3 Stocks That Investors May Be Undervaluing By Up To 50%

In a week marked by volatility, global markets have been influenced by fluctuating corporate earnings and geopolitical tensions, with the U.S. Federal Reserve holding interest rates steady while the European Central Bank opted for a rate cut. Amidst these shifts, investors are seeking opportunities in stocks that may be undervalued due to broader market dynamics or sector-specific pressures. Identifying such stocks often involves looking beyond short-term fluctuations to assess intrinsic value and potential growth prospects relative to current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shihlin Electric & Engineering (TWSE:1503) | NT$175.50 | NT$350.30 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$89.80 | NT$179.26 | 49.9% |

| Old National Bancorp (NasdaqGS:ONB) | US$24.45 | US$48.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.91 | 50% |

| Hanwha Systems (KOSE:A272210) | ₩25200.00 | ₩50281.74 | 49.9% |

| AbbVie (NYSE:ABBV) | US$192.97 | US$385.39 | 49.9% |

| Verra Mobility (NasdaqCM:VRRM) | US$25.88 | US$51.66 | 49.9% |

| Sunstone Development (SHSE:603612) | CN¥15.99 | CN¥31.95 | 50% |

| Ming Yuan Cloud Group Holdings (SEHK:909) | HK$3.56 | HK$7.10 | 49.9% |

| Hua Hong Semiconductor (SEHK:1347) | HK$26.45 | HK$52.75 | 49.9% |

Click here to see the full list of 924 stocks from our Undervalued Stocks Based On Cash Flows screener.

Let's take a closer look at a couple of our picks from the screened companies.

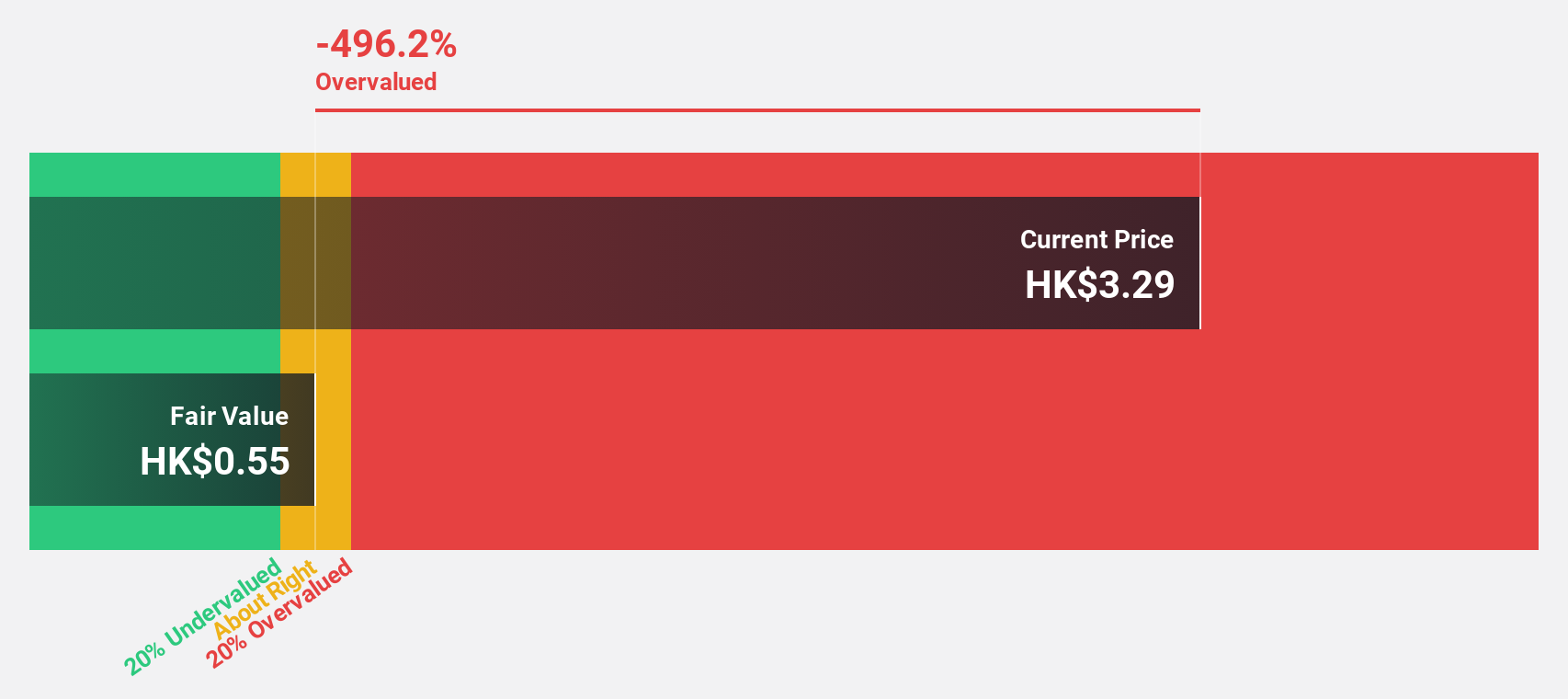

Ming Yuan Cloud Group Holdings (SEHK:909)

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers software solutions for property developers in China, with a market cap of HK$5.72 billion.

