Breakout Alert! Lido DAO (LDO) Open Interest Soars by 30%, Bullish Sign?

Amid the ongoing crypto market recovery, Lido DAO’s (LDO) bullish price action has captured traders’ attention. In recent weeks, LDO has been struggling within a tight range between $1.50 and $2.00. However, with the current price recovery, it appears to be breaking out of this zone.

Lido DAO (LDO) Technical Analysis

According to expert technical analysis, LDO has been trading within a narrow range since late December 2024, with the $2 level acting as strong resistance. LDO has faced resistance multiple times during this period, leading to notable price declines.

However, the current market sentiment is shifting, which could trigger a price surge and a breakout above this resistance level.

LDO Price Prediction

Based on recent price action and historical momentum, this breakout can be considered successful only if the asset closes a daily candle above the $2.15 level, otherwise, it would be a fakeout. If this happens, there is a strong possibility that the LDO token could soar by 55% to reach the $3.37 level in the future.

However, the asset is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating that LDO is in an uptrend. On the positive side, the asset’s Relative Strength Index (RSI) is currently below the 55 level, suggesting that altcoin still has enough room to rise significantly in the coming days.

Bullish On-Chain Metrics

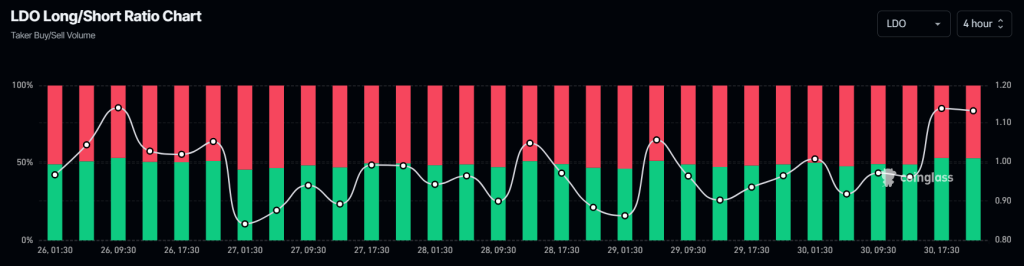

Looking at this bullish outlook following the breakout, traders have shown strong interest in the asset, as revealed by the on-chain analytics firm Coinglass. Data shows that LDO’s open interest (OI) has surged by 32% in the past 24 hours and 20% in the past four hours, indicating an increase in new positions by intraday traders.

However, the LDO long/short ratio reveals that intraday traders are strongly betting on the long side, as it currently stands at 1.14. At press time, over 53.50% of traders hold long positions, while 46.50% hold short positions, making the ratio favorable for the bulls.

Current Price Momentum

LDO is currently trading near $2.13 and has experienced a price surge of over 16% in the past 24 hours. During the same period, its trading volume jumped by 60%, indicating heightened participation from traders and investors following the breakout.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10