As major U.S. indexes continue to trade at record high levels following the Federal Reserve's decision to cut key interest rates, investors are eyeing opportunities across various market segments. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area despite their somewhat outdated label. When these stocks are supported by strong financial health, they can offer unique growth opportunities and potential stability. In this article, we will explore several penny stocks that stand out for their financial strength and potential long-term promise.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80735 | $5.81M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.05B | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $173.78M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.59 | $588.6M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.50 | $129.74M | ★★★★★☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.26 | $9.77M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.24 | $3.83M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $3.9606 | $50.3M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

Click here to see the full list of 751 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Duluth Holdings (NasdaqGS:DLTH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Duluth Holdings Inc. operates in the United States, selling casual wear, workwear, outdoor apparel, and accessories for men and women under the Duluth Trading brand, with a market cap of approximately $134.89 million.

Operations: Duluth Trading generates revenue through its online retail segment, which accounted for $642.13 million.

Market Cap: $134.89M

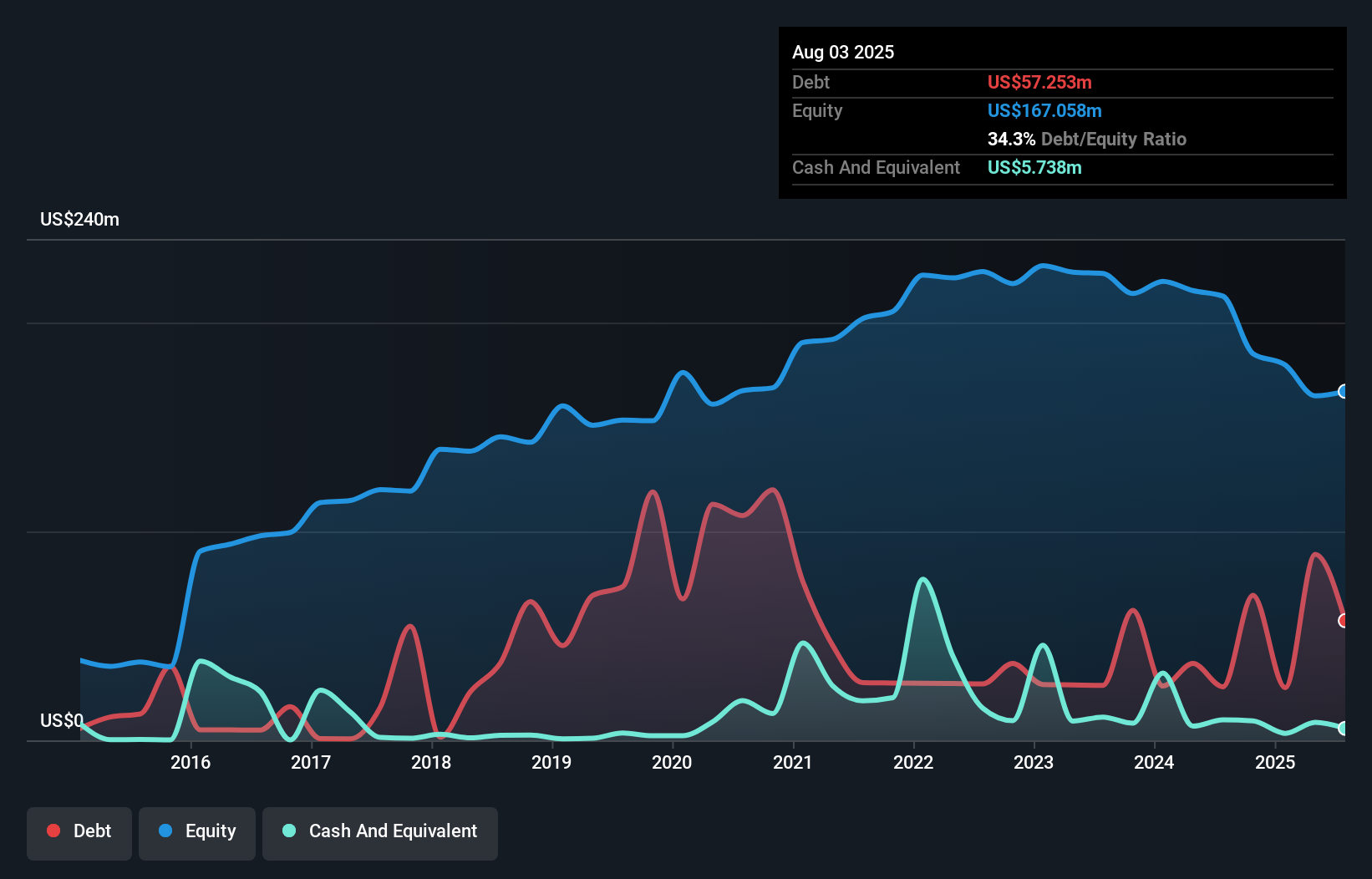

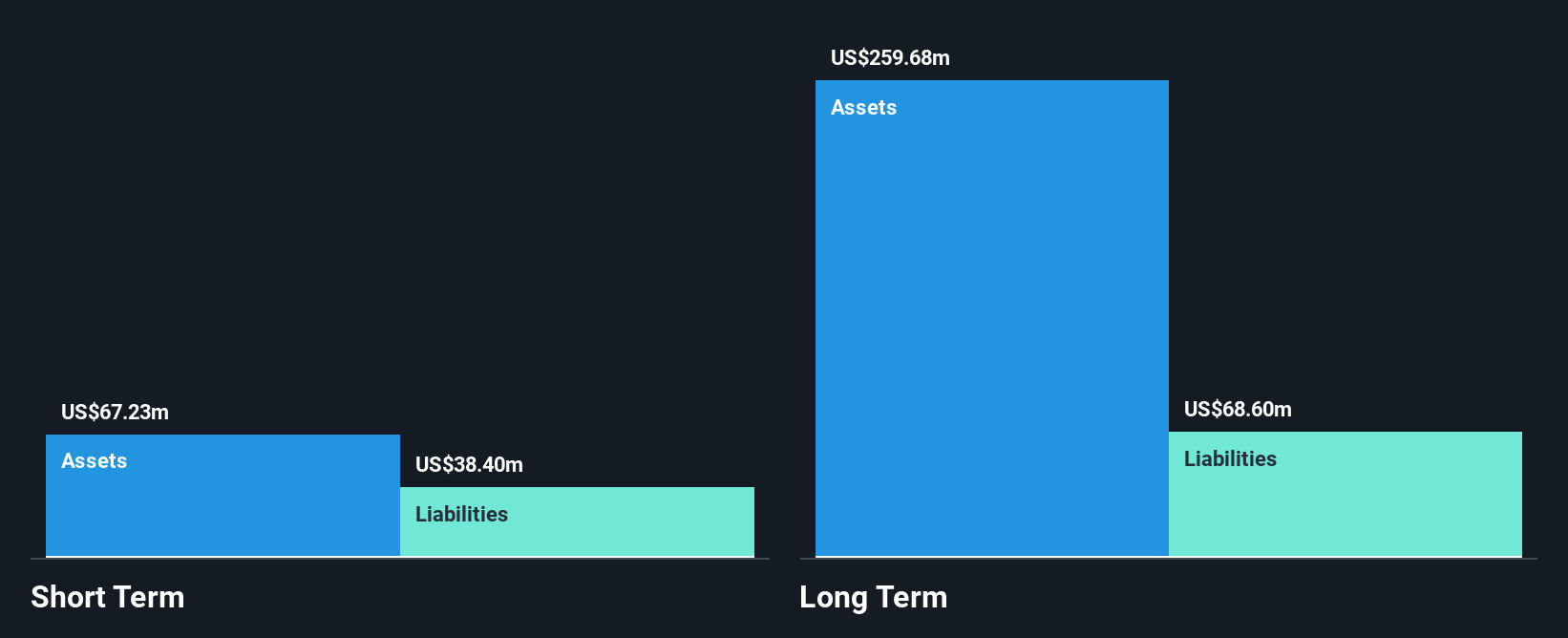

