Crypto Adoption Boom Worldwide Following Donald Trump’s Re-election

- Donald Trump's 2024 win and pro-crypto policies sparked record investment in global cryptocurrency markets.

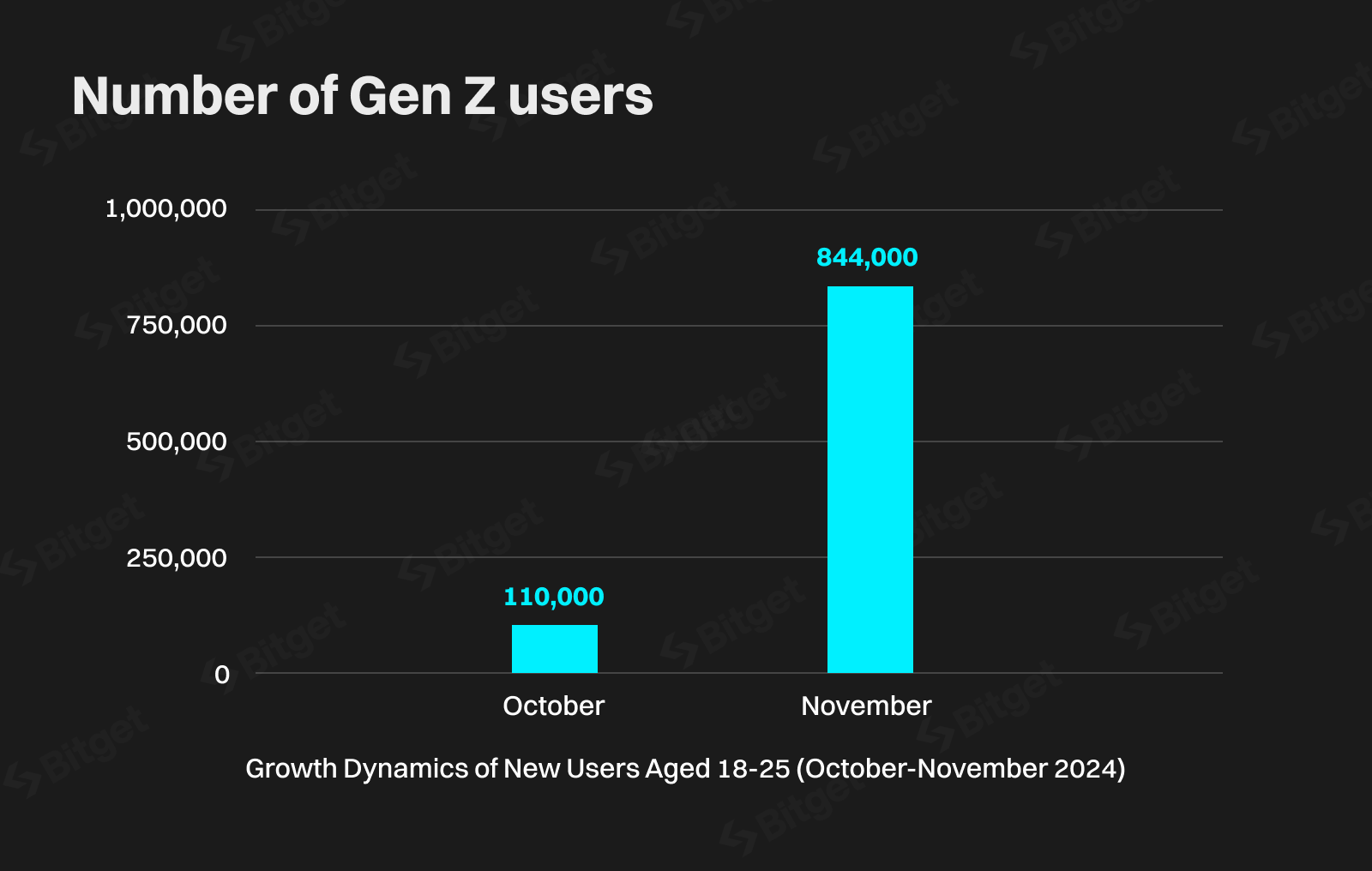

- Crypto adoption among users aged 18–25 rose by 683%, fueled by optimism and a pro-Bitcoin stance.

- Crypto ETPs in Europe grew by $6 billion since November 2024, with UK ownership rising to 12%.

