Aave Considers Fee Switch as USDe Pegging Proposal Draws Concerns

- Aave, a leading DeFi platform, plans to activate a fee switch mechanism to enhance revenue management and ensure long-term sustainability.

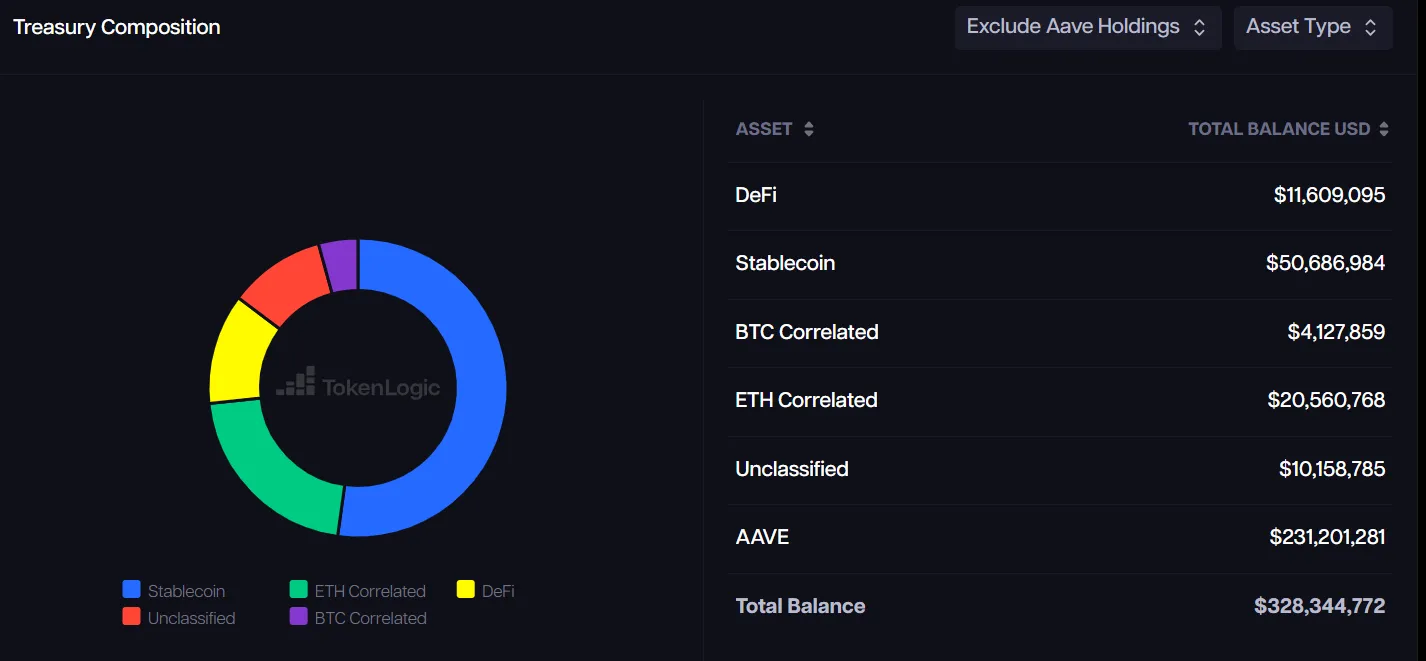

- Aave has a a robust treasury exceeding $328 million that would benefit token holders and stakers through fee redistribution.

- Concurrently, the Aave community is evaluating a proposal to link Ethena’s USDe stablecoin to Tether’s USDT to improve pricing stability.

Aave, a leading decentralized finance (DeFi) platform, is gearing up to introduce a fee switch mechanism aimed at boosting its economic model.

This step aligns with broader efforts to ensure long-term sustainability and deliver value to the Aave ecosystem.

Aave’s Fee Switch Initiative

On January 4, Stani Kulechov, Aave’s founder, hinted at plans to activate a fee switch initiative. This proposal aims to enhance the platform’s revenue management by enabling the Aave DAO to adjust how fees are collected and distributed.

Such mechanisms are common in DeFi platforms and typically reward token holders and stakers through transaction fee redistribution.

Aave’s robust financial standing supports this initiative. Its treasury holds nearly $100 million in non-native assets, including stablecoins, Ethereum, and other cryptocurrencies. When factoring in AAVE tokens, this figure exceeds $328 million, according to TokenLogic.

Marc Zeller, founder of Aave Chan, first introduced the idea of a fee switch last year and emphasized its inevitability earlier this year. According to Zeller, Aave’s net revenue significantly surpasses its operational expenses, making the move not just viable but strategic.

“When your protocol treasury looks like this, and DAO net revenue is more than twice the Opex (incentives included), The Fee Switch isn’t an if; it’s a when,” Zeller stated.

Aave is the largest DeFi lending protocol, providing users with decentralized borrowing and lending options. According to DeFillama data, more than $37 billion worth of assets are locked on the platform.

Aave’s USDe-USDT Proposal Sparks Criticism

Meanwhile, the Aave community is also evaluating a more contentious proposal to link Ethena’s USDe, a synthetic stablecoin, to Tether’s USDT.

This change would align USDe’s price with USDT using Aave’s pricing feeds, replacing the existing Chainlink oracle. The goal is to mitigate risks associated with price fluctuations and unprofitable liquidations.

USDe stands out from traditional stablecoins like USDT due to its reliance on derivatives and digital assets like Ethereum and Bitcoin rather than fiat reserves. USDe is the third-largest stablecoin, behind USDT and USDC, according to DeFillama data.

Despite significant support for the proposal, some community members have argued that it could create conflicts of interest, as advisors involved in drafting the proposal have ties to Aave and Ethena. Critics, like ImperiumPaper, have suggested that these advisors recuse themselves to ensure impartiality.

“LlamaRisk is on Ethena’s Risk Committee, which comes with monthly compensation. Ethena hired Chaos early on to help design and develop the risk frameworks used by Ethena. Both should recuse themselves from any oversight of USDe parameters,” Imperium Paper stated.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10