Duluth Holdings Inc. presents a mixed picture as a penny stock. Despite generating US$642.13 million in revenue, the company remains unprofitable with increasing losses over recent years, reporting a net loss of US$3.74 million for the second quarter of 2024. The company's financial stability is bolstered by its short-term assets exceeding both short and long-term liabilities, and its debt levels are well-managed with a net debt to equity ratio of 7.4%. Recent executive changes and removal from the S&P Global BMI Index may impact investor confidence, though management remains experienced with stable governance practices in place.

- Click to explore a detailed breakdown of our findings in Duluth Holdings' financial health report.

- Understand Duluth Holdings' earnings outlook by examining our growth report.

Smart Sand (NasdaqGS:SND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Sand, Inc. is an integrated company that excavates, processes, and sells frac and industrial sand for hydraulic fracturing in the U.S. oil and gas industry, with a market cap of $92.29 million.

Operations: The company's revenue is derived entirely from its Metals & Mining - Miscellaneous segment, amounting to $295.70 million.

Market Cap: $92.29M

Smart Sand, Inc. is navigating the penny stock landscape with a market cap of US$92.29 million and recent strategic financial maneuvers, including a share repurchase program up to US$10 million and a special cash dividend of $0.10 per share. Despite stable weekly volatility and satisfactory net debt to equity ratio (3.3%), the company faces challenges with declining profit margins (0.4% from 2.7%) and negative earnings growth (-83.8%). The new US$30 million credit facility enhances liquidity but interest coverage remains weak at 0.8x EBIT, indicating potential financial pressure amid insider selling activities recently observed.

- Navigate through the intricacies of Smart Sand with our comprehensive balance sheet health report here.

- Learn about Smart Sand's future growth trajectory here.

