ONDO Price Holds 20% Monthly Gains but Struggles to Regain Momentum

- ONDO remains up 22% in 30 days but struggles with weak trend strength and fading buying pressure.

- Key indicators show consolidation, with ONDO’s ADX below 15 for five days, signaling a lack of clear momentum.

- A breakout above $1.49 could drive gains, but a drop below $1.28 may lead to further declines toward $1.00.

Ondo Finance (ONDO) price has been in a consolidation phase over the past few days, but it remains up 20% in the last 30 days, solidifying its position as one of the most relevant RWA (Real-World Assets) tokens in the market. Despite its recent lack of momentum, ONDO continues to hold a $4.2 billion market cap.

Key indicators suggest uncertainty, with trend strength weakening and buying pressure fading. Whether ONDO breaks out of its range or continues consolidating will depend on its ability to regain momentum in the coming sessions.

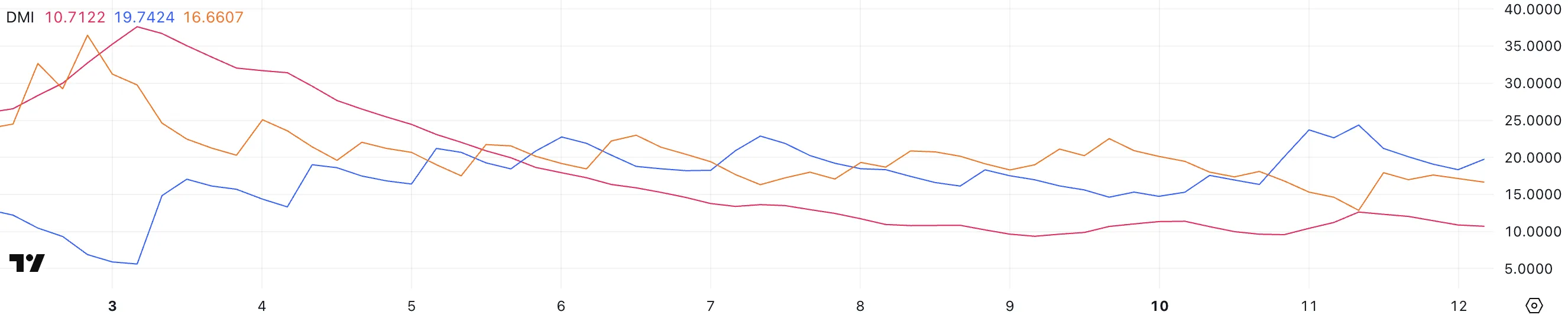

ONDO DMI Shows Lack of a Clear Trend

ONDO DMI chart shows an ADX of 10.7, remaining below 15 for five consecutive days, signaling extremely weak trend strength. The ADX (Average Directional Index) measures trend strength rather than direction, with values below 20 typically indicating a lack of a strong trend and above 25 suggesting a more established movement.

Since ONDO’s ADX has stayed low for several days, it confirms the market is in consolidation, with no clear bullish or bearish momentum.

Meanwhile, the +DI has dropped from 24.2 to 19.7, while the -DI has risen from 12.8 to 16.6, showing a slight shift in directional strength but no decisive breakout. Although these movements suggest some shifts in buying and selling pressure, both indicators appear to be stabilizing.

This aligns with ONDO current sideways price action, where neither buyers nor sellers have full control. Until ADX rises above 20, a strong trend is unlikely, and ONDO may continue consolidating in the short term.

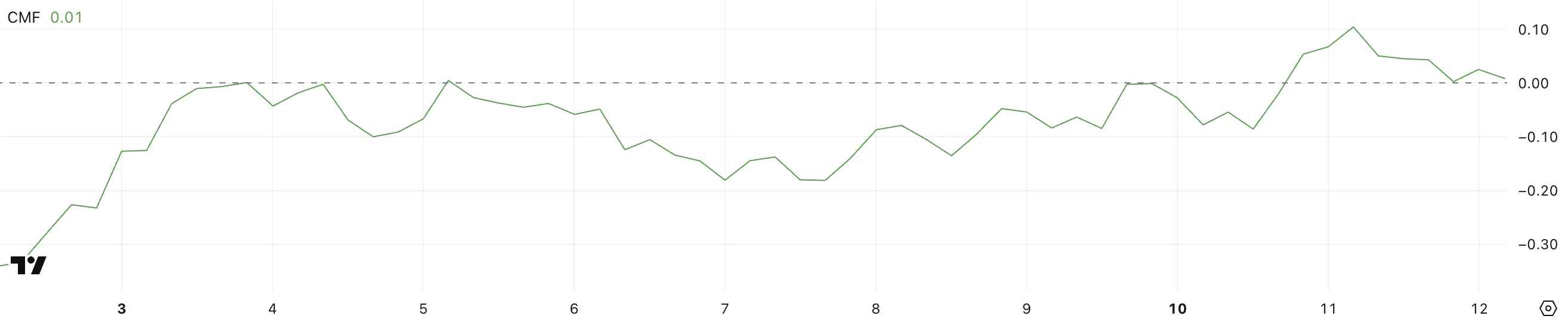

ONDO CMF Struggles to Stay Positive

ONDO CMF is currently at 0.01, dropping from 0.1 in the past day after spending nearly two weeks in negative territory between January 31 and February 10.

The Chaikin Money Flow (CMF) measures buying and selling pressure based on volume and price action. Values above zero indicate accumulation and values below zero signal distribution.

A rising CMF suggests stronger buying interest, while a declining or negative CMF indicates selling pressure dominating the market.

ONDO failing to sustain above 0.1 and now trending lower suggests a weakening bullish momentum.

With CMF barely holding above zero, buying pressure is fading, increasing the risk of a return to negative values. If it dips below zero again, it could indicate renewed selling pressure, potentially leading to a further price decline or extended consolidation.

ONDO Price Prediction: Will the Consolidation Continue?

ONDO price has been trading within a tight range between $1.38 and $1.31 in the last few days, even after it announced its own Layer-1. Its EMA lines are closely aligned, signaling a lack of clear momentum.

Despite its sharp correction from $1.60 to $1.13 between January 30 and February 2, it remains one of the largest RWA tokens, maintaining a $4.2 billion market cap. The current sideways movement suggests the market is indecisive, waiting for a breakout in either direction.

As one of the most interesting RWA coins for February, if ONDO establishes an uptrend, it could first test resistance at $1.49. If that level is broken, a further push toward $1.66 could follow.

However, if bearish pressure increases and the $1.28 support fails, the price could extend its decline toward $1.00.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10