Ethereum’s $43 Billion Volume Powers Price Surge Past $3,600 — Altcoin Season Nears

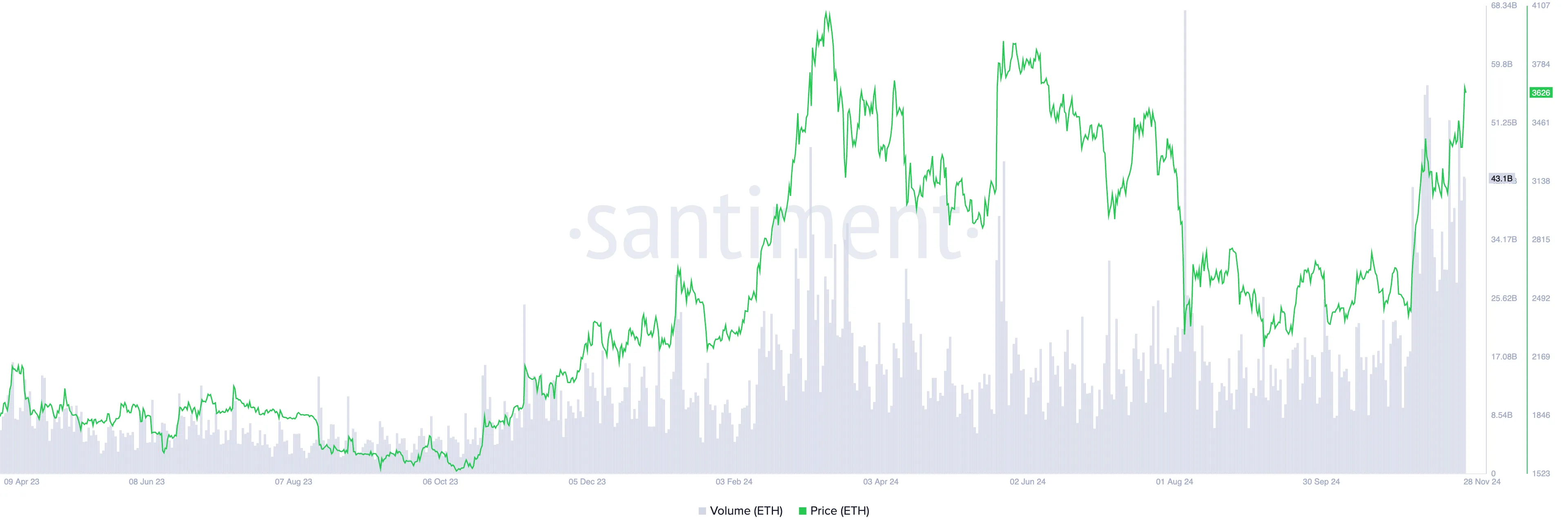

- Ethereum (ETH) surges past $3,600, driven by $43 billion in 24-hour trading volume, indicating strong market interest and confidence in the rally.

- Despite a slight increase in exchange netflow, the overall sentiment remains bullish, suggesting sustained upward momentum for ETH.

- ETH’s Parabolic SAR indicator suggests sustained upward momentum, with the coin poised to reach a year-to-date high if bullish sentiment persists.

Leading altcoin Ethereum (ETH) has experienced a notable price surge over the past 24 hours, breaking the $3,600 mark. As of this writing, ETH exchanges hands at $3,613, a level it last traded at in June.

This rebound has been fueled by a massive trading volume exceeding $43 billion in the past 24 hours. This hints at a sustained rally toward the psychological $4,000 price mark.

Ethereum Price Surge Hints at Altcoin Season

ETH’s trading volume has totaled $43 billion over the past 24 hours. This surge in trading activity has propelled the coin’s value to a price last observed five months ago.

When an asset’s trading volume climbs alongside its price, it indicates strong market interest and confidence in the upward movement. This combination suggests that the price rally is backed by significant buying activity, making it more sustainable.

Therefore, ETH’s high trading volume reflects the uptick in market demand and broad participation. This reduces the likelihood of a sudden reversal.

