Kraken Records $1.5 Billion in Revenue as US Trading Volume Surges

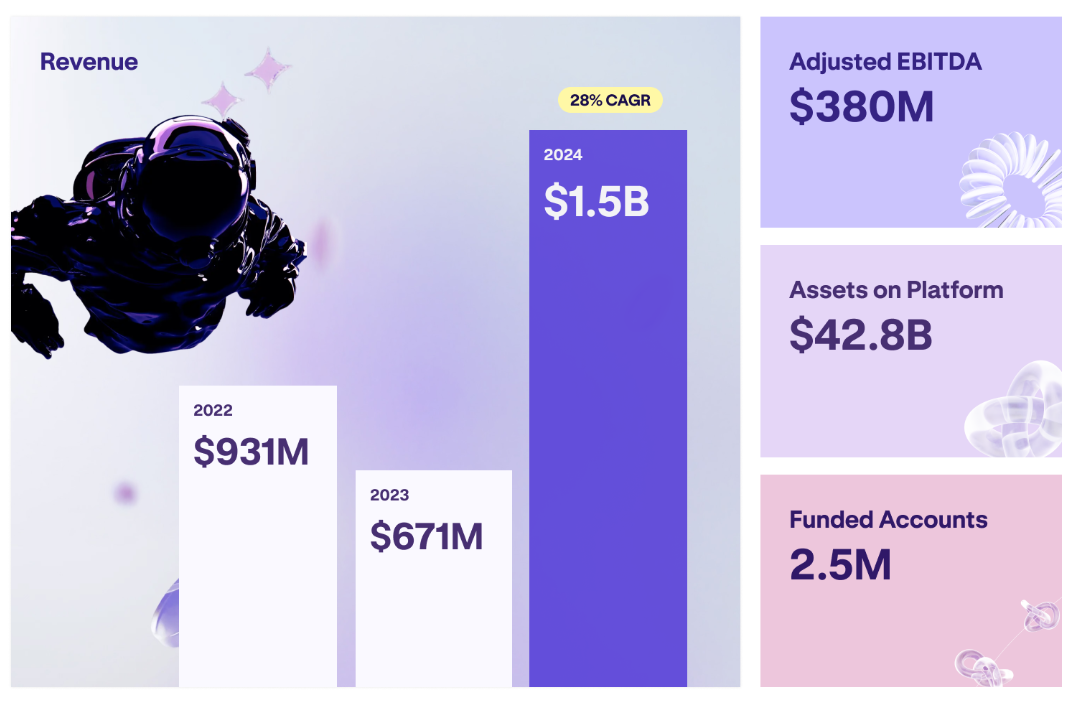

- Crypto exchange Kraken's revenue surged 128% in 2024 to reaching $1.5 billion.

- The firm said this was driven by $665 billion in trading volume and a rising crypto market.

- Despite its strong performance, Kraken faces ongoing regulatory challenges in the US.

Kraken’s revenue surged significantly in 2024, reaching $1.5 billion—an increase of 128% year over year.

The US-based crypto exchange’s financial success aligns with a broader market upswing, which saw Bitcoin and other digital assets reach new all-time highs.

Kraken’s Trading Volume Hits $665 Billion

In 2024, the platform reported $380 million in earnings before interest, taxes, depreciation, and amortization (EBITDA), fueled by $665 billion in trading volume.

On average, Kraken generated over $2,000 per customer while holding approximately $42.8 billion in assets. The platform also managed 2.5 million funded accounts, becoming the fifth-largest centralized exchange in terms of daily trading volume.

Kraken attributes its success to a long-term growth strategy rather than short-term market trends. This focus has helped it dominate the stable-to-fiat on-ramp sector. The exchange managed over 40% of the global stable-fiat volume among major centralized exchanges.

The company also emphasized its commitment to seamless execution, reporting 2.5 billion trades since inception, 99.9% platform uptime, and sub-2ms round-trip latency.

Kraken Co-CEO Arjun Sethi reaffirmed the firm’s commitment to transparency while announcing plans to release quarterly financial reports that would include the exchange of proof-of-reserves disclosures.

“Today’s financial highlights are the first of many as we continue to prioritize transparency and accountability. We remain committed to publishing our Proof of Reserves regularly, ensuring our clients’ highest level of trust,” Sethi added.

While speculation about a 2025 initial public offering (IPO) continues, Kraken has not confirmed any plans. Instead, the firm stated that it maintains financial independence, having raised only $27 million in primary funding since its launch in 2011.

Regulatory Hurdles Persist

Despite its strong financial performance, Kraken continues to face significant regulatory hurdles in the US.

The exchange settled with the SEC in 2023 over its staking services, leading to the suspension of the product. However, it reintroduced staking for users in 39 states earlier this week while announcing to shut down its NFT marketplace in February.

Meanwhile, Kraken remains entangled in an SEC lawsuit, which alleges it has been operating as an unregistered exchange, broker, and clearing agency. The regulator claims Kraken facilitated unlawful crypto securities transactions since 2018, generating significant revenue.

However, a recent court ruling allowed the exchange to proceed with its “fair notice” and “due process” defenses, though its “major questions doctrine” argument was dismissed.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10