Top Dividend Stocks To Consider For Your Portfolio

As global markets navigate mixed signals, with U.S. stocks ending the year on a high note despite some recent volatility and economic indicators like the Chicago PMI showing contraction, investors are seeking stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them attractive options for those looking to balance risk and reward amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2019 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

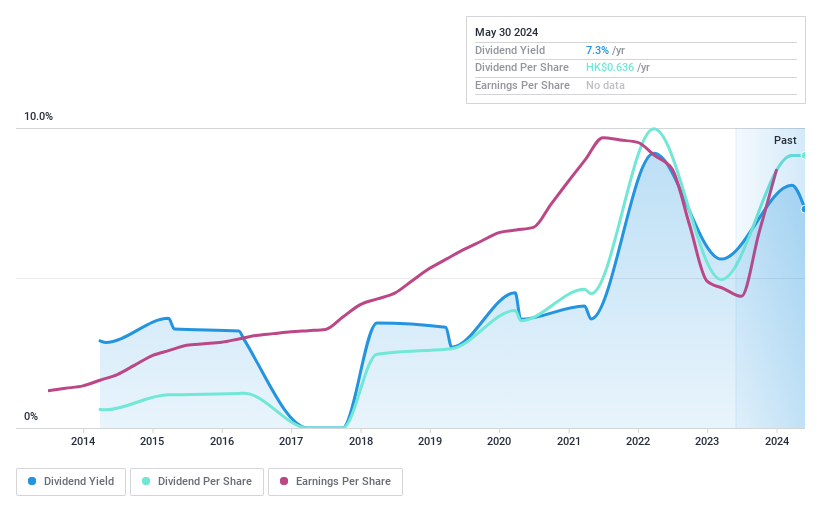

Xingfa Aluminium Holdings (SEHK:98)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Xingfa Aluminium Holdings Limited is an investment holding company that manufactures and sells construction and industrial aluminium profiles in the People’s Republic of China, with a market cap of HK$2.94 billion.

Operations: Xingfa Aluminium Holdings Limited's revenue is primarily derived from its construction aluminium profiles segment, which generated CN¥14.42 billion, and its industrial aluminium profiles segment, contributing CN¥2.79 billion.

Dividend Yield: 8.8%

Xingfa Aluminium Holdings offers a compelling dividend yield of 8.77%, placing it among the top 25% in the Hong Kong market. Despite its attractive yield, the company's dividend history is marked by volatility and unreliability over the past decade, with significant annual drops. However, dividends are well-covered by earnings and cash flows, with payout ratios at 26.5% and 26.1%, respectively. The stock trades significantly below its estimated fair value, suggesting potential undervaluation.

- Click to explore a detailed breakdown of our findings in Xingfa Aluminium Holdings' dividend report.

- Our expertly prepared valuation report Xingfa Aluminium Holdings implies its share price may be lower than expected.

