Ethereum Poised for 97% Rally to $7,300 Post Breakout, Says Analyst

- Ethereum (ETH) surged from $2,400 to $3,700, with a potential rally targeting $7,346 if it breaks the $3,800 resistance.

- The cup and handle pattern suggests strong future price gains, but confirmation of a breakout is needed for sustained growth.

- Long-term holder (LTH) behavior is a concern; rising Liveliness could signal increased selling, potentially stalling ETH's bullish momentum.

Ethereum (ETH) has been on a strong rally, with its price rising from $2,400 to $3,700 in recent weeks. This surge has captured the attention of traders and investors, fueling optimism about ETH’s future. However, according to pseudonymous analyst VentureFounder, Ethereum is primed for an even larger rally, potentially reaching $7,346.

Despite the bullish outlook, Ethereum’s foundation remains slightly unstable, with concerns over long-term holder (LTH) behavior and market volatility. While a major breakout is anticipated, caution remains as Ethereum navigates these critical phases.

Ethereum Has a Strategic Rise Ahead

Analyst venturefounder suggests that Ethereum is currently forming a “cup and handle” triangle consolidation pattern, which is often seen as a sign of future price gains. According to this analysis, if Ethereum successfully breaks above the $3,800 resistance level, it could target $7,346—an increase of over 97% from its current price. This technical pattern implies that a sustained rally is possible, but only if ETH confirms the breakout and continues to build momentum.

However, the pattern is not yet fully confirmed, and Ethereum’s path forward hinges on its ability to push past the $3,800 resistance. Until this occurs, Ethereum remains in a consolidation phase, and a breakout could be the catalyst for further price appreciation. As such, traders will be watching for any signs of upward movement to validate the predicted rally.

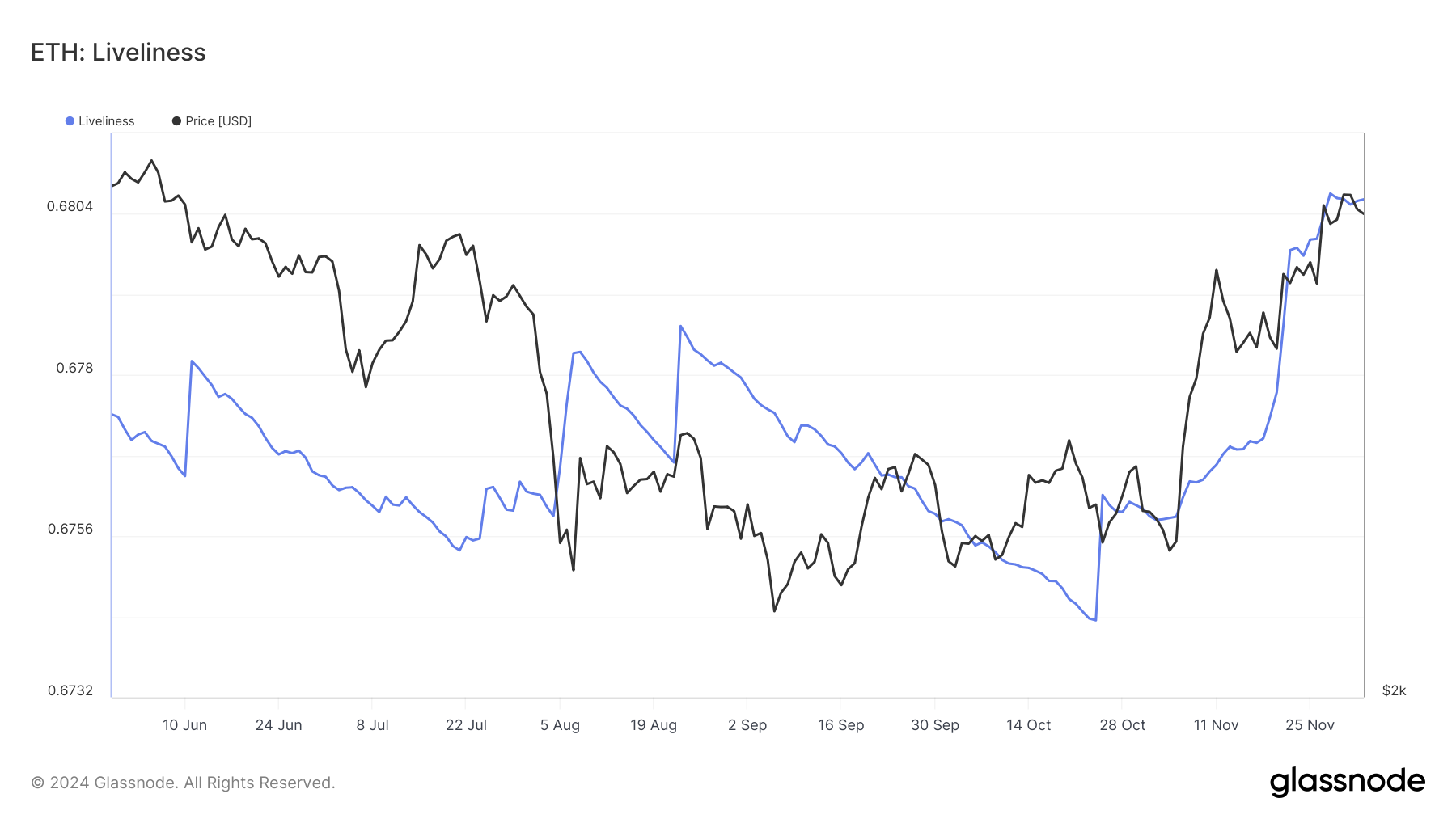

Ethereum’s macro momentum remains positive, although there are concerns about the long-term holder (LTH) supply, which is measured by the Liveliness indicator. This metric tracks whether long-term holders are selling or accumulating Ethereum.

An uptick in Liveliness indicates that LTHs are liquidating their positions, which could signal a bearish trend or a shift in market sentiment. Conversely, a decrease in Liveliness suggests that long-term holders are accumulating or holding their Ethereum, reinforcing a bullish outlook.

At present, LTH uncertainty is a concern. If Ethereum’s Liveliness continues to rise, it could indicate that long-term holders are selling off, which may put downward pressure on the price. Such selling activity could destabilize the rally and delay any potential price surge. Therefore, the behavior of LTHs remains a crucial factor to watch.

ETH Price Prediction: Aiming at All-Time High

Ethereum currently sits at around $3,700, just below the crucial $3,800 resistance level. If ETH successfully breaks above this threshold, it could initiate a rally toward $7,346, as the cup and handle pattern suggests. This would represent a 97% increase, signaling significant bullish potential.

However, it is essential for Ethereum to establish firm support above $3,800 before any substantial price gains can materialize.

Bouncing off of $3,800 is also the key to ETH crossing the $4,000 mark, which is the current year-to-date high. This would warrant conviction from retail holders and interest from institutional investors.

However, if Ethereum’s Liveliness continues to climb and long-term holders keep liquidating their positions, the bullish scenario may be at risk. A sustained period of selling could cause a price correction, pushing Ethereum back toward the lower $3,327 range. This potential downturn would invalidate the current bullish thesis and could delay the anticipated rally.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10