Hyperliquid (HYPE) Sees Signs of Recovery, But Lack of Capital Inflow Remains a Challenge

- HYPE’s MACD bullish crossover signals potential recovery, but weak Chaikin Money Flow reflects insufficient investor inflows.

- Price has risen 8% recently, holding above $19.47 support; breaching $23.20 resistance is critical for targeting $29.85.

- Failure to break $23.20 or losing $19.47 support risks stalling momentum and invalidating the bullish outlook for HYPE.

HYPE has been undergoing a slow recovery following a sharp correction, but broader market conditions suggest this could change soon.

While the price shows signs of improvement, a stronger uptrend will depend on increased participation and confidence from investors, which remains a crucial missing factor.

Hyperliquid Investors’ Support Is Missing

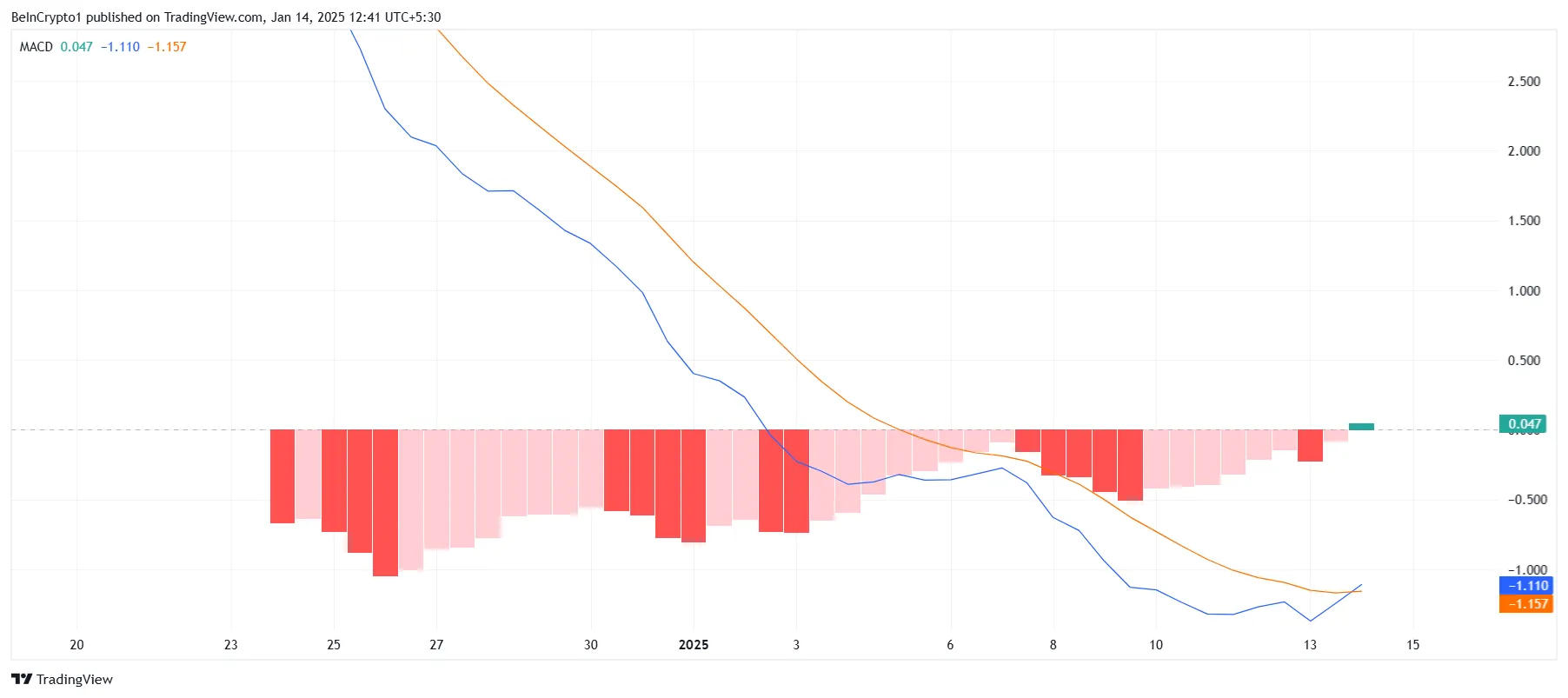

HYPE’s Moving Average Convergence Divergence (MACD) has recorded a bullish crossover for the first time in a long while. This shift in the MACD follows a slight price recovery over recent days, indicating that bullish momentum is beginning to revive and could strengthen further with market support.

The bullish crossover in the MACD is a positive indicator, signaling a potential trend reversal. If HYPE maintains its upward trajectory, the renewed momentum may attract more investors, building confidence in the cryptocurrency’s near-term performance.

