It's Unlikely That Shareholders Will Increase Gowing Bros. Limited's (ASX:GOW) Compensation By Much This Year

Key Insights

- Gowing Bros to hold its Annual General Meeting on 27th of November

- CEO John Gowing's total compensation includes salary of AU$162.1k

- The total compensation is 67% less than the average for the industry

- Over the past three years, Gowing Bros' EPS fell by 95% and over the past three years, the total loss to shareholders 28%

The underwhelming performance at Gowing Bros. Limited (ASX:GOW) recently has probably not pleased shareholders. The next AGM coming up on 27th of November will be a chance for shareholders to have their concerns addressed by the board, challenge management on company strategy and vote on resolutions such as executive remuneration, which may help change the company's future prospects. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for Gowing Bros

Comparing Gowing Bros. Limited's CEO Compensation With The Industry

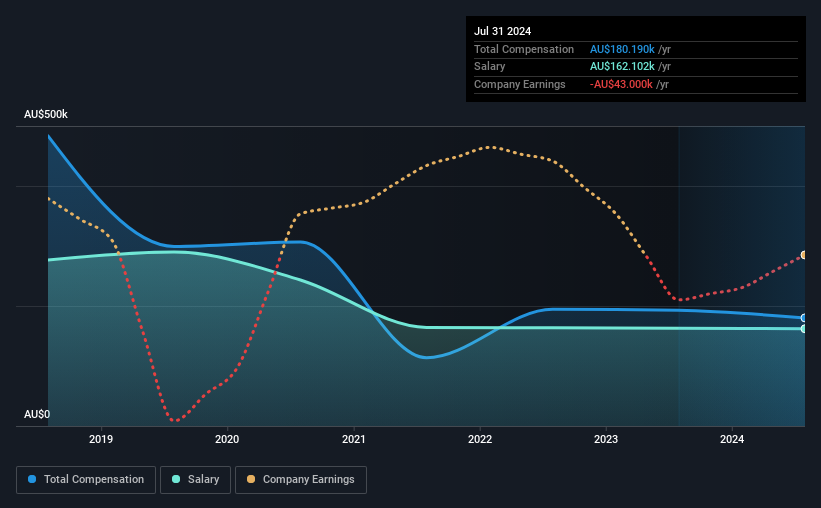

At the time of writing, our data shows that Gowing Bros. Limited has a market capitalization of AU$111m, and reported total annual CEO compensation of AU$180k for the year to July 2024. We note that's a small decrease of 6.5% on last year. In particular, the salary of AU$162.1k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Australian Diversified Financial industry with market capitalizations under AU$308m, the reported median total CEO compensation was AU$548k. That is to say, John Gowing is paid under the industry median. Furthermore, John Gowing directly owns AU$44m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | AU$162k | AU$163k | 90% |

| Other | AU$18k | AU$30k | 10% |

| Total Compensation | AU$180k | AU$193k | 100% |

Talking in terms of the industry, salary represented approximately 67% of total compensation out of all the companies we analyzed, while other remuneration made up 33% of the pie. According to our research, Gowing Bros has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Gowing Bros. Limited's Growth

Over the last three years, Gowing Bros. Limited has shrunk its earnings per share by 95% per year. It saw its revenue drop 6.6% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Gowing Bros. Limited Been A Good Investment?

Since shareholders would have lost about 28% over three years, some Gowing Bros. Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for Gowing Bros (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10