing CN¥1.23 billion. The gross profit margin has shown variability over time, with a recent figure of 10.57%.

PE: -2.0x

Gemdale Properties and Investment, a smaller player in Hong Kong's market, has recently captured attention due to its insider confidence. Lian Huat Loh acquired 10 million shares worth about RMB 2.6 million between July and October 2024, indicating potential optimism despite the company's challenges. Over the first nine months of 2024, Gemdale reported contracted sales of RMB 14.18 billion across over one million square meters. However, financial struggles persist with significant losses reported for the first half of the year due to increased impairment losses from joint ventures and properties under development.

- Take a closer look at Gemdale Properties and Investment's potential here in our valuation report.

Gain insights into Gemdale Properties and Investment's historical performance by reviewing our past performance report.

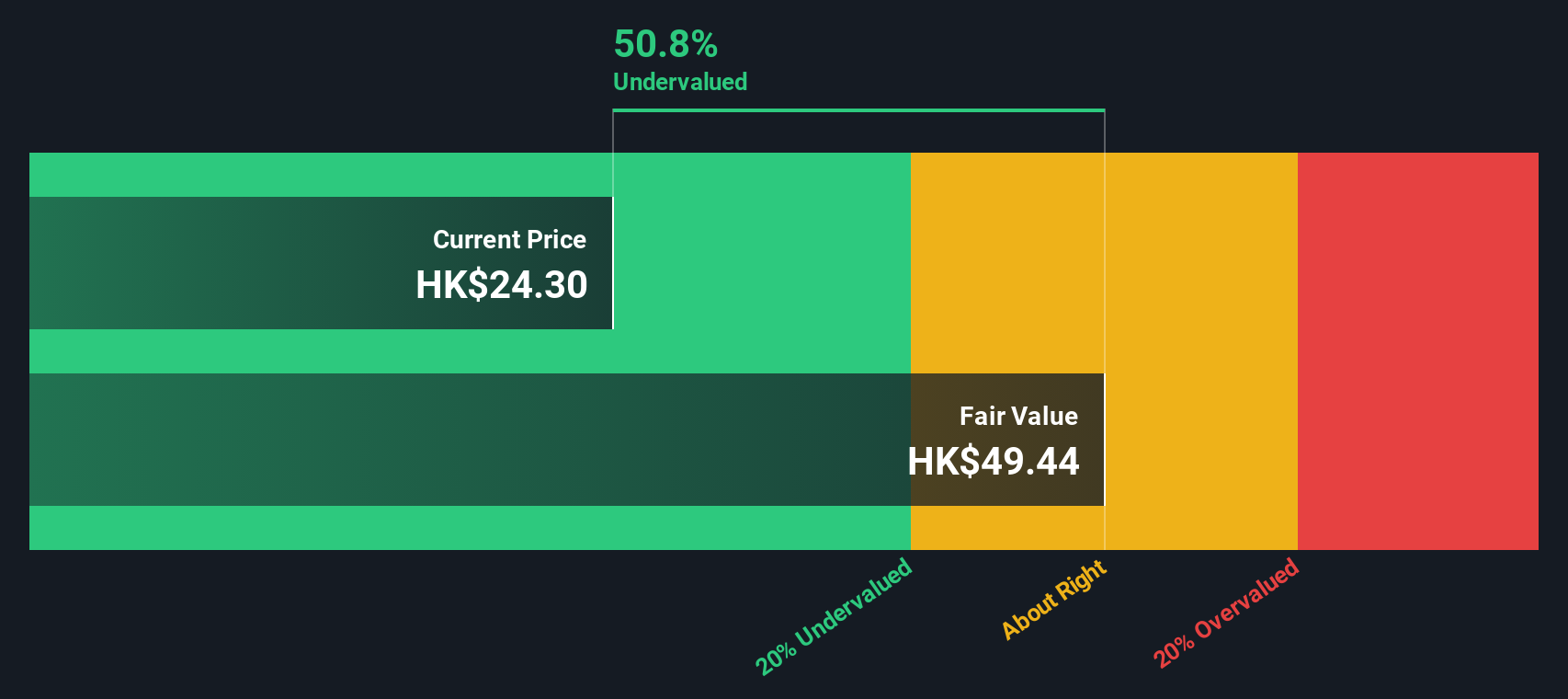

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ferretti is engaged in the design, construction, and marketing of yachts and recreational boats with a market capitalization of approximately HK$8.75 billion.

Operations: The company generates revenue primarily from the design, construction, and marketing of yachts and recreational boats. Over recent periods, its gross profit margin has shown variability, reaching 37.42% in the latest report. Operating expenses include significant allocations towards general and administrative costs.

PE: 10.7x

Ferretti, a small company in Hong Kong, recently saw a boost with their addition to the S&P Global BMI Index on September 23, 2024. Despite being dropped from the same index earlier that month, this inclusion reflects potential market confidence. The company reported sales of €695 million for the first half of 2024, up from €628 million last year. With earnings projected to grow annually by 12.8%, Ferretti's financial outlook appears promising despite relying entirely on external borrowing for funding.

- Dive into the specifics of Ferretti here with our thorough valuation report.

Evaluate Ferretti's historical performance by accessing our past performance report.

Taking Advantage

- Click through to start exploring the rest of the 7 Undervalued SEHK Small Caps With Insider Buying now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10