3 Stocks That May Be Trading Up To 49.4% Below Intrinsic Value Estimates

Amidst a turbulent start to the year for global markets, with U.S. equities experiencing declines due to inflation fears and political uncertainties, investors are on the lookout for opportunities that might be overlooked in such a choppy environment. As value stocks have shown relative resilience compared to their growth counterparts, identifying stocks trading below intrinsic value could offer potential advantages in navigating these uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Turkcell Iletisim Hizmetleri (IBSE:TCELL) | TRY95.20 | TRY190.03 | 49.9% |

| Livero (TSE:9245) | ¥1564.00 | ¥3113.47 | 49.8% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.18 | TRY78.34 | 50% |

| Bank BTPN Syariah (IDX:BTPS) | IDR860.00 | IDR1715.86 | 49.9% |

| German American Bancorp (NasdaqGS:GABC) | US$39.26 | US$78.06 | 49.7% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1115.85 | ₹2226.73 | 49.9% |

| MLG Oz (ASX:MLG) | A$0.57 | A$1.14 | 49.9% |

| Atlas Arteria (ASX:ALX) | A$4.89 | A$9.73 | 49.7% |

| Shinko Electric Industries (TSE:6967) | ¥5868.00 | ¥11708.78 | 49.9% |

| Coeur Mining (NYSE:CDE) | US$6.35 | US$12.63 | 49.7% |

Click here to see the full list of 870 stocks from our Undervalued Stocks Based On Cash Flows screener.

We're going to check out a few of the best picks from our screener tool.

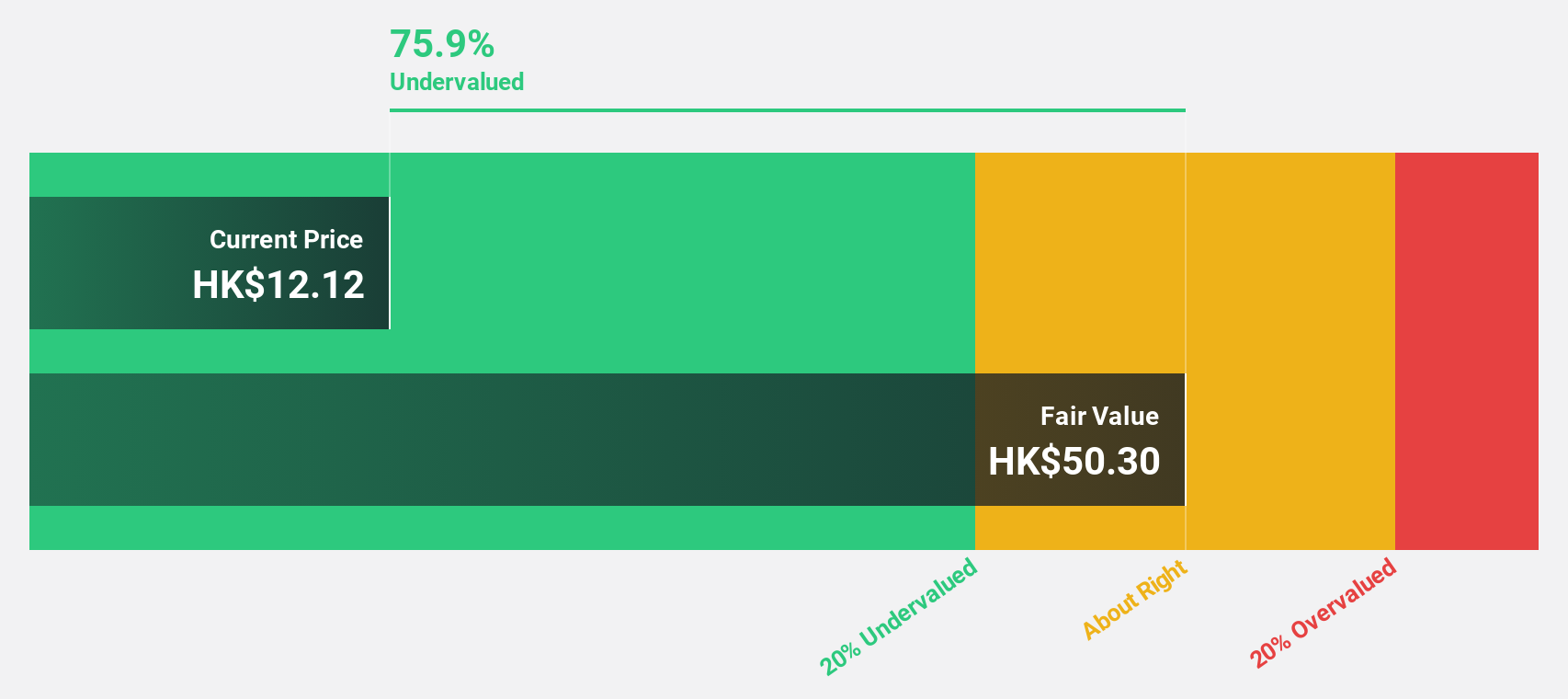

Yadea Group Holdings (SEHK:1585)

Overview: Yadea Group Holdings Ltd. is an investment holding company that develops, manufactures, and sells electric two-wheeled vehicles and related accessories in the People's Republic of China, with a market cap of HK$37.78 billion.

Operations: The company's revenue segments include CN¥31.76 billion from electric two-wheeled vehicles and related accessories, and CN¥5.23 billion from batteries and electric drive.

