McCormick's (NYSE:MKC) Upcoming Dividend Will Be Larger Than Last Year's

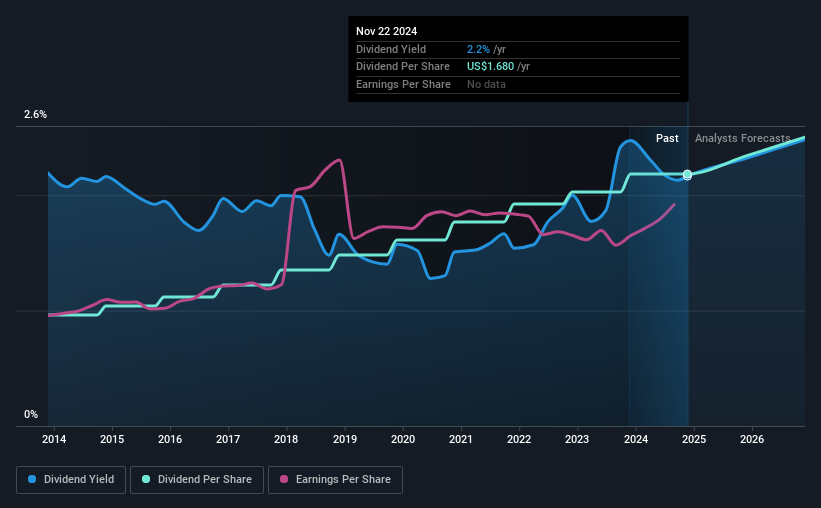

The board of McCormick & Company, Incorporated (NYSE:MKC) has announced that it will be increasing its dividend by 7.1% on the 13th of January to $0.45, up from last year's comparable payment of $0.42. This takes the annual payment to 2.2% of the current stock price, which unfortunately is below what the industry is paying.

Check out our latest analysis for McCormick

McCormick's Future Dividend Projections Appear Well Covered By Earnings

The dividend yield is a little bit low, but sustainability of the payments is also an important part of evaluating an income stock. Prior to this announcement, McCormick's dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 21.4%. Assuming the dividend continues along recent trends, we think the payout ratio could be 52% by next year, which is in a pretty sustainable range.

McCormick Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2014, the annual payment back then was $0.74, compared to the most recent full-year payment of $1.68. This implies that the company grew its distributions at a yearly rate of about 8.5% over that duration. The growth of the dividend has been pretty reliable, so we think this can offer investors some nice additional income in their portfolio.

Dividend Growth May Be Hard To Achieve

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Earnings per share has been crawling upwards at 2.1% per year. Growth of 2.1% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

We Really Like McCormick's Dividend

Overall, a dividend increase is always good, and we think that McCormick is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for McCormick that investors should know about before committing capital to this stock. Is McCormick not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10