SUI Struggles to Recover from Recent Losses Amid Investor Skepticism

- SUI remains above $3.00 despite a 43% year-to-date decline, but weak investor confidence limits its recovery potential.

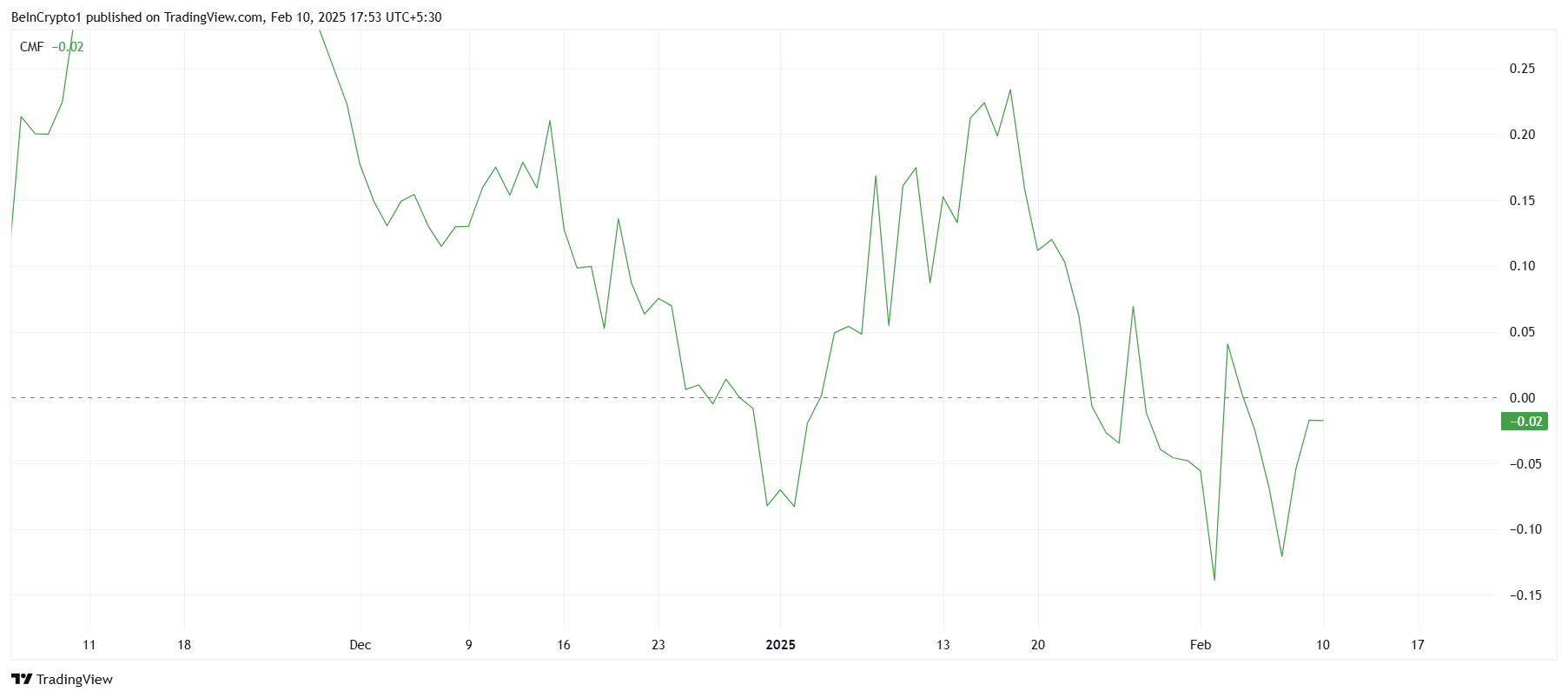

- The MACD indicator nears a bullish crossover, but ongoing capital outflows in the CMF suggest traders remain skeptical.

- Holding $3.18 support could push SUI toward $3.69, but losing this level may trigger a drop to $2.85, extending losses.

SUI has struggled to regain lost ground after a significant 43% decline since the beginning of the year. Despite multiple bounce-back attempts, the altcoin has failed to establish a sustainable recovery.

A lack of investor confidence has further delayed SUI’s price rebound, keeping it under pressure in a volatile market.

SUI Investors’ Skepticism Is A Bane

The Moving Average Convergence Divergence (MACD) indicator is approaching a potential bullish crossover. If confirmed, it would be SUI’s first positive shift in nearly a month. This technical development could signal the start of a recovery rally, drawing attention from investors looking for renewed momentum.

However, the market remains cautious, with traders waiting for confirmation before making significant moves. A successful MACD crossover could encourage buying activity, but hesitation persists due to prevailing bearish sentiment. Without stronger demand, SUI’s recovery attempt may remain short-lived.

The Chaikin Money Flow (CMF) indicator highlights ongoing capital outflows, reflecting weak investor participation. Since the start of the month, CMF has failed to close above the zero line, showing that selling pressure continues to dominate. This suggests that investors remain skeptical about SUI’s potential for a sustained price increase.

Until inflows start outweighing outflows, SUI may struggle to generate enough demand for a strong breakout. Without a shift in investor sentiment, the altcoin’s recovery could be delayed further. The market needs a surge in accumulation to confirm bullish momentum and counteract existing resistance.

SUI Price Prediction: Support Is Intact

SUI’s price has risen by 6% over the last 24 hours, currently trading at $3.25. Despite broader bearish market conditions, the altcoin has maintained its position above $3.00. This resilience has helped prevent a drop below the critical support level of $2.85, keeping hopes for a rebound alive.

Market indicators present mixed signals, but SUI’s ability to hold above the $3.18 support level offers a potential bullish outlook. If the altcoin secures this level, it could move toward $3.69, marking a significant price increase.

However, losing the $3.18 support could shift momentum back in favor of the bears. If selling pressure intensifies, SUI may revisit the $2.85 support, with a break below this level invalidating any bullish thesis. Such a scenario could extend investor losses and delay the possibility of a sustained recovery.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10