Epsilon Energy's (NASDAQ:EPSN) Dividend Will Be $0.0625

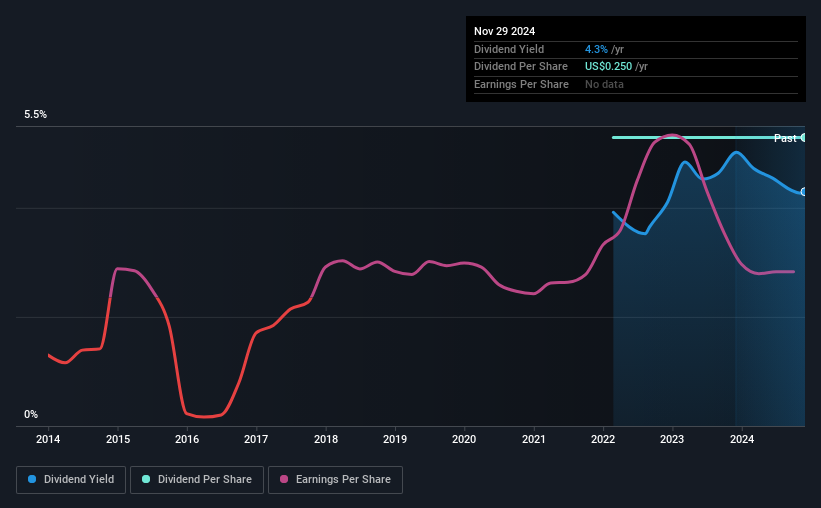

Epsilon Energy Ltd.'s (NASDAQ:EPSN) investors are due to receive a payment of $0.0625 per share on 31st of December. Based on this payment, the dividend yield will be 4.3%, which is fairly typical for the industry.

View our latest analysis for Epsilon Energy

Epsilon Energy's Future Dividends May Potentially Be At Risk

Solid dividend yields are great, but they only really help us if the payment is sustainable. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. This high of a dividend payment could start to put pressure on the balance sheet in the future.

If the company can't turn things around, EPS could fall by 4.0% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach 108%, which could put the dividend under pressure if earnings don't start to improve.

Epsilon Energy Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The payments haven't really changed that much since 3 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Epsilon Energy May Find It Hard To Grow The Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, things aren't all that rosy. Epsilon Energy has seen earnings per share falling at 4.0% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

We're Not Big Fans Of Epsilon Energy's Dividend

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Epsilon Energy has 3 warning signs (and 2 which are concerning) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Epsilon Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10