PDD Holdings (NasdaqGS:PDD) Navigates 4% Dip After Tariff Announcement

PDD Holdings (NasdaqGS:PDD) experienced a 17.74% on-market total return last quarter, amid significant market fluctuations. The company's performance came as part of a broader market context where major indexes like the Nasdaq dropped 5.5% in February, its worst since September 2023. During this time, President Donald Trump's announcement of tariffs on Chinese goods affected U.S.-listed Chinese firms, resulting in a 4% dip in PDD's shares one trading day. While tech stocks overall faced a turbulent period due to a wider sell-off, PDD's recovery mirrors investor sentiment buoyed by easing inflation data and potential rate cuts from the Federal Reserve. The company's resilience amidst these factors aligns with general market optimism, as evidenced by a 1.6% rise in the Nasdaq towards February's close. Such external economic indicators and geopolitical events also highlight the volatility impacting international market players like PDD.

Unlock comprehensive insights into our analysis of PDD Holdings stock here.

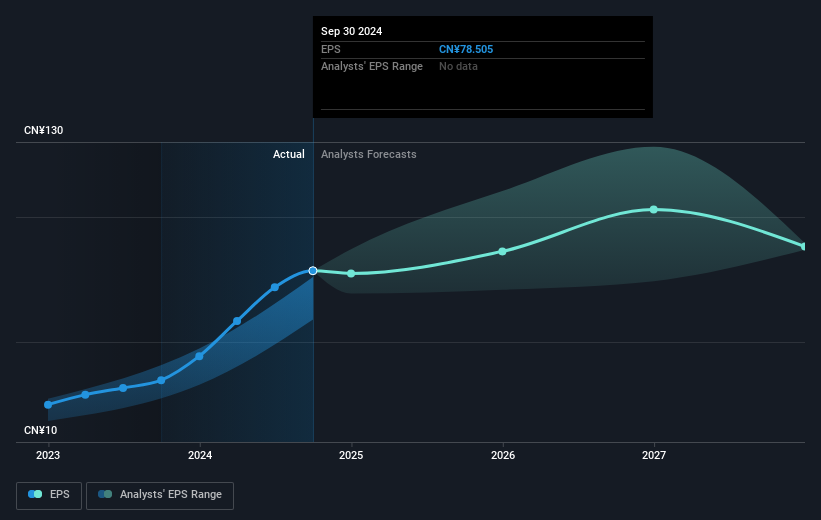

The past five years have seen PDD Holdings (NasdaqGS:PDD) deliver a substantial total return of 209.28%. Acknowledging the increased volatility for U.S.-listed Chinese firms, PDD's resilience appears rooted in its remarkable earnings growth, which averaged 73.1% annually. This growth, illustrated by 2024's earnings reports, reveals significant increases in sales and net income, with quarterly figures like CNY 97.06 billion in sales and CNY 32.01 billion in net income for Q2, 2024. Notably, each quarter showcased increasing earnings per share, reflecting expanding profitability. However, despite these achievements, PDD underperformed relative to both the US Market and the Multiline Retail industry over the past year.

Significant legal proceedings may have also impacted investor sentiment, such as the securities fraud class action lawsuit announced in October 2024. Executive changes can play a key role in a company's trajectory, indicated by Dr. Qi Lu's departure from the board in November 2023, accompanied by subsequent appointments to vital committees. These elements together provide insight into the company's long-term performance in an evolving business climate.

- Learn how PDD Holdings' intrinsic value compares to its market price with our detailed valuation report.

- Explore the potential challenges for PDD Holdings in our thorough risk analysis report.

- Already own PDD Holdings? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10