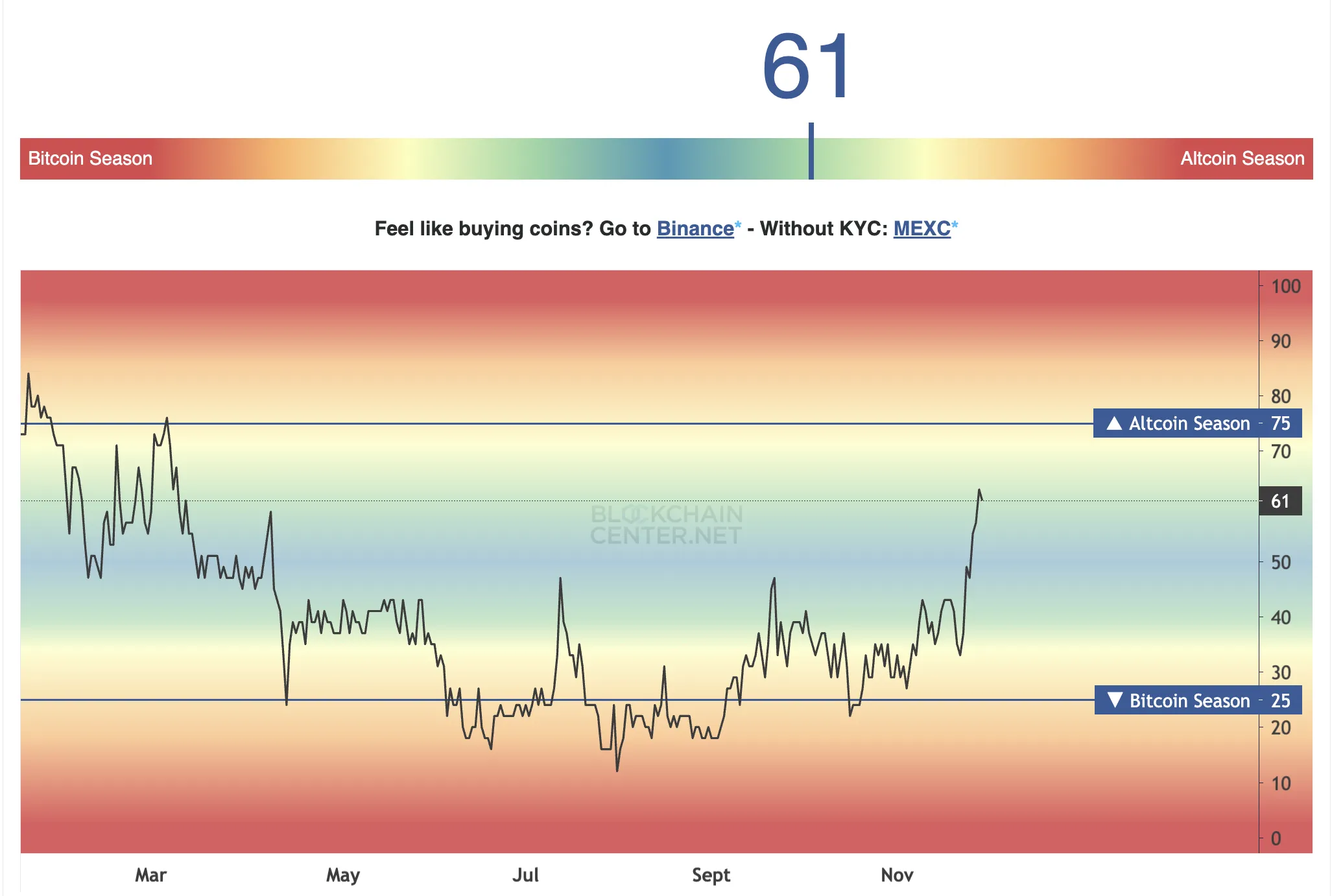

Further, Ethereum’s recent surge suggests a potential shift toward the altcoin season. According to Blockchain Center’s Altcoin Season Index (ASI), the score now stands at 61 out of 100, nearing the 75-point threshold to signal the commencement of the highly-anticipated time.