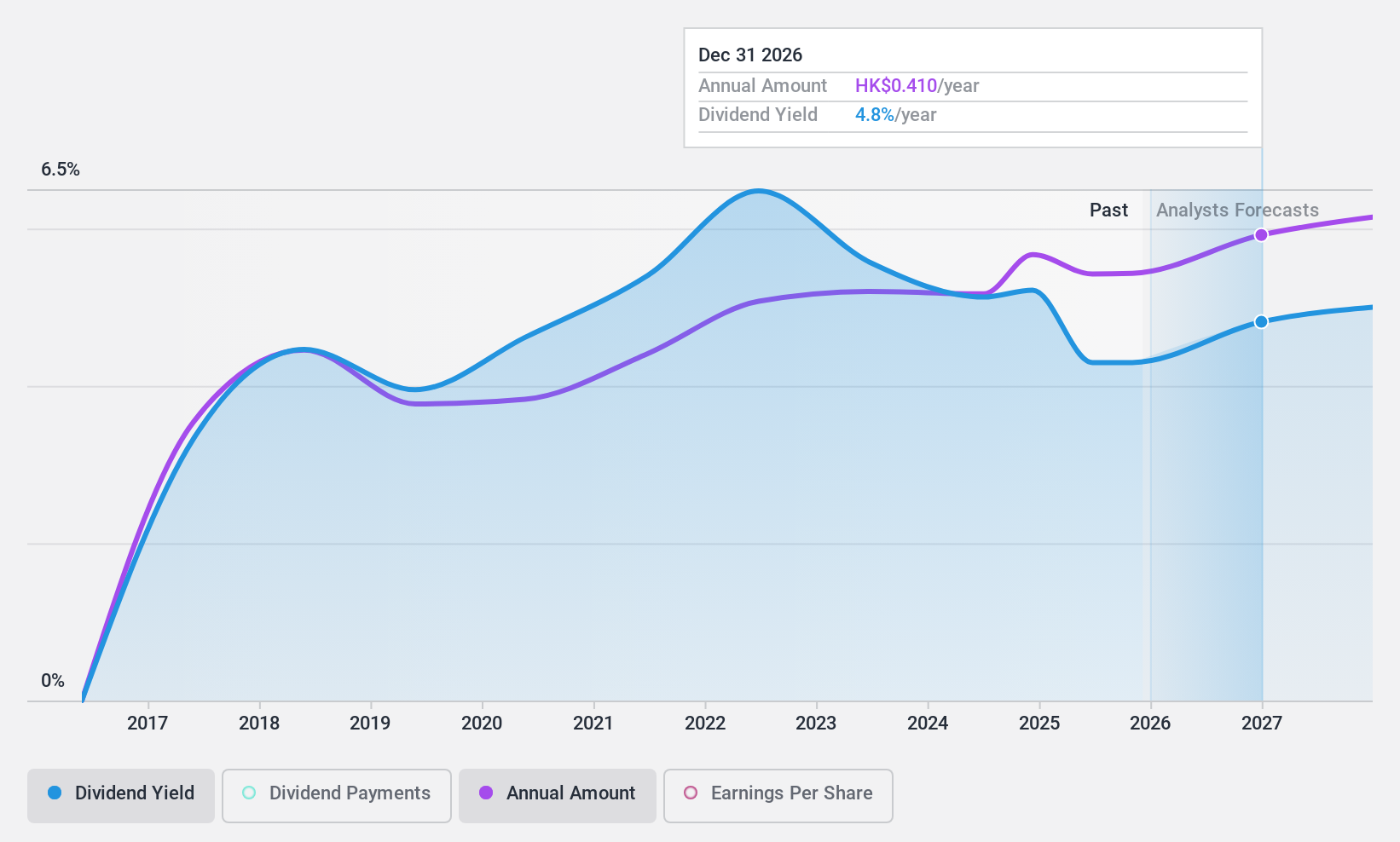

China CITIC Bank (SEHK:998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China CITIC Bank Corporation Limited offers a range of banking products and services both within the People's Republic of China and internationally, with a market cap of HK$365.79 billion.

Operations: China CITIC Bank Corporation Limited generates revenue through its diverse banking products and services offered domestically and abroad.

Dividend Yield: 7.4%

China CITIC Bank's dividend yield of 7.42% is below the top 25% in Hong Kong, and its dividend history has been volatile over the past decade. Despite this instability, dividends are currently well-covered by earnings with a payout ratio of 41.8%, expected to decrease to 27.8% in three years, indicating sustainability potential. The stock trades at a significant discount to its estimated fair value, suggesting it may be undervalued relative to peers and industry standards.

- Navigate through the intricacies of China CITIC Bank with our comprehensive dividend report here.

- The valuation report we've compiled suggests that China CITIC Bank's current price could be quite moderate.

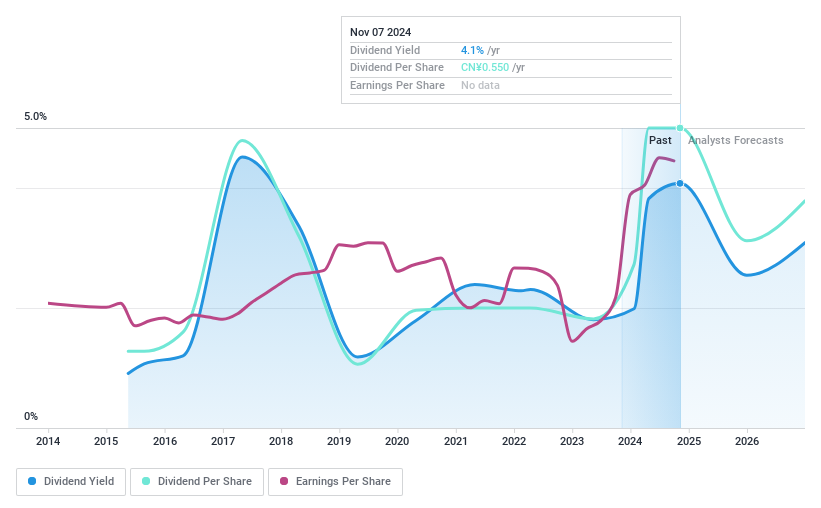

Sichuan Guoguang Agrochemical (SZSE:002749)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sichuan Guoguang Agrochemical Co., Ltd. is involved in the research and development, manufacturing, marketing, and distribution of agrochemical products both in China and internationally, with a market cap of CN¥6.60 billion.

Operations: Sichuan Guoguang Agrochemical Co., Ltd. generates its revenue from the development, production, and sale of agrochemical products and materials across domestic and international markets.

Dividend Yield: 3.9%

Sichuan Guoguang Agrochemical's dividend yield of 3.93% ranks in the top 25% of China's market, supported by a payout ratio of 68.6% and cash flow coverage at 80.9%. Despite earnings growth and trading below estimated fair value, its dividend history is unstable with past volatility over 20%. Recent affirmations include a CNY 3 per 10 shares dividend for Q3 2024, but shareholder dilution occurred last year.

- Get an in-depth perspective on Sichuan Guoguang Agrochemical's performance by reading our dividend report here.

- Our valuation report unveils the possibility Sichuan Guoguang Agrochemical's shares may be trading at a discount.

Seize The Opportunity

- Dive into all 2019 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10