Closing Bell: ASX up as small caps Botanix Pharma, Ora Banda Mining join ASX 300

- ASX bounces back but still under 8k mark

- Big moves in ASX 200 rebalance

- Cyclone Alfred eases, insurers up, Johns Lyng drops

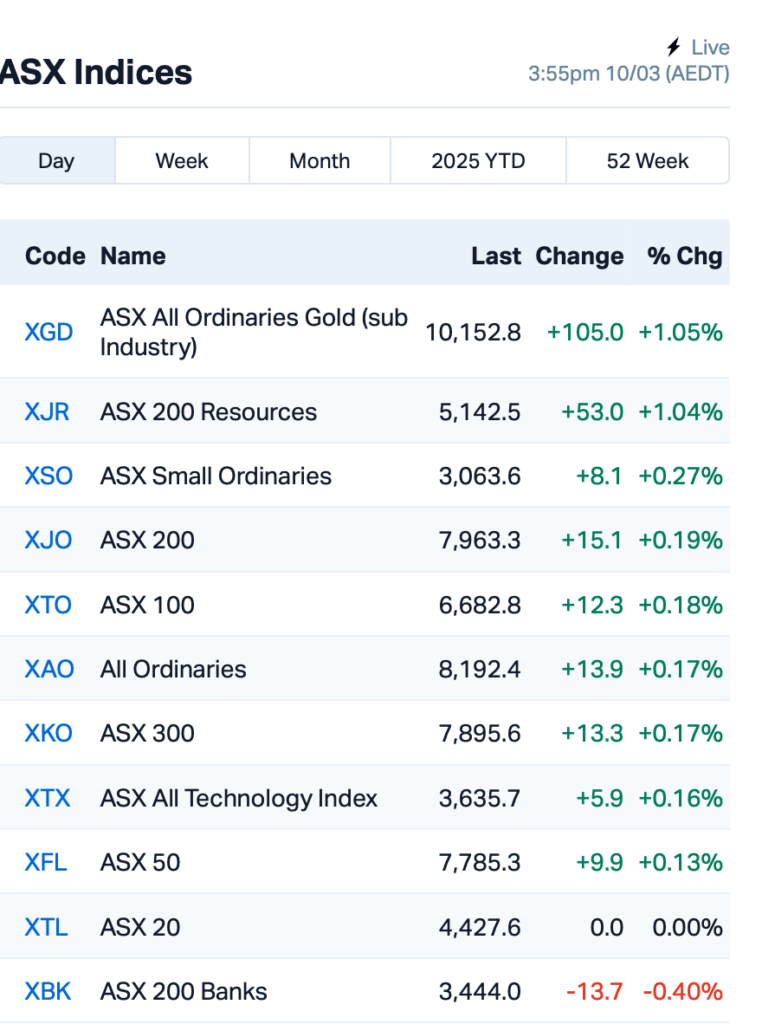

The ASX managed to eke out a small gain on Monday, edging higher by 0.18% after taking a dive to a six-month low just last Friday. But it’s still hanging just under that crucial 8000 mark.

Despite the slight uptick, everyone’s bracing for more volatility this week. The big concern is the tariffs – a 25% levy on steel and aluminium exports to the US is set to kick in on Wednesday.

There’s not much hope left for the Albanese government to get a waiver from the White House, experts said.

On top of that, China’s inflation data came in weaker than expected over the weekend, which certainly didn’t help the mood. February’s consumer prices dropped by 0.7%, well below the forecast.

Crypto investors were also feeling the heat, with Bitcoin falling fast toward US$80,000 after some comments from Donald Trump over the weekend sparked fears of a possible US recession.

“I hate to predict things like that. There is a period of transition, because what we’re doing is very big,” Trump told Fox.

“We’re bringing wealth back to America. That’s a big thing. And there are always periods of… it takes a little time. It takes a little time, but I think it should be great for us.”

Oil prices have taken a hit, too, dropping to their lowest level since September. With Brent crude trading just above US$70 a barrel, speculators are starting to cut their bullish bets on oil.

