3 ASX Penny Stocks With At Least A$100M Market Cap

The Australian market remained flat over the last week but has seen a significant 20% increase over the past year, with earnings forecasted to grow by 12% annually. While penny stocks may seem like an outdated term, they continue to represent intriguing opportunities for growth at lower price points, especially when backed by strong balance sheets and solid fundamentals. This article explores three high-quality penny stocks that stand out as hidden gems in today's market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.555 | A$63.88M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$303.87M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.865 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$838.04M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.71 | A$1.82B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.13 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$93.09M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.93 | A$114.45M | ★★★★★★ |

Click here to see the full list of 1,026 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties, with a market cap of A$398.23 million.

Operations: The company generates revenue primarily from its Chatree segment, which amounts to A$133.09 million.

Market Cap: A$398.23M

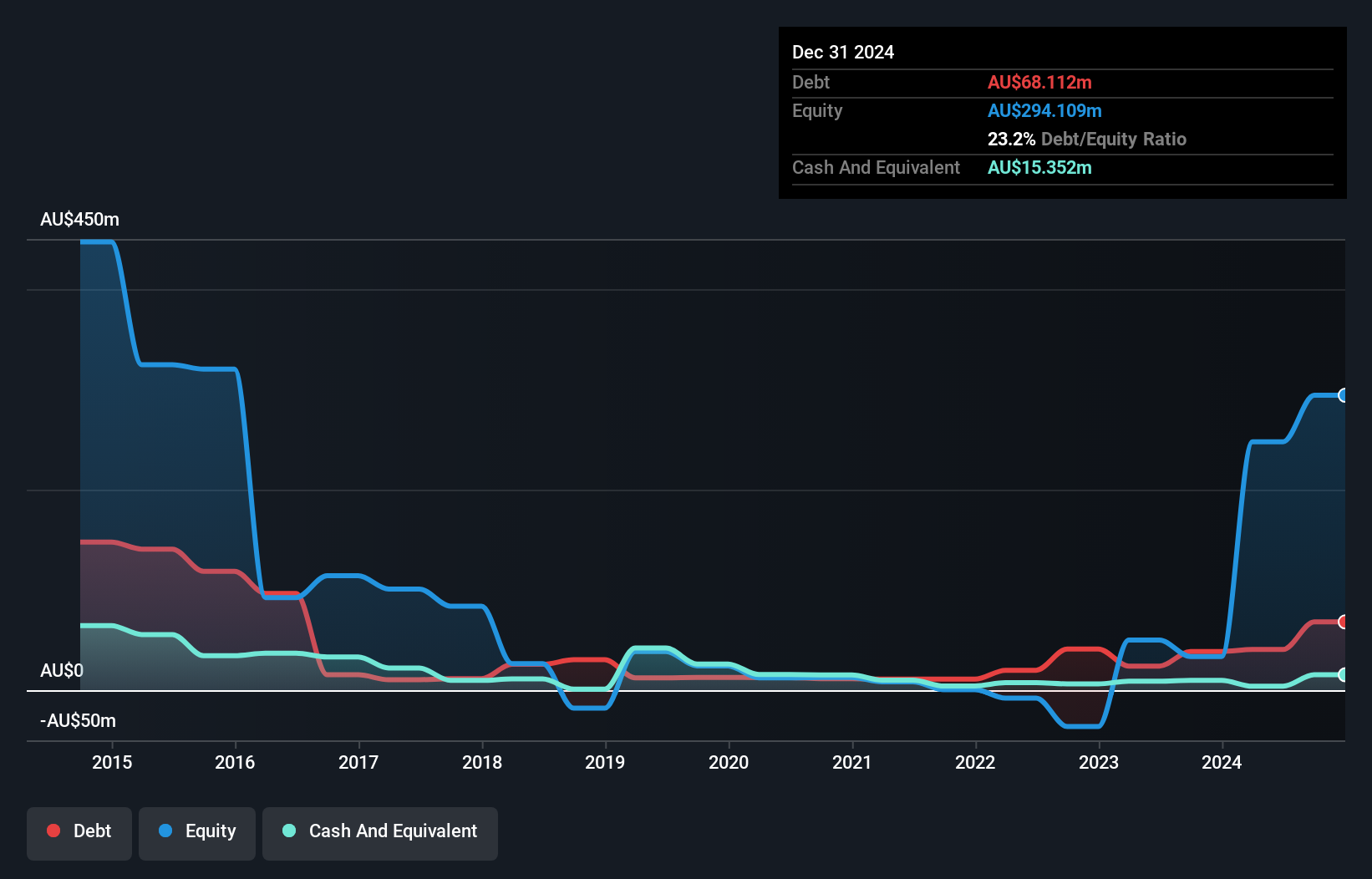

Kingsgate Consolidated has demonstrated significant financial growth, with its revenue surging to A$133.09 million from A$27.34 million in the previous year, and net income reaching A$199.76 million. The company's debt is well-managed, supported by operating cash flow and a satisfactory net debt to equity ratio of 14.8%. Despite a new management team with limited tenure, Kingsgate's return on equity is outstanding at 80.7%, and interest payments are well-covered by EBIT at 28.9 times coverage. However, earnings are expected to decline significantly over the next three years despite recent impressive growth figures exceeding industry averages.

- Dive into the specifics of Kingsgate Consolidated here with our thorough balance sheet health report.

- Learn about Kingsgate Consolidated's future growth trajectory here.

Qube Holdings (ASX:QUB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qube Holdings Limited, with a market cap of A$6.75 billion, offers logistics solutions for import and export supply chains across Australia, New Zealand, and Southeast Asia through its subsidiaries.

Operations: The company's revenue is primarily generated from its Operating Division, which accounts for A$3.51 billion.

