We Think Shareholders Are Less Likely To Approve A Pay Rise For Orcoda Limited's (ASX:ODA) CEO For Now

Key Insights

- Orcoda's Annual General Meeting to take place on 29th of November

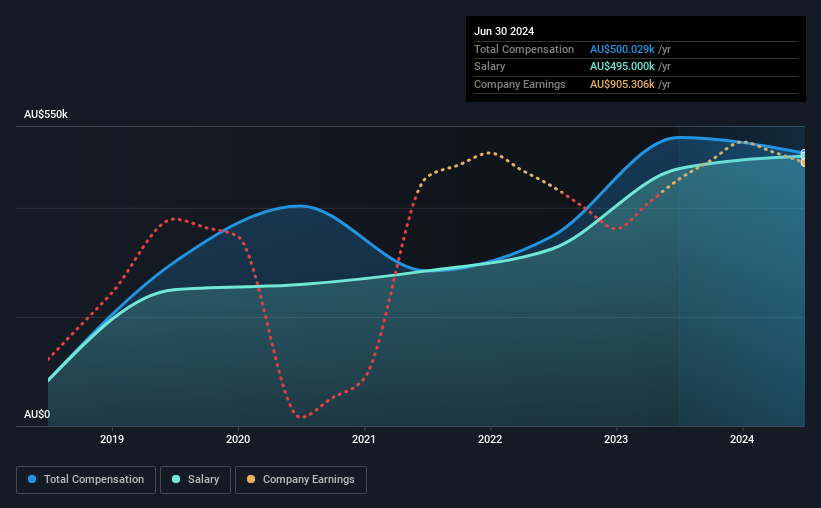

- CEO Geoff Jamieson's total compensation includes salary of AU$495.0k

- Total compensation is similar to the industry average

- Orcoda's three-year loss to shareholders was 13% while its EPS grew by 15% over the past three years

As many shareholders of Orcoda Limited (ASX:ODA) will be aware, they have not made a gain on their investment in the past three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 29th of November. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for Orcoda

Comparing Orcoda Limited's CEO Compensation With The Industry

At the time of writing, our data shows that Orcoda Limited has a market capitalization of AU$23m, and reported total annual CEO compensation of AU$500k for the year to June 2024. That's a slight decrease of 5.5% on the prior year. We note that the salary portion, which stands at AU$495.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the Australian Software industry with market capitalizations below AU$307m, we found that the median total CEO compensation was AU$458k. This suggests that Orcoda remunerates its CEO largely in line with the industry average. What's more, Geoff Jamieson holds AU$1.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$495k | AU$472k | 99% |

| Other | AU$5.0k | AU$57k | 1% |

| Total Compensation | AU$500k | AU$529k | 100% |

On an industry level, roughly 62% of total compensation represents salary and 38% is other remuneration. Orcoda is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Orcoda Limited's Growth

Orcoda Limited's earnings per share (EPS) grew 15% per year over the last three years. It achieved revenue growth of 26% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Orcoda Limited Been A Good Investment?

Since shareholders would have lost about 13% over three years, some Orcoda Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Geoff receives almost all of their compensation through a salary. Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Orcoda that investors should look into moving forward.

Switching gears from Orcoda, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10