“It is not out of the realm of possibility that prices could finally break down below their four-year support level of around US$65 a barrel,” said commodities expert Sal Gilbertie.

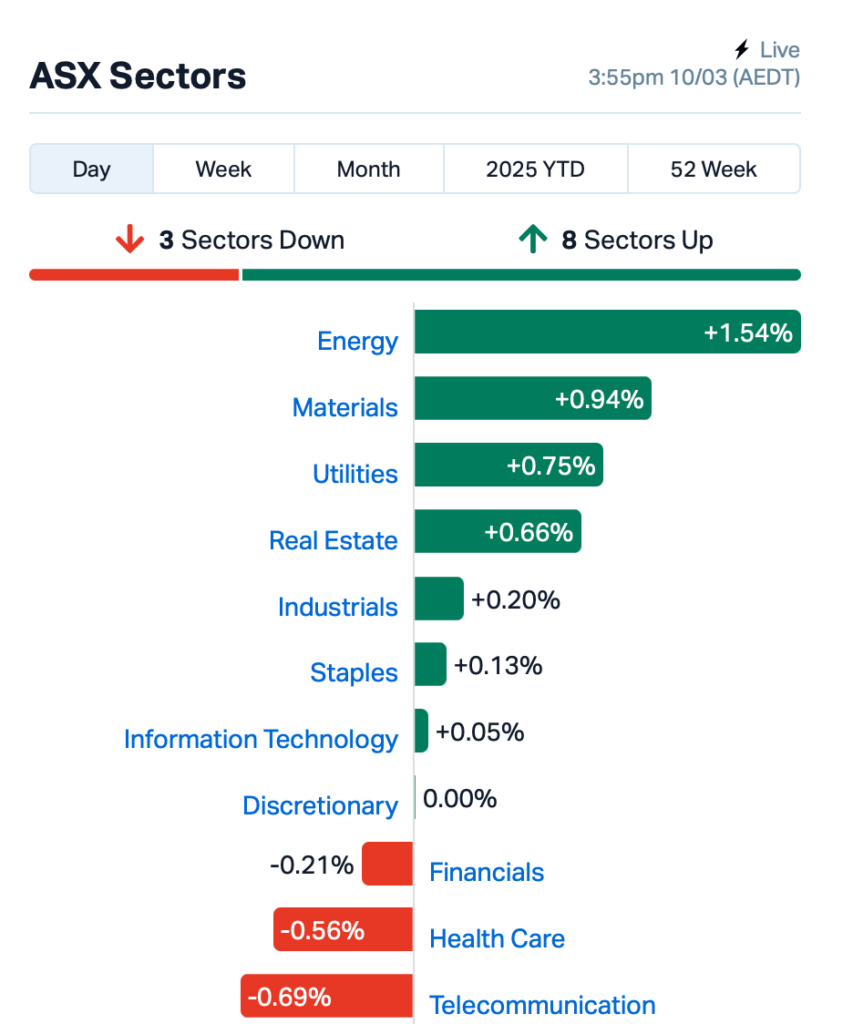

Back to the ASX, here’s where things stood leading up to Monday’s close.

Seven out of the 11 sectors managed to finish the day in the green, with energy stocks leading the charge.

Insurers bounced back after Cyclone Alfred caused less damage than feared. Suncorp Group (ASX:SUN) rose 3%, while QBE Insurance (ASX:QBE) and Insurance Australia (ASX:IAG) gained 1.5%.

Star Entertainment Group (ASX:SGR) has confirmed it’s weighing up a rescue bid from US casino giant Bally’s, just days after agreeing to sell a 50% stake in its Queen’s Wharf precinct to Hong Kong investors. Shares in Star remain suspended as the deal unfolds.