Market Cap: A$6.75B

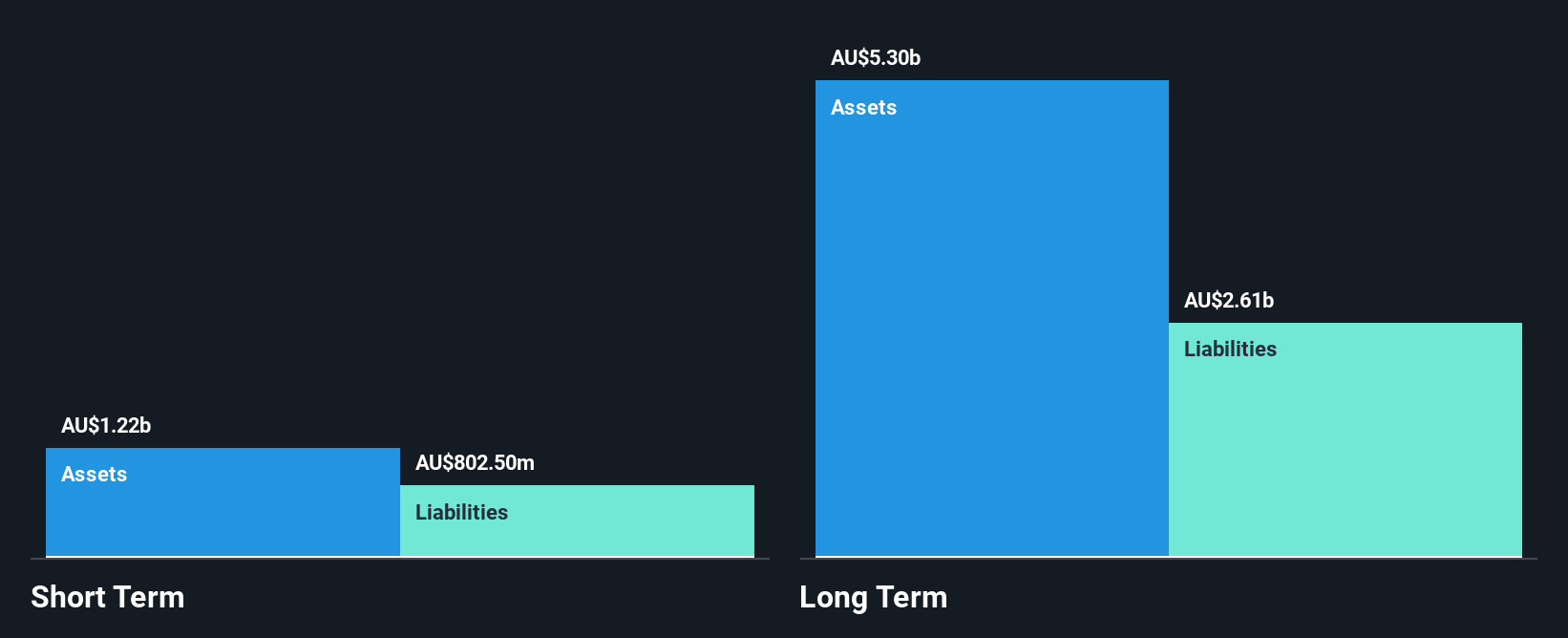

Qube Holdings has shown robust financial performance with earnings growing by 29.1% over the past year, surpassing its five-year average growth of 7.4%. The company's revenue reached A$3.36 billion, up from A$2.88 billion the previous year, while net income increased to A$221.9 million from A$167.9 million. Qube's debt management is prudent, as evidenced by a satisfactory net debt to equity ratio of 39.7%, and its interest payments are well-covered by EBIT at three times coverage. Recent board changes include the retirement of Deputy Chairman Sam Kaplan, who will continue offering strategic advice post-retirement.

- Jump into the full analysis health report here for a deeper understanding of Qube Holdings.

- Understand Qube Holdings' earnings outlook by examining our growth report.

Silver Mines (ASX:SVL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver Mines Limited focuses on acquiring, exploring, and developing silver projects in Australia with a market cap of A$180.96 million.

Operations: The company's revenue segment includes Agricultural Operations, generating A$0.26 million.

Market Cap: A$180.96M

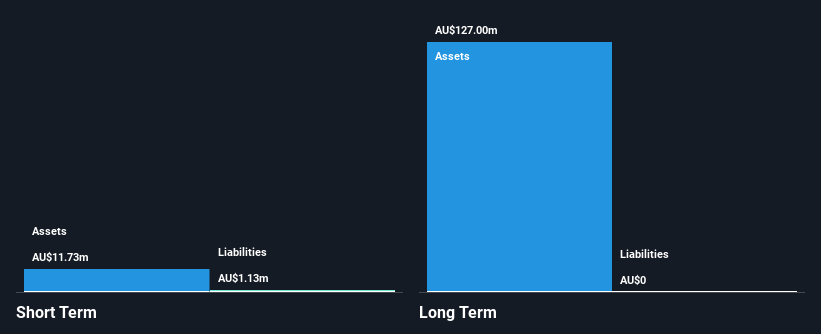

Silver Mines Limited, with a market cap of A$180.96 million, is pre-revenue and reported sales of A$0.26 million for the year ending June 30, 2024. Despite a net loss reduction from A$4.11 million to A$2.22 million, the company remains unprofitable with increased losses over five years at 17.2% annually. The board's average tenure is experienced at 4.9 years; however, shareholders faced dilution with shares outstanding growing by 7.4%. Silver Mines has no debt and sufficient cash runway for over a year but exhibits high volatility compared to most Australian stocks.

- Take a closer look at Silver Mines' potential here in our financial health report.

- Examine Silver Mines' past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Gain an insight into the universe of 1,026 ASX Penny Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10