Toncoin Hits Historic Low in Risk Metrics – What This Means for TON Investors

- Toncoin (TON) has dropped 28% in value over the past month. It is now priced at $3.89, marking a historic low on a key metric.

- TON's Normalized Risk Metric (NMR) indicator suggests it's in a low-risk accumulation zone, ideal for long-term investors.

- The asset's negative MVRV ratio confirms it's undervalued, offering a potential "buy the dip" opportunity with long-term growth prospects.

Telegram-linked Toncoin has experienced a significant price decline over the past month. It currently trades at $3.89, having shed 28% of its value in the past 30 days.

This dip has pushed TON to a historic low, presenting a potential accumulation phase for long-term investors.

Toncoin Falls, But There Is a Catch

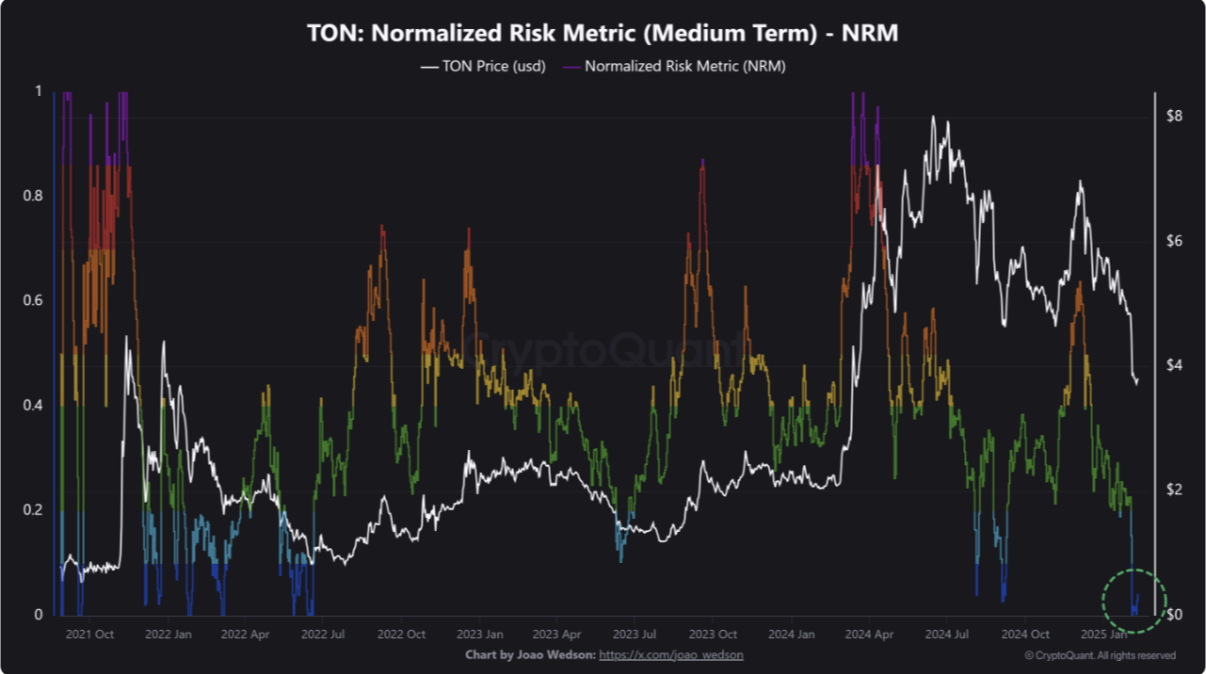

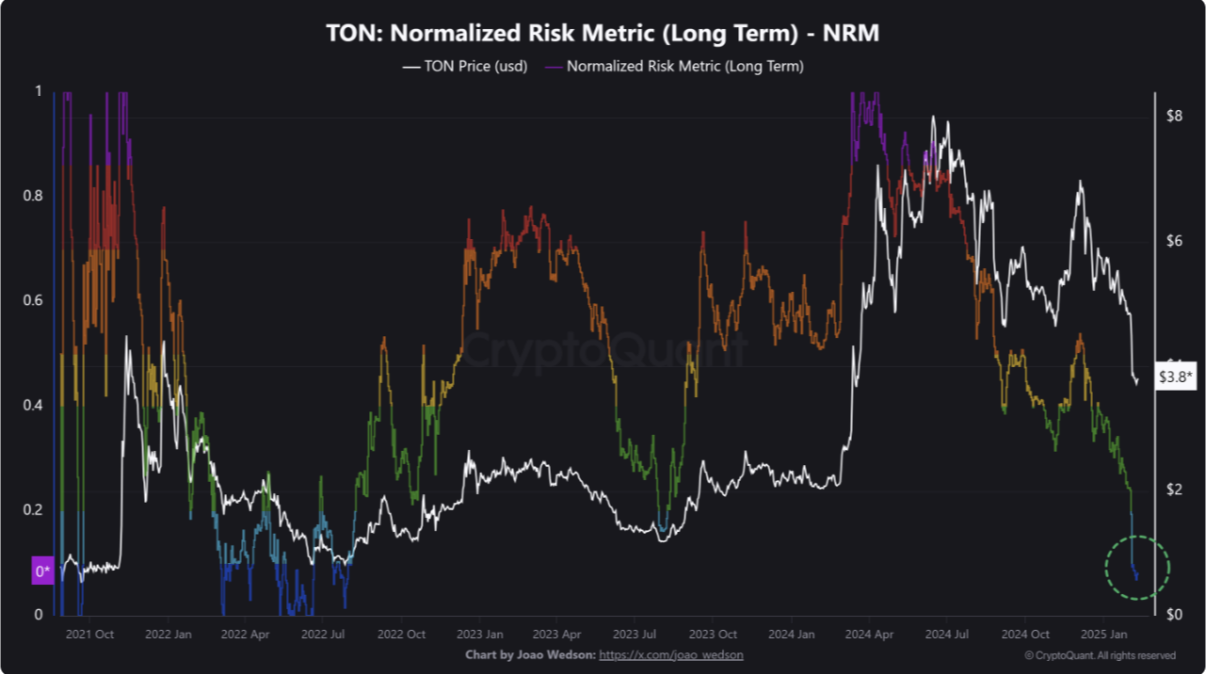

In a new report, CryptoQuant analyst Joao Wedson notes that TON has reached historically low levels on the Normalized Risk Metric (NRM) indicator, presenting a buying opportunity for long-term investors.

The NRM indicator tracks an asset’s value by comparing its current price to key weighted moving averages. When NRM is at low levels like this, it suggests that an asset is trading at a historically undervalued price relative to its long-term trends.

According to Wedson, TON’s NRM is at its lowest in both the medium and long term, suggesting that the token is currently in a low-risk accumulation zone. This means that its current price is undervalued compared to historical trends, making it an attractive entry point for investors who believe in its long-term potential.