ASX rebalance summary

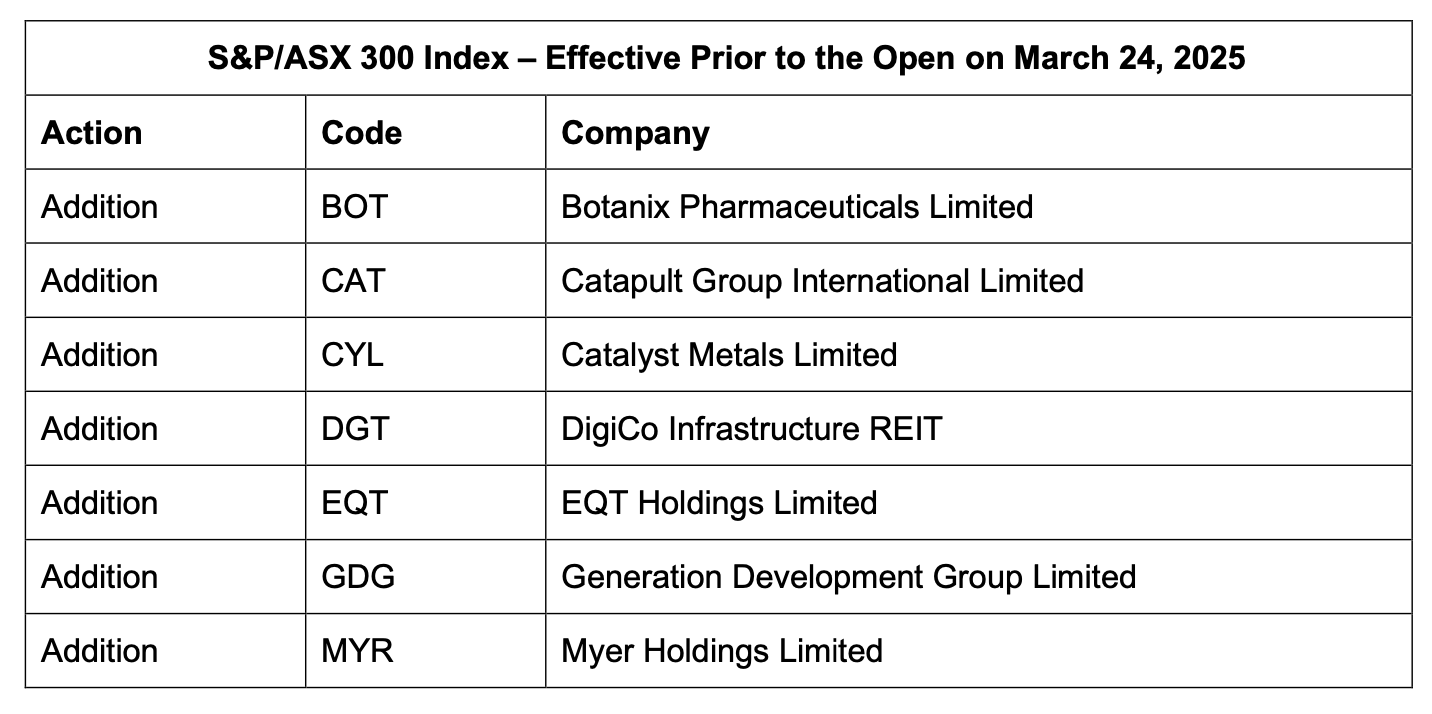

Meanwhile, March marks the first quarter of index rebalancing, and if you’re holding index funds or ETFs, it’s time to pay attention.

Index rebalancing is more than just a tweak; it’s a reset of market weightings that could shift the ground under your portfolio.

Why is it so critical? Well, when a stock is added to a major index like the ASX 200, it gets the spotlight. Funds and ETFs tracking the index now need to buy that stock, pushing its price up.

