Cloudflare (NYSE:NET) Surges 41% As Sales Rise 27% Year-Over-Year

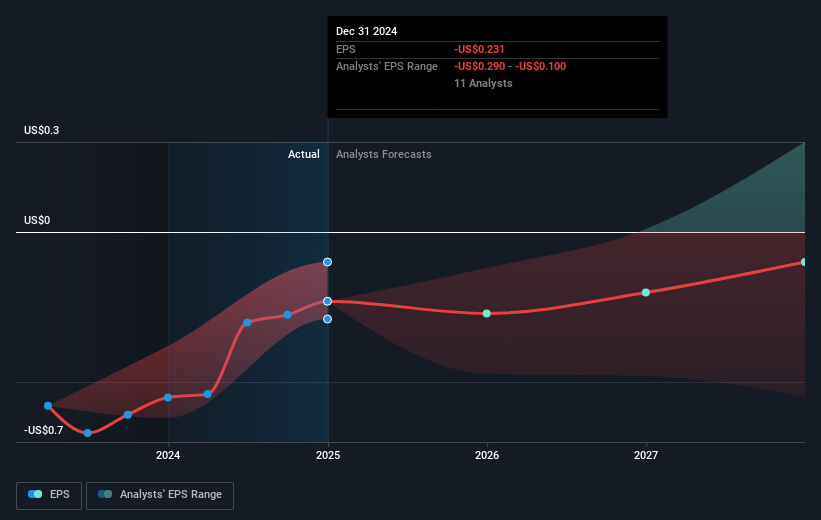

Cloudflare (NYSE:NET) recently announced that Michelle Zatlyn, a significant contributor to the company's growth, was appointed Co-Chairman of the Board alongside CEO Matthew Prince. This development coincided with Cloudflare's fourth quarter earnings report, which revealed a notable sales increase of 27% year-over-year, reducing net losses and improving per-share loss figures significantly. The company's forward-looking revenue guidance for the first quarter and full year 2025 signaled continued growth expectations among investors. Furthermore, Cloudflare's announcement of "Content Credentials," a feature aligning with industry standard initiatives, showcases innovation and relevance in the tech sector. During this time, the broader market experienced a decline, with major indexes struggling, yet Cloudflare's shares rose 41% over the quarter. This discrepancy underscores the company's ability to perform amid macroeconomic pressures, supported by a benign inflation reading that calmed interest rate concerns and optimism around a potential tariff impact lingering for future quarters.

Click here and access our complete analysis report to understand the dynamics of Cloudflare.

Over the past five years, Cloudflare has experienced a significant total shareholder return of over 500%. This impressive performance is noteworthy given the company's unprofitability over the period. Among the major drivers of Cloudflare's success, the expansion of its operations, such as opening a new hub in Lisbon in October 2024 to bolster EMEA support, stands out. Significant partnerships, like the collaboration with Databricks and CrowdStrike in 2023, have enhanced its reputation in cybersecurity. Meanwhile, June 2024 saw the launch of Cloudflare D1, reflecting its commitment to innovation in serverless databases.

Recent product advancements, such as Workers AI in April 2024, have positioned Cloudflare well in the evolving tech landscape, drawing favorable comparisons to industry peers. The company's remarkable return far exceeded the US IT industry's 13.3% growth over the last year, further highlighting its distinct market position as Cloudflare navigates growth amid inherent challenges.

- Understand the fair market value of Cloudflare with insights from our valuation analysis—click here to learn more.

- Assess the downside scenarios for Cloudflare with our risk evaluation.

- Is Cloudflare part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10