Estimated Discount To Fair Value: 33.3%

Yadea Group Holdings is trading at HK$12.52, significantly below its estimated fair value of HK$18.78, suggesting it may be undervalued based on cash flows. Despite a forecasted decrease in net profit for 2024 due to inventory destocking and price reductions, earnings are expected to grow annually by 18%, outpacing the Hong Kong market's average growth rate. However, its dividend yield of 3.67% isn't well-supported by free cash flows.

- Our expertly prepared growth report on Yadea Group Holdings implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Yadea Group Holdings' balance sheet health report.

Greenworks (Jiangsu) (SZSE:301260)

Overview: Greenworks (Jiangsu) Co., Ltd. focuses on the research, development, design, production, and sale of garden machinery with a market cap of CN¥6.31 billion.

Operations: The company generates revenue of CN¥5.13 billion from its Farm Machinery & Equipment segment.

Estimated Discount To Fair Value: 49.4%

Greenworks (Jiangsu) is trading at CN¥13.95, significantly below its estimated fair value of CN¥27.55, indicating potential undervaluation based on cash flows. The company has shown improvement with net income reaching CN¥9.3 million for the nine months ending September 2024, compared to a net loss previously. Despite revenue growth forecasted at 13.7% annually, which is slower than 20%, earnings are expected to grow substantially by 68.67% per year as profitability approaches within three years.

- Our earnings growth report unveils the potential for significant increases in Greenworks (Jiangsu)'s future results.

- Delve into the full analysis health report here for a deeper understanding of Greenworks (Jiangsu).

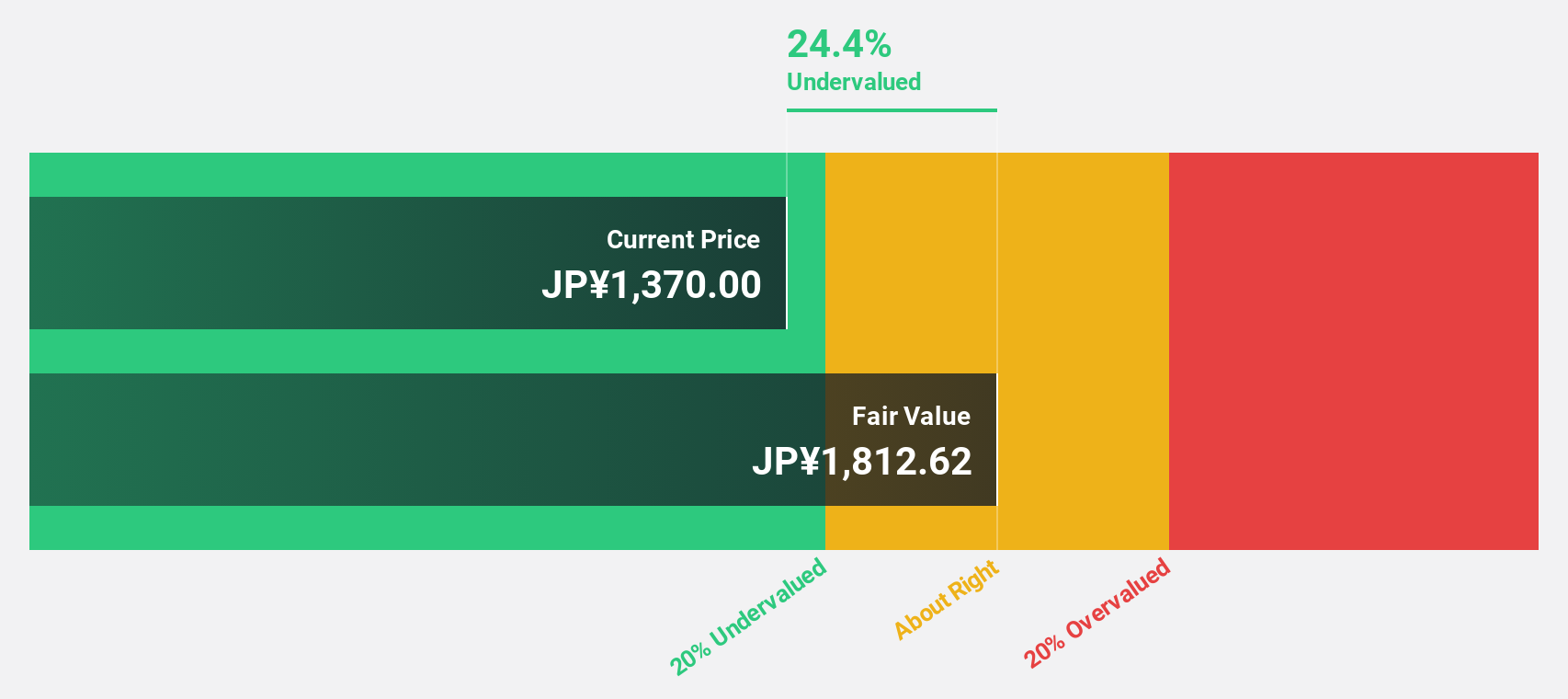

create restaurants holdings (TSE:3387)

Overview: Create Restaurants Holdings Inc. is a company that plans, develops, and manages food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan with a market cap of ¥246.77 billion.

Operations: Revenue segments for TSE:3387 include food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan.

Estimated Discount To Fair Value: 46.7%

Create restaurants holdings is trading at ¥1,309, considerably below its estimated fair value of ¥2,456.31, highlighting potential undervaluation based on cash flows. The company has demonstrated strong earnings growth of 78.5% over the past year and is expected to continue with a significant annual profit increase of 21%. While revenue growth is moderate at 5.4% annually, it surpasses the JP market average of 4.2%.

- In light of our recent growth report, it seems possible that create restaurants holdings' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of create restaurants holdings.

Key Takeaways

- Navigate through the entire inventory of 870 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10