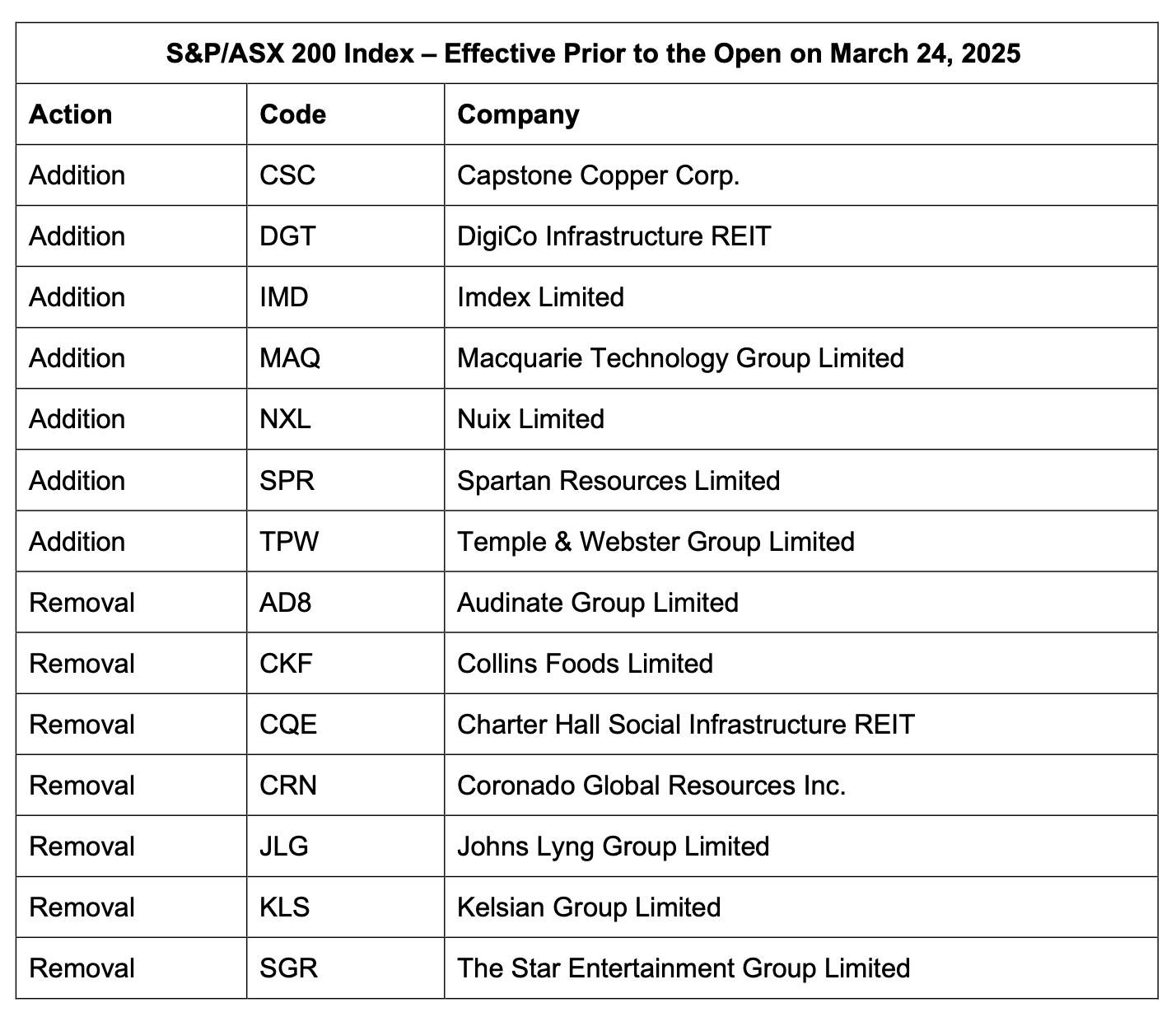

The latest shake-up in the ASX 200 index has seen some new surprises, with DigiCo Infrastructure REIT (ASX:DGT) and Capstone Copper Corp (ASX:CSC) making their way onto the list.

Unfortunately, Star Entertainment is out, alongside insurance repairer Johns Lyng Group (ASX:JLG) and coal miner Coronado Global Resources (ASX:CRN).

Mesoblast (ASX:MSB) was added to the ASX 200 at the expense of Arcadium Lithium (ASX:LTM), whose shares are no longer trading after the Royal Court of Jersey approved its acquisition by Rio Tinto (ASX:RIO).