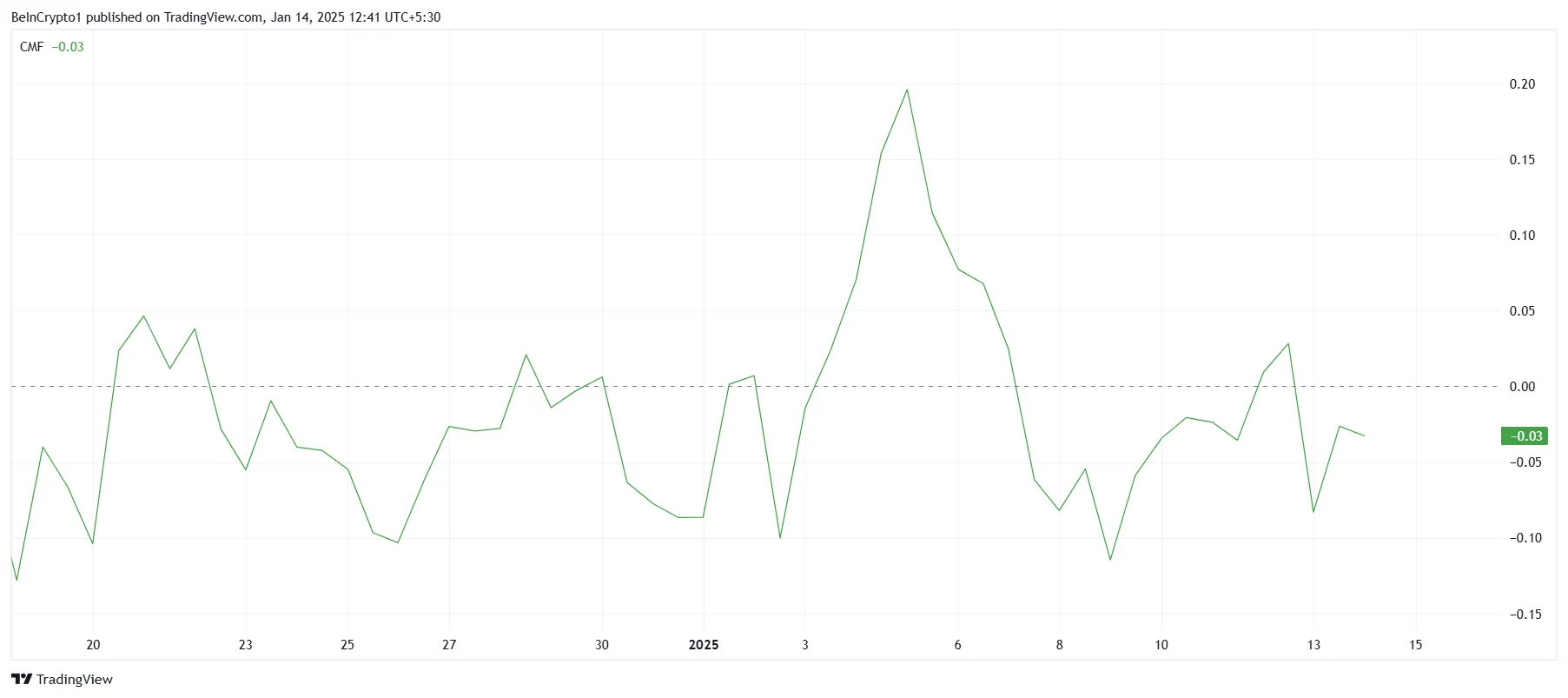

Despite recent price upticks, the Chaikin Money Flow (CMF) indicator for HYPE remains below the zero line. This reflects weak inflows, suggesting that while the market is beginning to stabilize, significant investor participation is still lacking. Stronger inflows are necessary for sustained price growth.

For HYPE to advance its recovery, investors need to inject more capital into the asset. Without sufficient inflows, the current momentum risks stalling, and the cryptocurrency may face difficulty in establishing a solid uptrend.

HYPE Price Prediction: Feuling The Growth

HYPE’s price has risen by 8% over the past few days, signaling early signs of recovery. However, this gain only offsets about half of the nearly 20% correction experienced in the previous week, leaving more ground to cover for a complete rebound.

Currently holding above the $19.47 support level, HYPE is targeting a breach of $23.20. Flipping this resistance into support could pave the way for a rally toward $29.85, enabling the crypto to recover its recent losses and build on its upward momentum.

If HYPE fails to breach the $23.20 resistance due to insufficient inflows, it could fall back to test the $19.47 support. Losing this level would invalidate the bullish outlook, potentially leading to further declines and dampening investor confidence.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10