What the S&P 500 has returned annually during various Washington political scenarios

franckreporter

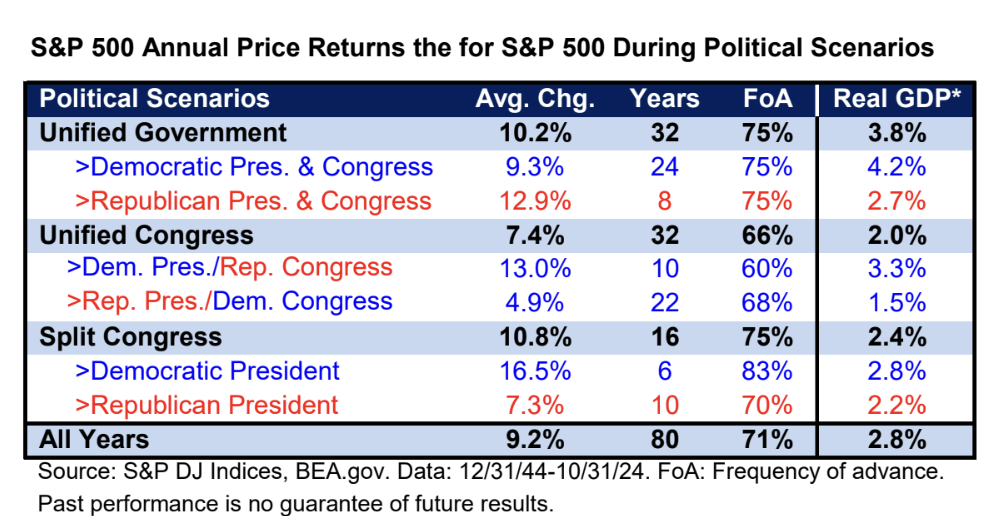

CFRA Research dug into stock market history related to U.S. elections and found that the S&P 500 (SP500) has posted the highest annual price returns under a divided government.

Polling between Vice President Kamala Harris and former President Donald Trump has been tight for the matchup set in late July when President Joe Biden stepped out of the race. Over the weekend, Iowa suddenly appeared as a potential swing state, with the Des Moines Register's Iowa Poll showing Harris with a small lead over Trump, who won the state in 2016 and 2020.

CFRA’s political strategy arm, Washington Analysis, predicts a Harris winning “by the narrowest of margins,” with Republicans taking control of the Senate, a result likely to stoke elevated volatility, CFRA Research’s Chief Investment Strategist Sam Stovall said in a note Monday.

Stovall found a split Congress led by a Democratic Party president has produced the highest average annual price gains, at 16.5%, with an 83% frequency of advance (FoA). That compares with a 9.2% average annual increase and a 71% FoA for all years since 1945, he said.

“The most rewarding political make-up for Republicans has been a ‘Red Wave,’ which experienced a 12.9% average annual increase and a 75% FoA,” Stovall said.

The lowest annual price returns have come under a Republican president with a Congress controlled by Democrats, at 4.9%, with a 68% frequency of advance. Here’s Stovall’s table of annual price returns for the S&P 500 (SP500) during various political scenarios:

Investors who want to track the S&P 500 (SP500) through ETFs can monitor funds including (IVV), (SPY), (VOO), (SSO), (RSP) and (SH).

For investors looking to track the elections through market instruments, here are some politically driven Republican and Democratic exchange-traded funds:

God Bless America ETF (YALL)

American Conservative Values ETF (ACVF)

Point Bridge America First ETF (MAGA)

Democratic Large Cap Core ETF (DEMZ)

Unusual Whales Subversive Democratic ETF (NANC)

Unusual Whales Subversive Republican ETF (KRUZ)

Readers interested in investing topics tied to the upcoming election can read coverage from Seeking Alpha's Investing Forum: Election 2024 event; please visit this page.

Dear readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10