Does NovoCure (NASDAQ:NVCR) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that NovoCure Limited (NASDAQ:NVCR) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for NovoCure

What Is NovoCure's Net Debt?

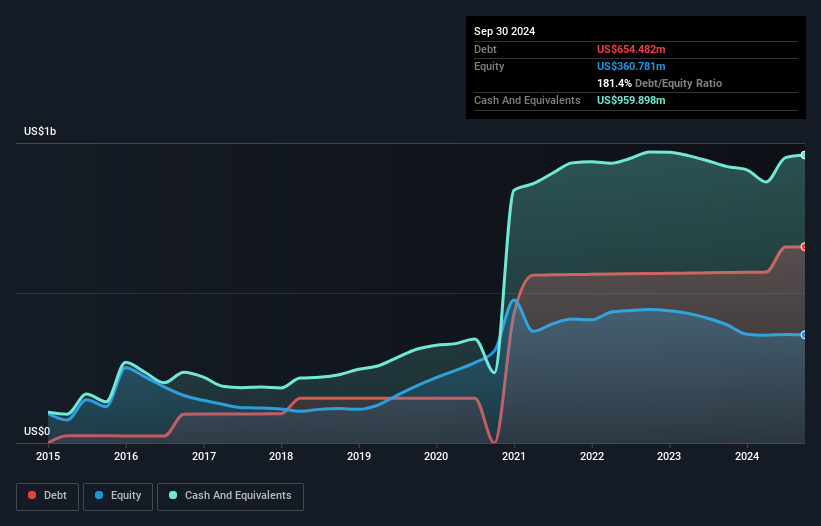

As you can see below, at the end of September 2024, NovoCure had US$654.5m of debt, up from US$568.0m a year ago. Click the image for more detail. But it also has US$959.9m in cash to offset that, meaning it has US$305.4m net cash.

How Healthy Is NovoCure's Balance Sheet?

The latest balance sheet data shows that NovoCure had liabilities of US$735.0m due within a year, and liabilities of US$126.2m falling due after that. On the other hand, it had cash of US$959.9m and US$92.5m worth of receivables due within a year. So it can boast US$191.2m more liquid assets than total liabilities.

This surplus suggests that NovoCure has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, NovoCure boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine NovoCure's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, NovoCure reported revenue of US$578m, which is a gain of 15%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is NovoCure?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that NovoCure had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$78m of cash and made a loss of US$150m. But the saving grace is the US$305.4m on the balance sheet. That means it could keep spending at its current rate for more than two years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for NovoCure you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if NovoCure might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10