Tilly's (NYSE:TLYS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tilly's, Inc. is a specialty retailer in the United States offering casual apparel, footwear, accessories, and hardgoods for young men and women as well as boys and girls, with a market cap of approximately $126.94 million.

Operations: The company's revenue is primarily generated from its Retail - Apparel segment, which accounts for $618.22 million.

Market Cap: $126.94M

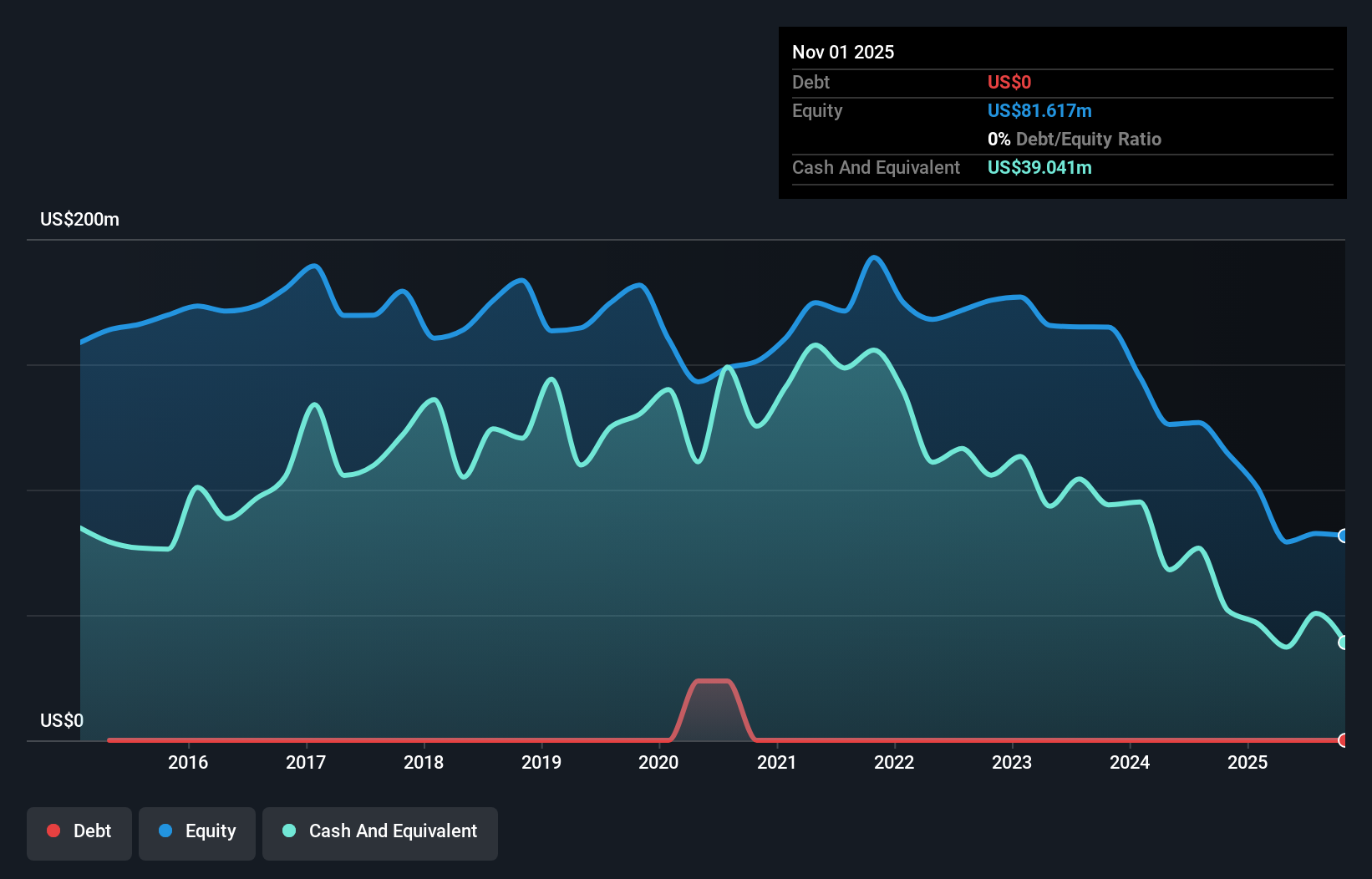

Tilly's, Inc. is navigating the penny stock market with a market cap of US$126.94 million, despite being unprofitable and experiencing increased losses over the past five years. The company remains debt-free, with short-term assets of US$194.4 million exceeding both short-term and long-term liabilities, indicating financial stability in asset management. Recent executive changes saw co-founder Hezy Shaked appointed as CEO, aiming to leverage his retail experience to improve operations amid declining sales projections for fiscal 2024. Despite reporting second-quarter sales growth to US$162.87 million, Tilly’s faces challenges with ongoing net losses impacting its financial outlook.

- Click here to discover the nuances of Tilly's with our detailed analytical financial health report.

- Explore Tilly's analyst forecasts in our growth report.

Next Steps

- Get an in-depth perspective on all 751 US Penny Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

沒有相關數據