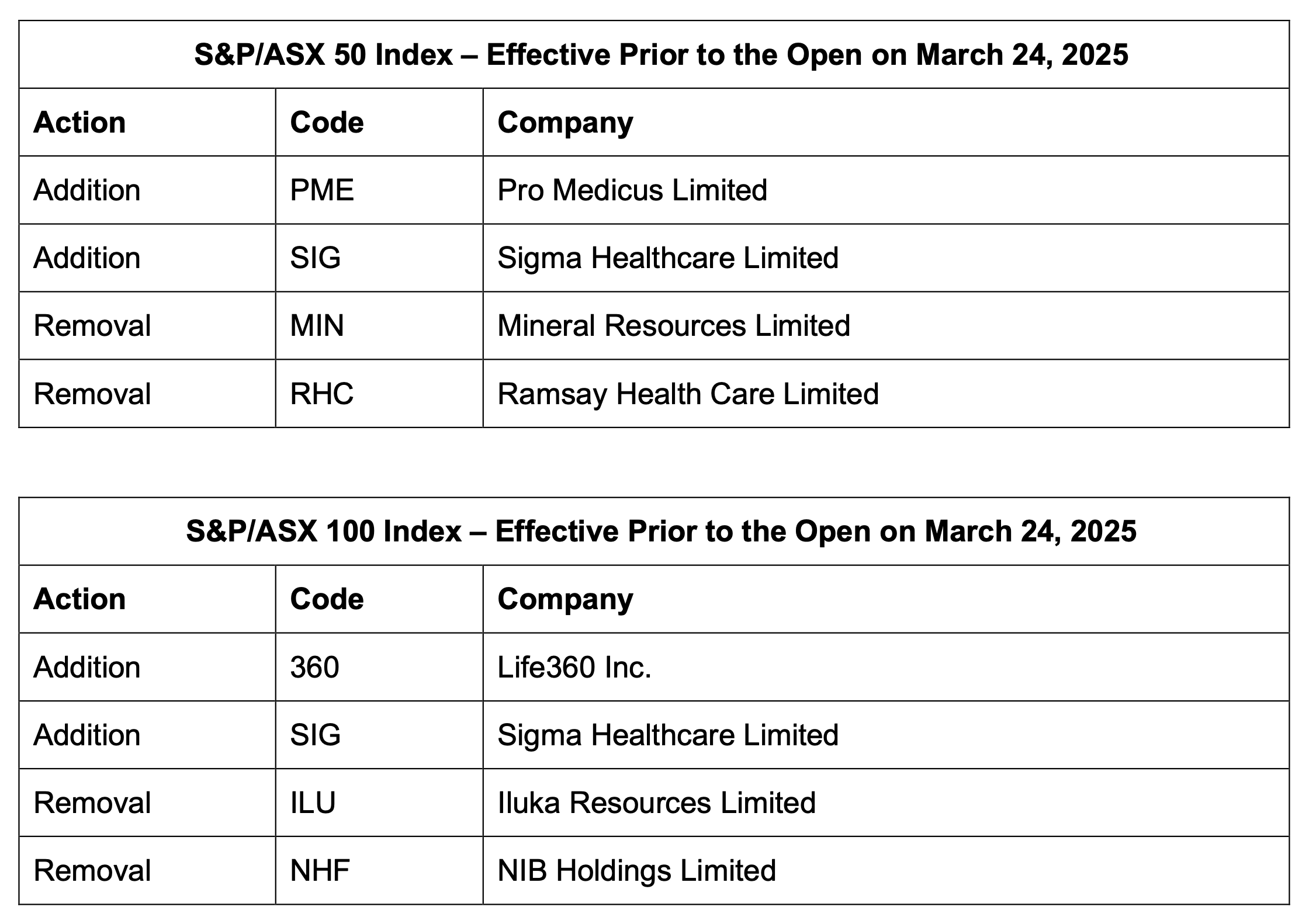

In general, many lithium stocks are being dropped from the index. Amongst those names was Mineral Resources (ASX:MIN).