Operations: The company generates revenue from its Cloud Services segment, amounting to CN¥1.32 billion, and from On-premise Software and Services, totaling CN¥281.71 million.

Estimated Discount To Fair Value: 49.9%

Ming Yuan Cloud Group Holdings is trading at HK$3.56, significantly below its estimated fair value of HK$7.1, indicating a potential undervaluation based on cash flows. The company is forecast to achieve profitability within three years with earnings growth expected at 59.43% annually, outpacing the Hong Kong market's revenue growth rate of 7.7%. Despite these positives, its return on equity remains low at 0.2% in the forecast period. Recent auditor changes to Ernst & Young may impact future financial reporting stability.

- The analysis detailed in our Ming Yuan Cloud Group Holdings growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Ming Yuan Cloud Group Holdings stock in this financial health report.

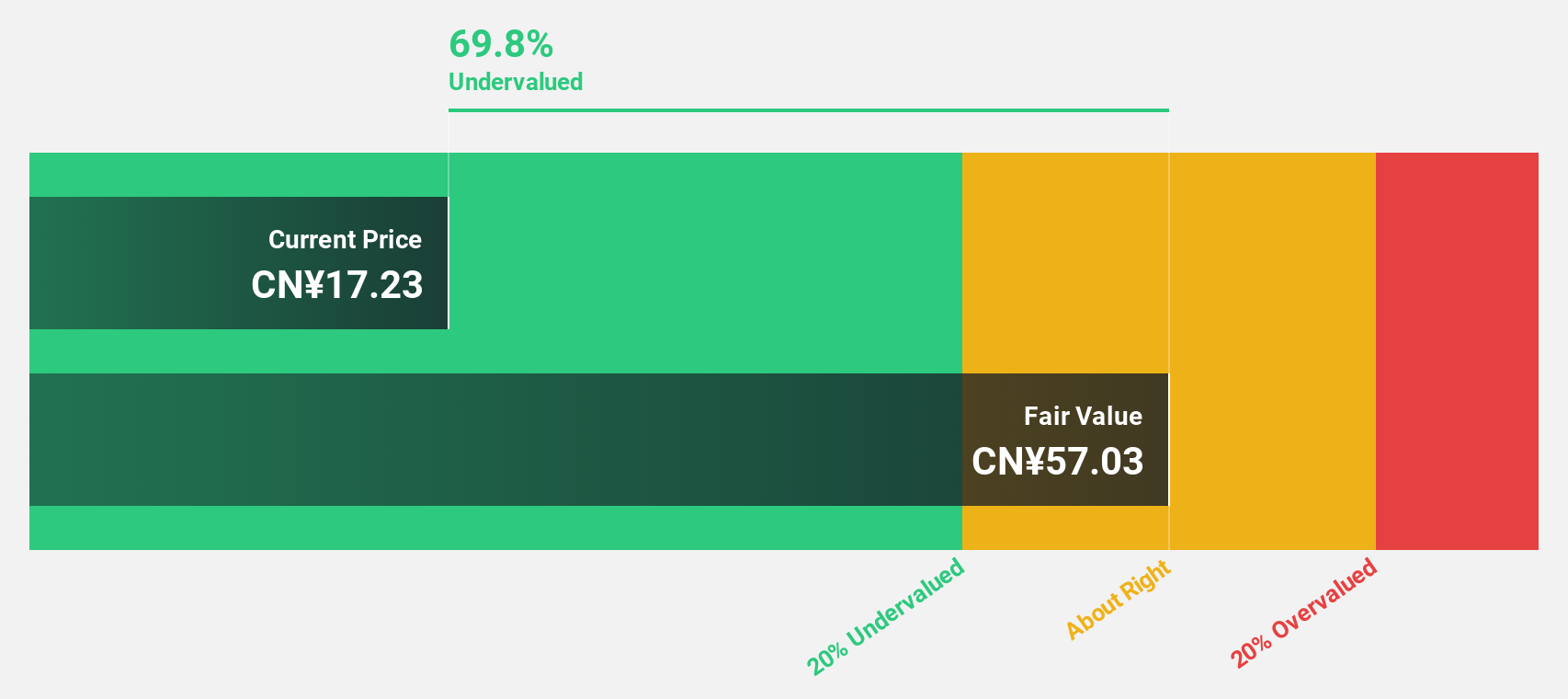

Sunstone Development (SHSE:603612)

Overview: Sunstone Development Co., Ltd. focuses on the research, development, production, and sales of prebaked carbon anodes for the aluminum industry both in China and internationally, with a market cap of CN¥7.24 billion.

Operations: Sunstone Development Co., Ltd. generates revenue through its involvement in the research, development, production, and sales of prebaked carbon anodes for the aluminum industry across domestic and international markets.