“For investors, this scenario could represent an interesting opportunity to start accumulating TON, taking advantage of a moment when the risk (or the asset’s “valuation”) is at its minimum, suggesting potential for appreciation in the medium to long term,” Wedson said.

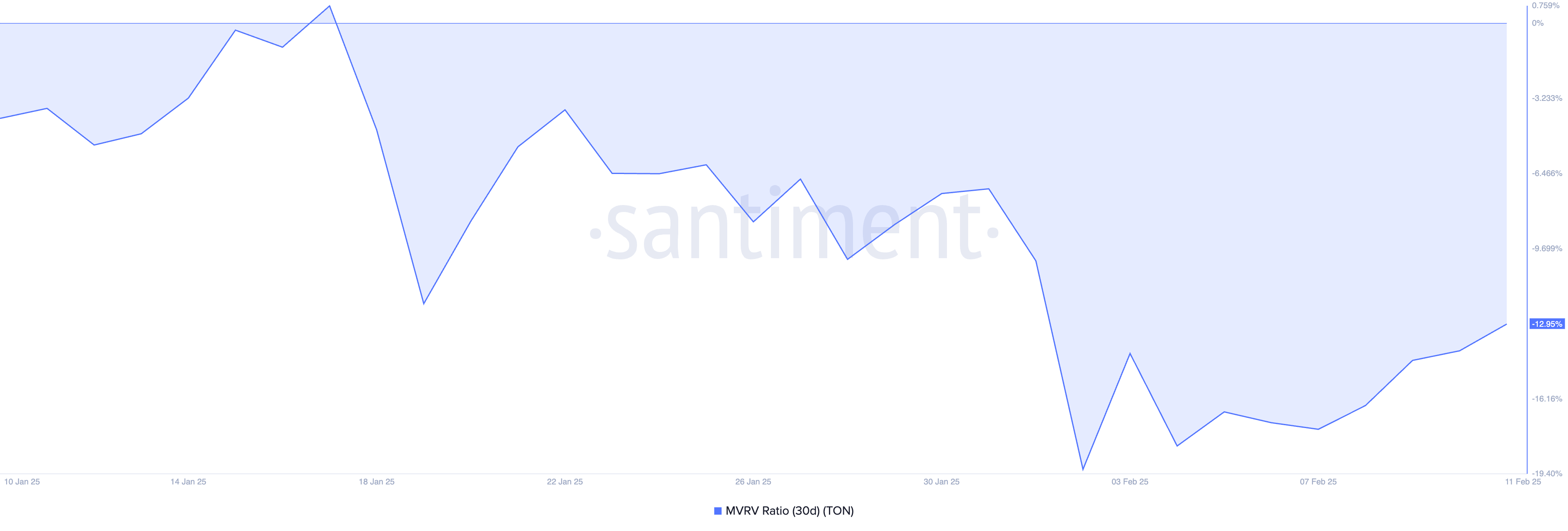

BeInCrypto’s assessment of the altcoin’s market value to realized value (MVRV) ratio using a 30-day moving average confirms its undervalued status. According to Santiment, this is -12.95% at press time.

An asset’s MVRV ratio identifies whether it is overvalued or undervalued by measuring the relationship between its market value and its realized value. When an asset’s MVRV ratio is positive, its market value is higher than the realized value, suggesting it is overvalued.

On the other hand, as with TON, when the ratio is negative, the asset’s market value is lower than its realized value. This suggests that the coin is undervalued compared to what people originally paid for it. Historically, negative ratios like this present a buying opportunity for those looking to “buy the dip” and “sell high.”

TON Price Prediction: Can It Sustain Momentum and Reach $4.96?

On a daily timeframe, TON has benefited from the broader market rally, noting a 1% price hike in the past 24 hours. If market participants increase their token accumulation, TON may maintain this upward trend in the short term.

In that case, its price could break above the critical resistance at $4 to trade at $4.17. If bullish support intensifies at this level, TON’s value could rally further to $4.96

Conversely, if TON holders refrain from accumulation, the token could lose its recent gains and drop to $2.91.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10