‘Christmas comes early’ as inheritance tax receipts jump on threshold freeze

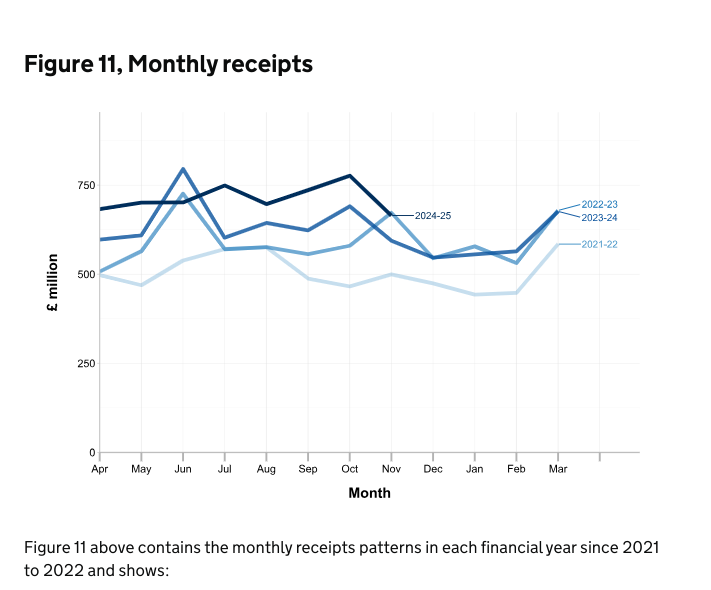

The amount of inheritance tax (IHT) brought in by the government ticked up to £600m in November, as frozen thresholds pushed more estates into paying the tax.

“Christmas has come early for the government,” said Shaun Moore, tax and financial planning expert at Quilter, with the higher tax receipts allowing the amount the government borrowed last month to fall substantially.

There has been a significant increase in the amount of IHT brought in this year, with receipts from April to November 2024 totalling £5.7bn, £500m higher than in the same period last year.

“The continued rise in inheritance tax receipts reflects how frozen thresholds and increasing property and asset values are pulling more families into the IHT net,” said Richard Bate, head of private wealth at Weightmans.

“With the nil-rate band frozen at £325,000 and the residence nil-rate band at £175,000 until 2030, the scope for tax-free inheritance has been shrinking each year.”

Decades of rising property prices have also been a major driver of more families paying IHT.

While one in 20 estates are currently liable to pay IHT, government estimates suggest this will increase to one in 10 by 2030.

“With the IHT threshold frozen until 2030, coupled with pensions being added to the taxable estate from April 2027, the government’s coffers will get a substantial top-up in the coming years,” explained Quilter’s Moore.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10