FSE Lifestyle Services' (HKG:331) Problems Go Beyond Weak Profit

The subdued market reaction suggests that FSE Lifestyle Services Limited's (HKG:331) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

Check out our latest analysis for FSE Lifestyle Services

Zooming In On FSE Lifestyle Services' Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

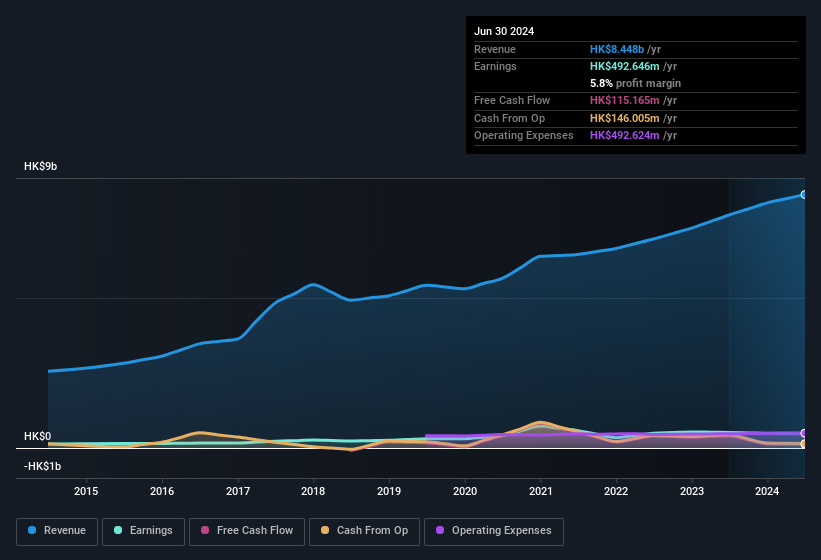

FSE Lifestyle Services has an accrual ratio of 0.89 for the year to June 2024. Ergo, its free cash flow is significantly weaker than its profit. Statistically speaking, that's a real negative for future earnings. Indeed, in the last twelve months it reported free cash flow of HK$115m, which is significantly less than its profit of HK$492.6m. FSE Lifestyle Services' free cash flow actually declined over the last year, but it may bounce back next year, since free cash flow is often more volatile than accounting profits.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On FSE Lifestyle Services' Profit Performance

As we discussed above, we think FSE Lifestyle Services' earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that FSE Lifestyle Services' underlying earnings power is lower than its statutory profit. In further bad news, its earnings per share decreased in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. To that end, you should learn about the 2 warning signs we've spotted with FSE Lifestyle Services (including 1 which is significant).

Today we've zoomed in on a single data point to better understand the nature of FSE Lifestyle Services' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10