Commonwealth Bank of Australia (ASX:CBA) Just Reported Interim Earnings: Have Analysts Changed Their Mind On The Stock?

It's been a good week for Commonwealth Bank of Australia (ASX:CBA) shareholders, because the company has just released its latest half-year results, and the shares gained 4.7% to AU$166. Commonwealth Bank of Australia reported in line with analyst predictions, delivering revenues of AU$14b and statutory earnings per share of AU$3.07, suggesting the business is executing well and in line with its plan. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for Commonwealth Bank of Australia

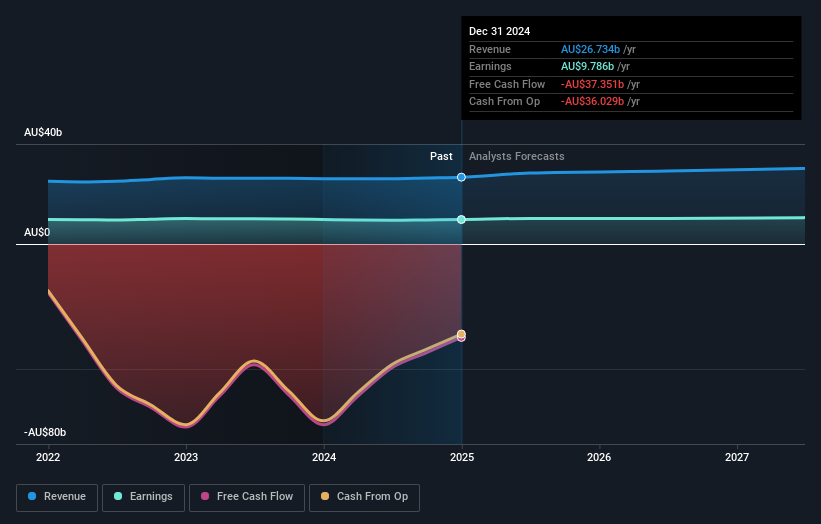

Taking into account the latest results, the consensus forecast from Commonwealth Bank of Australia's 13 analysts is for revenues of AU$28.4b in 2025. This reflects an okay 6.2% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to increase 4.8% to AU$6.14. Before this earnings report, the analysts had been forecasting revenues of AU$28.0b and earnings per share (EPS) of AU$5.91 in 2025. So the consensus seems to have become somewhat more optimistic on Commonwealth Bank of Australia's earnings potential following these results.

The consensus price target was unchanged at AU$107, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Commonwealth Bank of Australia analyst has a price target of AU$142 per share, while the most pessimistic values it at AU$80.00. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting Commonwealth Bank of Australia's growth to accelerate, with the forecast 13% annualised growth to the end of 2025 ranking favourably alongside historical growth of 4.7% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 4.4% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Commonwealth Bank of Australia is expected to grow much faster than its industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Commonwealth Bank of Australia's earnings potential next year. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at AU$107, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Commonwealth Bank of Australia analysts - going out to 2027, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Commonwealth Bank of Australia that you need to be mindful of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10