Aluminum Corporation of China Limited (HKG:2600) Just Released Its Third-Quarter Earnings: Here's What Analysts Think

One of the biggest stories of last week was how Aluminum Corporation of China Limited (HKG:2600) shares plunged 20% in the week since its latest third-quarter results, closing yesterday at HK$4.95. The result was fairly weak overall, with revenues of CN¥111b being 2.8% less than what the analysts had been modelling. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for Aluminum Corporation of China

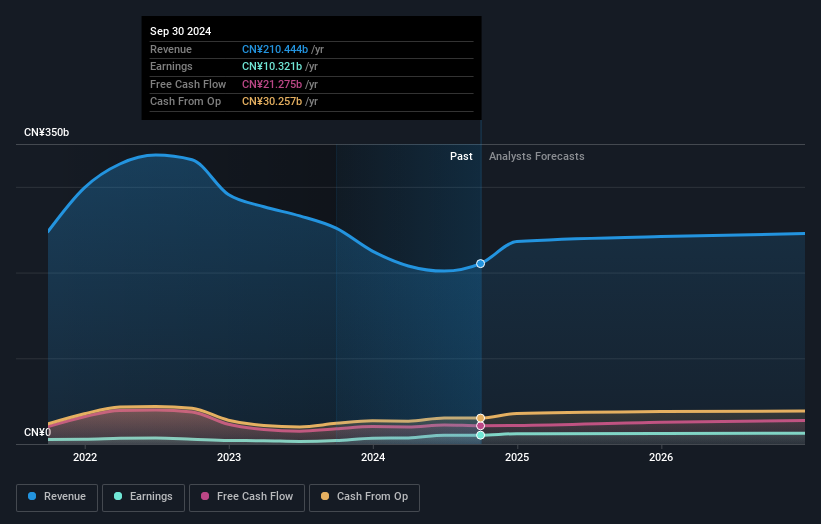

Following the latest results, Aluminum Corporation of China's eleven analysts are now forecasting revenues of CN¥241.9b in 2025. This would be a solid 15% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to step up 17% to CN¥0.70. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥241.5b and earnings per share (EPS) of CN¥0.71 in 2025. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

The analysts reconfirmed their price target of HK$6.57, showing that the business is executing well and in line with expectations. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Aluminum Corporation of China analyst has a price target of HK$8.91 per share, while the most pessimistic values it at HK$4.37. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Aluminum Corporation of China's growth to accelerate, with the forecast 12% annualised growth to the end of 2025 ranking favourably alongside historical growth of 4.9% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 7.8% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Aluminum Corporation of China to grow faster than the wider industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. The consensus price target held steady at HK$6.57, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Aluminum Corporation of China going out to 2026, and you can see them free on our platform here..

You still need to take note of risks, for example - Aluminum Corporation of China has 1 warning sign we think you should be aware of.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10