BlackRock Now Owns 5% of MicroStrategy

- BlackRock has increased its ownership stake in Strategy to 5%, signaling continued support for the company's Bitcoin-focused strategy despite recent market fluctuations and tax challenges.

- Strategy's aggressive Bitcoin acquisition approach, including a record $20 billion purchase in Q4 2024, has attracted institutional investors like BlackRock seeking indirect exposure to the cryptocurrency.

- Despite a recent pause in BTC purchases and potential tax liabilities on unrealized gains, Strategy remains committed to its Bitcoin-first approach, bolstered by BlackRock's increased investment.

A recent SEC filing revealed that BlackRock increased its stake in Strategy (formerly MicroStrategy) to 5%, equivalent to approximately 11.2 million shares.

Strategy’s frequent Bitcoin acquisitions have made it a go-to option for institutional players seeking indirect Bitcoin investment.

MicroStrategy’s Shares Are Up

In a recent filing, BlackRock, the world’s largest asset manager, disclosed a new acquisition of Strategy’s shares. This latest purchase represents a 0.91% increase from its previous 4.09% ownership as of September 2024.

A Schedule 13G is filed when an investor acquires more than 5% of a publicly traded company’s stock but does not intend to influence or control the company. Institutional investors must file within 45 days after year-end or within 10 days if ownership exceeds 10%.

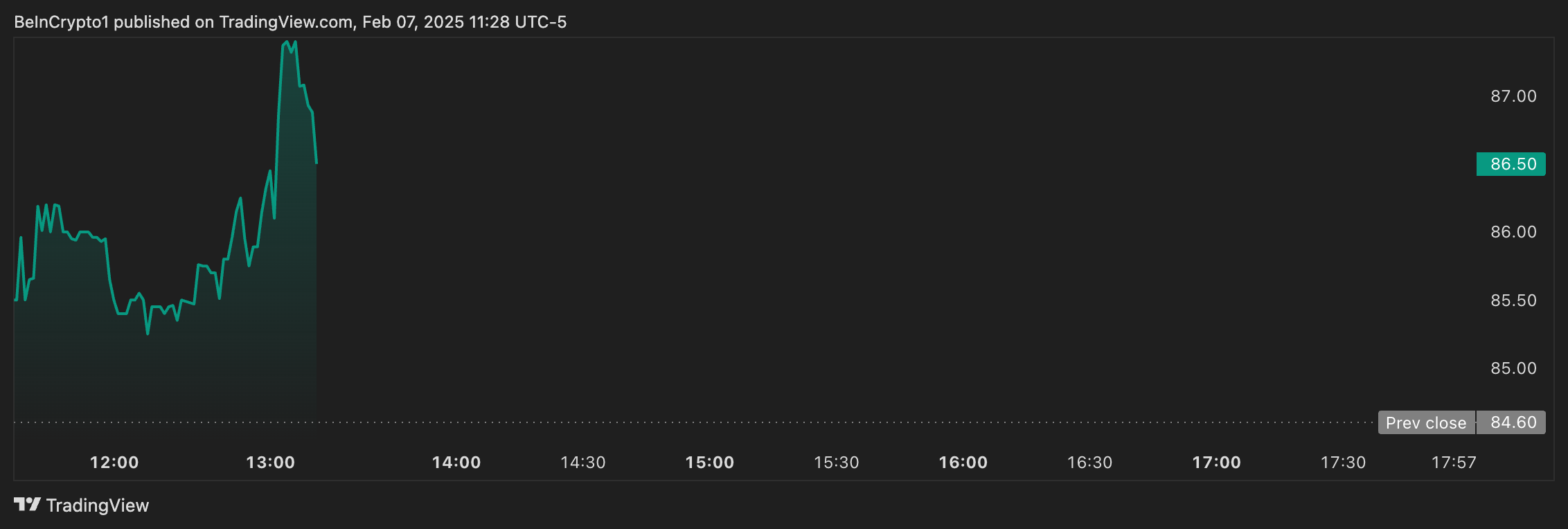

According to TradingView, Strategy experienced larger trading volumes in response to BlackRock’s purchase, while its shares on NASDAQ increased by 2%.

The timing of BlackRock’s increased stake coincides with Strategy’s continued Bitcoin accumulation. The company’s recent financial results reveal a record-breaking Q4 2024 for Bitcoin purchases, with acquisitions surpassing $20 billion.

Earlier this week, Michael Saylor announced that Microstrategy has rebranded to Strategy, incorporating the Bitcoin symbol in its official logo. Under its new brand name, the company aims to gain $10 billion on its Bitcoin holdings in 2025.

Less than two weeks ago, Strategy bought $1.1 billion in Bitcoin for the second time in one week. However, earlier this week, the firm stopped its 12-week streak of Bitcoin purchases.

“Last week, MicroStrategy did not sell any shares of Class A common stock under its at-the-market equity offering program, and did not purchase any Bitcoin. As of February 2, 2025, we hold 471,107 BTC acquired for ~$30.4 billion at ~$64,511 per Bitcoin,” Saylor claimed.

Several factors may explain this change in gears. Notably, Bitcoin’s value has struggled, particularly since the threat of US tariffs against Mexico, Canada, and China triggered a downturn in the cryptocurrency market.

Given the potential for further economic instability, Strategy may have adopted a more conservative in its future Bitcoin investments.

An Unforeseen Tax Dilemma

Strategy recently disclosed a significant tax issue from its $47 billion ownership in Bitcoin holdings. The company’s $18 billion in unrealized gains could be subject to the US corporate alternative minimum tax (CAMT) enacted in 2022 under the Biden administration.

This tax, designed to prevent companies from minimizing taxable income, applies a 15% rate to adjusted financial statement earnings, potentially taxing gains even before assets are sold.

While the Internal Revenue Service (IRS) has exempted unrealized stock gains, it has not yet extended this treatment to cryptocurrencies, leaving Strategy liable for billions in taxes starting in 2026.

BlackRock’s recent purchase offers some relief to Strategy as it continues to prioritize Bitcoin accumulation.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10