After Donald Trump’s victory in the 2024 US presidential election, the crypto market experienced a significant surge in adoption and investment, marking the most substantial growth seen in recent years.

Trump’s crypto-friendly policies, combined with his promises of a clearer regulatory framework, have fueled global interest and investment in the sector.

A New Wave of Global Crypto Investors

A recent survey by Binance involving over 27,000 participants across Asia, Australia, Europe, Africa, and Latin America revealed that 45% of respondents had entered the cryptocurrency market in 2024.

Interestingly, 44% of participants allocated less than 10% of their total assets to crypto. This highlights a growing awareness and confidence in crypto as a stable, long-term investment asset.

This growth is not just global; it is particularly evident among younger generations. According to Bitget, the number of Gen Z users on its platform skyrocketed by 683% after Trump’s re-election, making Gen Z account for 53.8% of new users. This surge is attributed to Trump’s pro-Bitcoin stance and an overall optimistic financial market outlook.

“Donald Trump’s pro-crypto stance during the US presidential election resonated with young users, highlighting the role of political narratives in shaping financial behavior.” – Bitget reported.

European Markets Witness Parallel Growth

The trend is equally strong in Europe. Financial News London reports a sharp rise in crypto-related ETP assets in 2024, marking a milestone for digital assets. Data from ETFGI reveals that European crypto ETPs attracted £108 million ( ~ $135 million) in new investments in November, making it the third-best month for the products this year.

“Some of the increase was sparked by Donald Trump’s US presidential election victory. Crypto ETP assets in Europe have risen by almost $6 billion since he won the race for the White House on 5 November.” Financial News London commented.

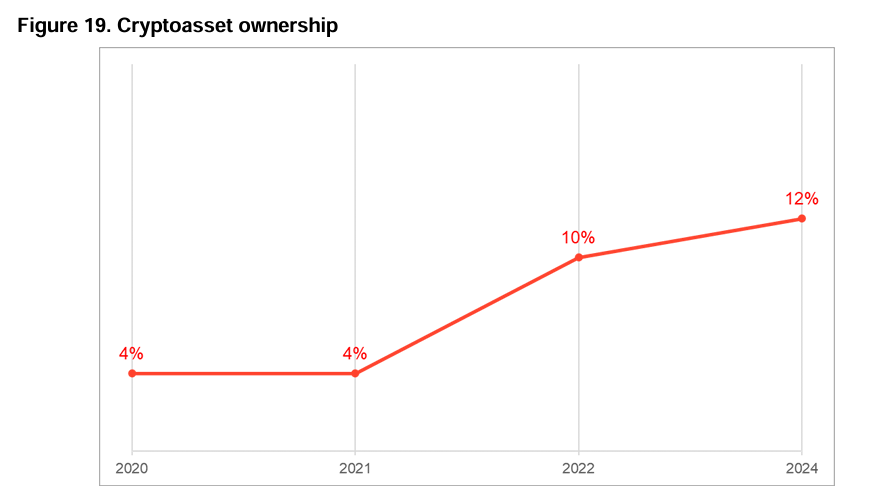

In the UK, the Financial Conduct Authority (FCA) observed a continuous rise in crypto ownership throughout 2024. FCA data shows that 12% of UK adults now own cryptocurrency, up from 10% in previous reports.

Awareness of crypto has also increased from 91% to 93%. The average value of crypto holdings grew from £1,595 to £1,842.

“The UK’s adoption rate suggests that residents owning crypto assets could grow significantly in the coming years. Drawing from the FCA research, many will use crypto to send and receive payments, pay for goods and services, and convert them to fiat and back. Businesses looking to capitalize on this trend should prioritize solutions that offer seamless crypto-fiat transactions, satisfying users’ need for the bridge between the two economies.” Uldis Teraudkalns, Chief Revenue Officer at Paybis, told BeInCrypto.

Trump’s major policy changes, such as establishing a strategic Bitcoin reserve and forming a Bitcoin and Crypto Advisory Council, have created unprecedented optimism about the future of cryptocurrencies. These actions have pushed Bitcoin prices to new record highs, with other cryptocurrencies like Ethereum following suit.

This election has marked a pivotal moment for the cryptocurrency industry, not just in the US but globally. Investors, from beginners to seasoned experts, are seeking opportunities in this dynamic market, hoping for a new era where cryptocurrencies gain broader recognition and regulation worldwide.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10