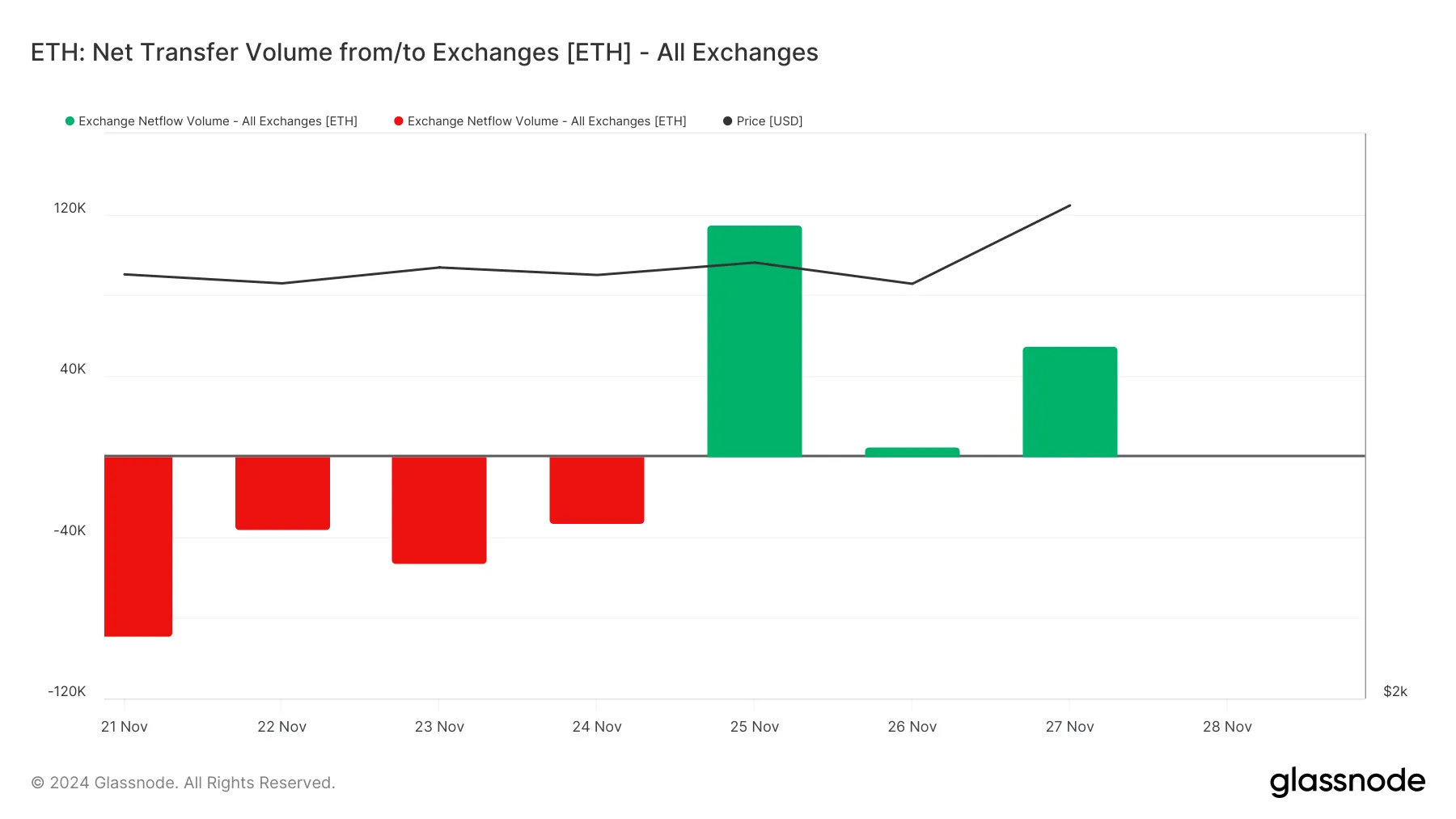

Notably, some profit-taking activity is already underway due to this price surge. This is reflected in the coin’s positive exchange netflow volume. On Wednesday, 54,974 ETH valued above $199 million were sent to exchanges.

The exchange netflow volume metric measures the difference between inflows into and outflows from exchanges over a specific period. When an asset’s netflow is positive, more coins are moving into exchanges than leaving, often signaling potential selling pressure as traders prepare to sell.

This increase in supply on exchanges can weigh on the price if demand does not match the heightened availability.

ETH Price Prediction: Rally Toward Year-To-Date High

Despite this, the overall bullish sentiment in the Ethereum market remains strong, suggesting that the uptrend may persist. The setup of ETH’s Parabolic Stop and Reverse (SAR) indicator, as assessed on a daily chart, confirms this bullish outlook.

This indicator identifies potential trend reversals and provides dynamic support and resistance levels. It places dots above or below the price chart: dots below the price suggest a bullish trend, while the dots above indicate a bearish trend.

As in ETH’s case, when the SAR rests below the price, it signals upward momentum and suggests a bullish trend. If the bullish trend persists, the ETH coin price may breach resistance at $3,669 and climb toward its year-to-date high of $4,093.

On the other hand, a decline in bullish pressure will occasion the ETH coin price to fall toward support formed at $3,336.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10