These 4 Measures Indicate That Furniweb Holdings (HKG:8480) Is Using Debt Safely

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Furniweb Holdings Limited (HKG:8480) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Furniweb Holdings

What Is Furniweb Holdings's Net Debt?

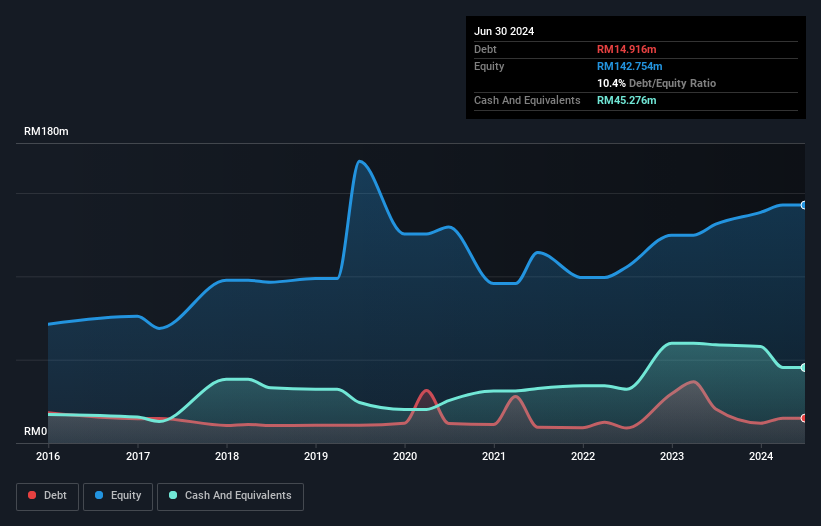

As you can see below, Furniweb Holdings had RM14.9m of debt at June 2024, down from RM20.4m a year prior. But on the other hand it also has RM45.3m in cash, leading to a RM30.4m net cash position.

How Strong Is Furniweb Holdings' Balance Sheet?

According to the last reported balance sheet, Furniweb Holdings had liabilities of RM34.2m due within 12 months, and liabilities of RM18.2m due beyond 12 months. On the other hand, it had cash of RM45.3m and RM52.2m worth of receivables due within a year. So it can boast RM45.0m more liquid assets than total liabilities.

This surplus strongly suggests that Furniweb Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that Furniweb Holdings has more cash than debt is arguably a good indication that it can manage its debt safely.

On top of that, Furniweb Holdings grew its EBIT by 58% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Furniweb Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Furniweb Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Furniweb Holdings created free cash flow amounting to 16% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Furniweb Holdings has net cash of RM30.4m, as well as more liquid assets than liabilities. And we liked the look of last year's 58% year-on-year EBIT growth. So is Furniweb Holdings's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Furniweb Holdings is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10