Zions Bancorporation (NASDAQ:ZION) reported better-than-expected third-quarter financial results on Monday.

Zions Bancorp reported quarterly earnings of $1.37 per share which beat the analyst consensus estimate of $1.17 per share. The company reported quarterly sales of $798.000 million which beat the analyst consensus estimate of $778.857 million.

Harris H. Simmons, Chairman and CEO of Zions Bancorporation, commented, “We’re pleased with the continued improvement in our financial performance, reflected in the 21% increase in earnings per share over the same period last year. The net interest margin strengthened to 3.03% from 2.93% a year ago, and operating costs increased a modest 1%. Average noninterest-bearing demand deposits decreased 1.7% relative to the prior quarter of this year, but were flat to last quarter’s ending balance, suggesting continued stabilization of this important source of low-cost funding. Tangible common equity has grown 28% over the past year, and 8% over the past quarter.”

Zions Bancorporation shares gained 6.4% to trade at $52.58 on Tuesday.

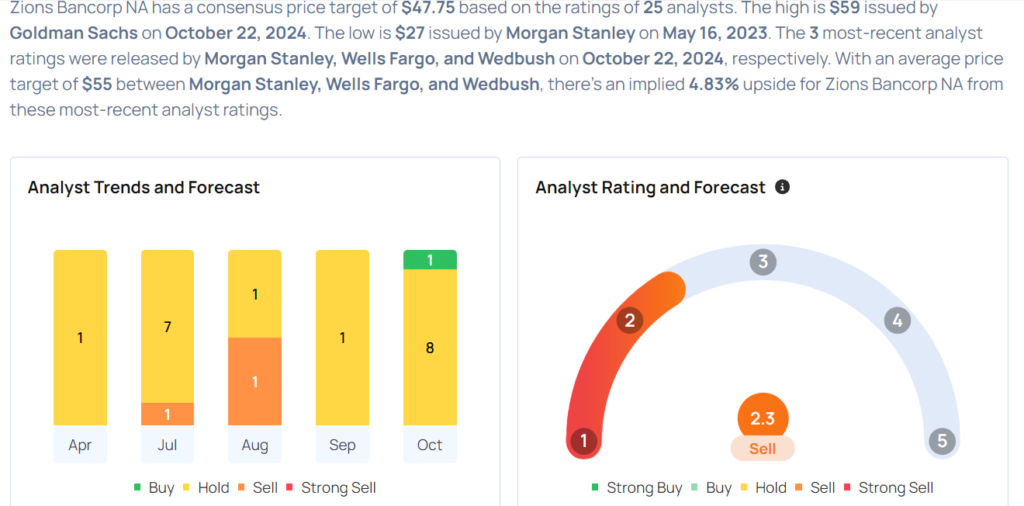

These analysts made changes to their price targets on Zions Bancorporation following earnings announcement.

- Baird analyst David George maintained Zions Bancorp with a Neutral and raised the price target from $52 to $55.

- RBC Capital analyst Jon Arfstrom maintained the stock with a Sector Perform and raised the price target from $55 to $57.

- Stephens & Co. analyst Terry McEvoy maintained the stock with an Equal-Weight and increased the price target from $53 to $55.

- Goldman Sachs analyst Ryan Nash maintained Zions Bancorp with a Neutral and raised the price target from $52 to $59.

- Keefe, Bruyette & Woods analyst Christopher Mcgratty maintained Zions Bancorp with a Market Perform and raised the price target from $53 to $56.

- Wedbush analyst David Chiaverini maintained Zions Bancorp with a Neutral and raised the price target from $52 to $55.

- Wells Fargo analyst Mike Mayo maintained the stock with an Equal-Weight and raised the price target from $50 to $54.

- Morgan Stanley analyst Ken Zerbe maintained Zions Bancorp with an Equal-Weight and raised the price target from $54 to $56.

Considering buying ZION stock? Here’s what analysts think:

Read Next:

- Top 3 Defensive Stocks That May Keep You Up At Night This Month