Estimated Discount To Fair Value: 50%

Sunstone Development is trading at CNY 15.99, well below its estimated fair value of CNY 31.95, highlighting a potential undervaluation based on cash flows. Revenue growth is projected at 23.6% annually, surpassing the Chinese market average of 13.5%, with earnings expected to grow significantly by over 80% per year and profitability anticipated within three years. However, interest payments are not well covered by earnings and return on equity forecasts remain modest at 11.7%.

- In light of our recent growth report, it seems possible that Sunstone Development's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Sunstone Development.

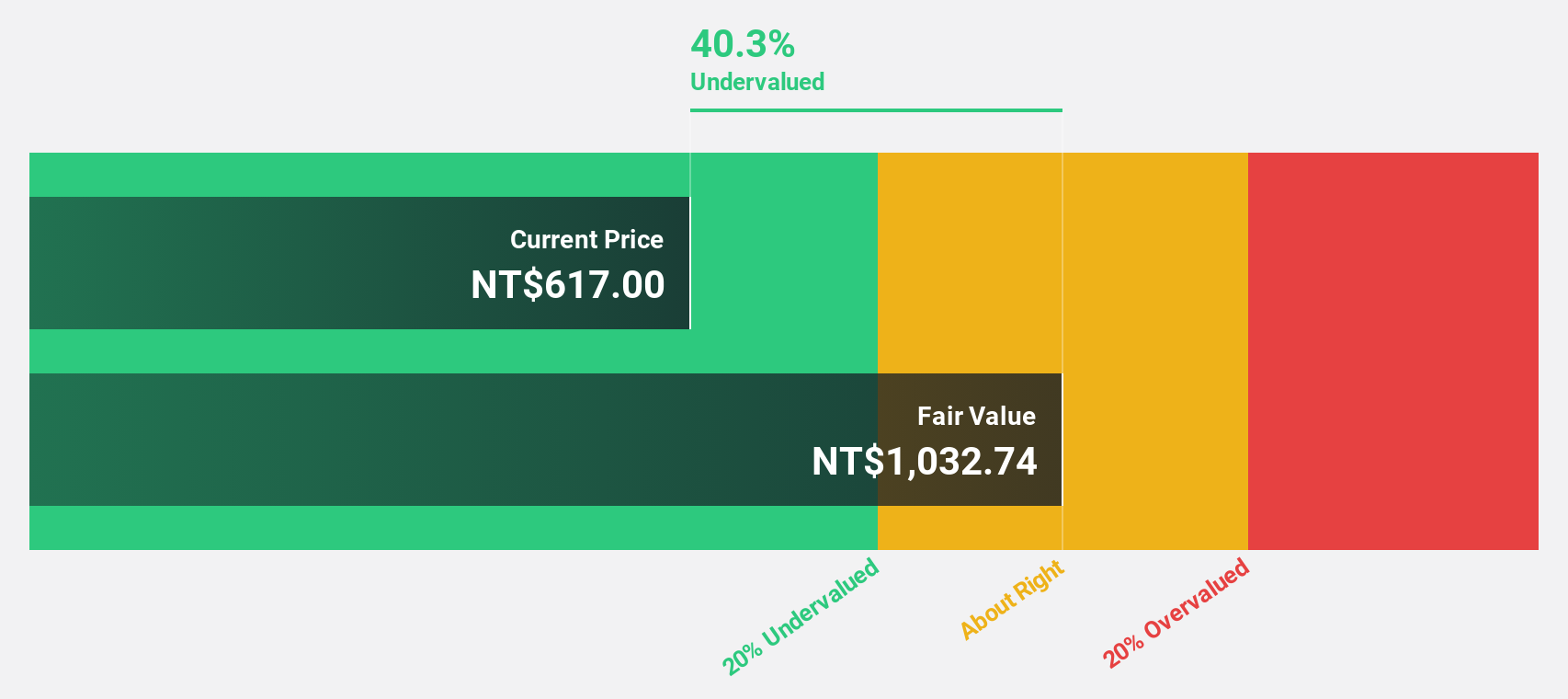

Bizlink Holding (TWSE:3665)

Overview: Bizlink Holding Inc. is involved in the research, design, development, manufacturing, and sale of interconnect products for cable harnesses across various countries including the United States, China, and Germany with a market cap of NT$113.70 billion.

Operations: The company's revenue segments include the Computer Transmission Department with NT$49.83 billion, the Home Electric Appliance Division at NT$9.22 billion, and the Industrial Application Department generating NT$25.58 billion.

Estimated Discount To Fair Value: 23.1%

Bizlink Holding, trading at NT$643, is considered undervalued as it falls over 20% below its fair value estimate of NT$836.37. Despite recent volatility, the company has shown robust earnings growth of 22.6% in the past year and forecasts suggest a significant annual profit increase of 38.1%, outpacing Taiwan's market average. However, revenue growth projections are moderate at 16.7% annually and return on equity is expected to be modest at 19.9%.

- According our earnings growth report, there's an indication that Bizlink Holding might be ready to expand.

- Navigate through the intricacies of Bizlink Holding with our comprehensive financial health report here.

Where To Now?

- Access the full spectrum of 924 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10