10X Research Reveals Reasons Why Ethereum (ETH) May Have Lost its Appeal

- Declining staking yields are reducing Ethereum's appeal as competitors offer higher returns, per 10X Research.

- Low yields in DeFi and competition from high-yield TradFi options are diminishing ETH’s attractiveness.

- Ethereum’s price faces bearish momentum, risking further declines if support at $2,425 is not maintained.

Ethereum (ETH) has witnessed a decline in demand over the past few months. Due to this slowdown in blockchain activity, the Ether burn rate has been reduced. This has increased the coin’s circulating supply and put downward pressure on its price.

In a new report, digital asset research firm 10X Research highlights what might be responsible for this.

Ethereum Begins to Lose Its Shine

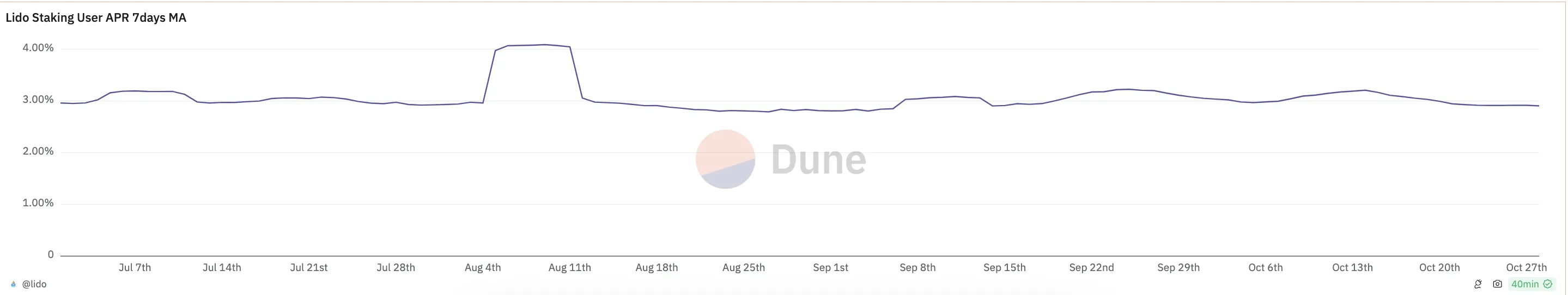

In its latest report, 10X Research highlighted falling staking yields on the Ethereum network as a major factor contributing to the decline in blockchain activity. For instance, the Annual Percentage Rate (APR) for users on Lido, Ethereum’s largest staking provider, has consistently dropped since August, now at 2.90%.

Read more: How to Invest in Ethereum ETFs?

The digital asset research firm highlighted that this trend stems from the rapid rise of low-cost meme tokens on chains like Solana. Consequently, many ETH holders now view staking primarily as a modest income source rather than a catalyst for broader ecosystem engagement.

Moreover, the existence of high-yield traditional finance options has also made staking ETH on the Ethereum network less appealing, further reducing the demand for the network.

“With TradFi interest rates (such as 2-year Treasury yields at 4.1%) significantly outpacing ETH staking yields at 2.9%, Ethereum holders face a slow bleed. The lack of demand for ETH drives down its collateral value in USD, Bitcoin, and other preferred benchmarks and diminishes overall appeal,” 10X Research explained.

10X Research noted that Ethereum saw a brief rise in activity following the September FOMC meeting, but momentum has since waned. If Donald Trump wins the upcoming election, high US Treasury yields could keep outpacing ETH staking yields, putting continued pressure on ETH prices.

“There is a risk that ETH fades into the background, as we have seen with other high flyers during the previous 2016/2017 and 2020/2021 cycles. Contrary to Bitcoin, Ethereum has not made a new high so far in this cycle; instead, it would need to rally by +87% to eclipse the 2021 high,” the research firm added.

