GE HealthCare Technologies (NasdaqGS:GEHC) Launches Freelium Platform And Flyrcado For Imaging Excellence

GE HealthCare Technologies (NasdaqGS:GEHC) experienced a notable price movement of 9.41% over the last quarter, partly driven by strategic developments such as the launch of the Freelium magnet platform and Flyrcado imaging agent, marking advancements in diagnostic technology and sustainability. The company also strengthened its market position through FDA clearance of the Voluson Expert Series and strategic partnerships with Sutter Health and UCSF, enhancing access to innovative healthcare solutions. The recent $138 million manufacturing expansion in Ireland signals GE HealthCare's commitment to capacity growth. This performance comes amidst a wider market decline of 3.9% over the same period, highlighting GE HealthCare's relative resilience. While major U.S. stock indexes have recently faltered, the healthcare firm’s robust product launches and collaborations appear to have supported its share price, contrasting with recent market trends such as the varying performances of technology stocks like Tesla and Nvidia.

Click here to discover the nuances of GE HealthCare Technologies with our detailed analytical report.

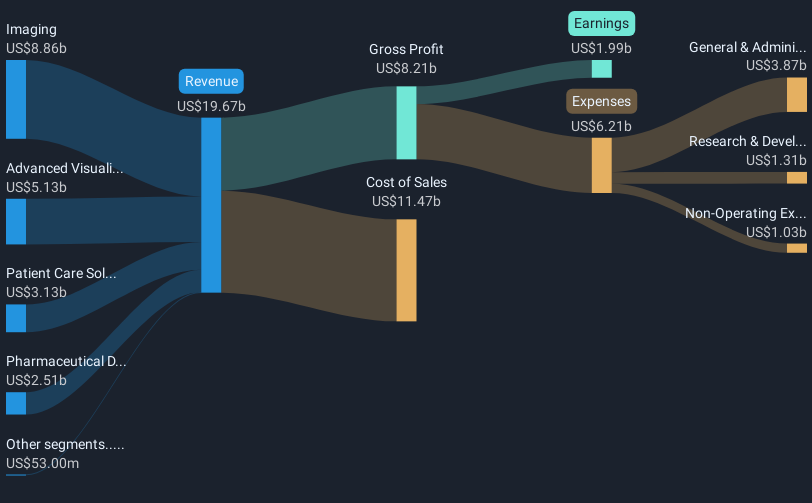

Over the past year, GE HealthCare Technologies' total shareholder return has seen a decline of 1.70%. This performance stands out when compared to the US Medical Equipment industry, which achieved a return of 11.7% during the same period. Key factors influencing GE HealthCare's performance include its earnings growth, which surged by 43.5%, significantly outpacing the Medical Equipment industry's growth. However, the company's valuation, trading 29.3% below estimated fair value, may have influenced investor sentiment. Additionally, GE HealthCare's recent $138 million manufacturing expansion aims to enhance production capacity, potentially positioning the company for future growth amidst economic challenges.

Despite the negative total return, GE HealthCare maintained a robust net profit margin, improving from 7.1% to 10.1% over the year. Earnings announcements, such as the Q4 results, revealed a net income increase to US$720 million from US$403 million year-over-year, offering some positive investor signals. The company's commitment to advancing AI and digital integration further illustrates its focus on driving future efficiencies and innovation within the healthcare sector.

- Understand the fair market value of GE HealthCare Technologies with insights from our valuation analysis—click here to learn more.

- Gain insight into the risks facing GE HealthCare Technologies and how they might influence its performance—click here to read more.

- Shareholder in GE HealthCare Technologies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10