ETH Price Prediction: The Nays May Have It

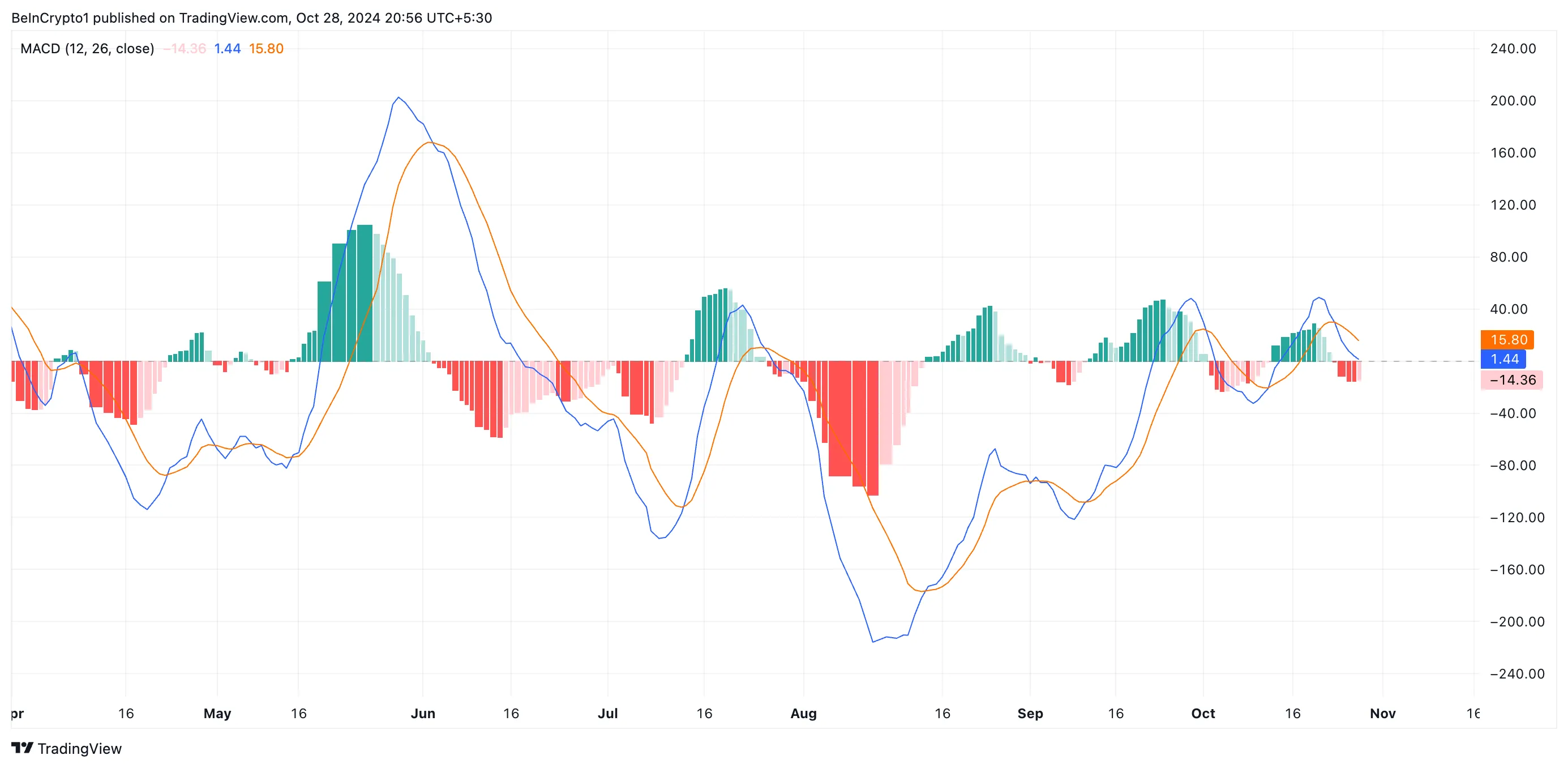

As of this writing, Ethereum is trading at $2,512, just shy of the resistance formed at $2582. BeInCrypto’s assessment of the ETH/USD one-day chart assessment confirms the bearish bias plaguing the leading altcoin.

For example, readings from its moving average convergence/divergence (MACD) confirm the slowed demand for ETH. The coin’s MACD line (blue) is below the signal line (orange) and is poised to cross below the zero line.

MACD measures an asset’s price trends and momentum and identifies its potential buy or sell signals. When set up this way, it indicates a bearish trend in the market, suggesting that overall momentum is negative and the asset is in a downtrend.

If this trend continues, Ethereum’s price will likely drop toward support at $2,425. If the bulls fail to defend this level, Ethereum could plummet further to $2,116.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Conversely, a shift to positive market momentum could push Ethereum’s price above its resistance at $2,582, with a target of $2,871 — a high it last reached in August.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10