Meanwhile, healthcare duo Pro Medicus (ASX:PME) and Sigma Healthcare (ASX:SIG) will join the ASX 50 index, while hospital operator Ramsay Health Care (ASX:RHC) will drop out.

Here’s a quick list of who’s in and out:

Source: ASX

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap RML Resolution Minerals 0.015 67% 22,971,457 $2,684,377 WOA Wide Open Agricultur 0.017 55% 20,245,093 $5,870,553 HT8 Harris Technology Gl 0.015 50% 3,035,524 $2,991,355 AEV Avenira Limited 0.010 43% 4,873,082 $22,243,508 88E 88 Energy Ltd 0.002 33% 4,002,309 $43,400,718 VML Vital Metals Limited 0.002 33% 9,165,545 $8,842,600 CMG Criticalmineralgrp 0.155 29% 9,299 $8,644,487 NMG New Murchison Gold 0.012 26% 61,515,744 $77,295,797 MTB Mount Burgess Mining 0.005 25% 1,200,099 $1,358,150 PAB Patrys Limited 0.003 25% 618,016 $4,114,895 PRX Prodigy Gold NL 0.003 25% 2,000,000 $6,350,111 LMS Litchfield Minerals 0.180 24% 1,017,912 $4,090,645 AMO Ambertech Limited 0.170 21% 138,927 $13,356,670 EPM Eclipse Metals 0.006 20% 5,173,240 $14,299,095 SER Strategic Energy 0.006 20% 24,470 $3,355,167 STM Sunstone Metals Ltd 0.006 20% 3,472,892 $25,750,018 RFA Rare Foods Australia 0.019 19% 25,029 $4,351,732 AVE Avecho Biotech Ltd 0.007 17% 33,958,453 $19,015,782 PVT Pivotal Metals Ltd 0.007 17% 477,638 $5,443,355 SHE Stonehorse Energy Lt 0.007 17% 19,803 $4,106,610 TMK TMK Energy Limited 0.004 17% 3,649,343 $28,090,995 EQS Equitystorygroupltd 0.030 15% 643,614 $4,311,330 VNL Vinyl Group Ltd 0.110 15% 5,749,797 $120,868,218 AVW Avira Resources Ltd 0.008 14% 449,926 $1,028,578 DTR Dateline Resources 0.004 14% 15,298,381 $8,979,490

Resolution Minerals (ASX:RML) has struck a deal to acquire three projects focused on antimony, gold and copper in New South Wales and Queensland. The projects include Drake East (NSW), Neardie (QLD), and Spur South (NSW), with Drake East showing high-grade antimony, gold, and silver. Neardie hosts past-producing antimony mines, and Spur South is in a highly mineralised area. The move aims to tap into the growing demand for antimony, which saw a 250% price increase in 2024, said the company.

Wide Open Agriculture (ASX:WOA) is making moves with over 5 metric tonnes of lupin protein sales across Europe, Latin America, and Australia. WOA has secured orders from a leading health food company in Europe, a Mexican distributor, Latin American distributors in Argentina and Chile, and an Aussie food manufacturer. These initial sales prove the global potential of WOA’s lupin protein, said the company.

Phosphate explorer Avenira (ASX:AEV) has landed a big investment from its largest shareholder, Hebang Biotechnology. Hebang’s chucking in $7.567 million through a placement of shares at $0.007 each, pending approval. With this, Hebang’s stake in Avenira will jump to 49%. On top of that, Hebang’s also agreed to provide an unsecured loan of $7.567 million to help push Avenira’s DSO project forward. The funds, Avenira said, will help it get its phosphate project to the finish line.

New Murchison Gold (ASX:NMG) has hit visible gold in a diamond drill core at its Crown Prince gold project. Drilling targeted extensions of gold mineralisation, and at 252m down hole, a quartz-carbonate vein with native gold was found. This is the deepest gold find in the south-eastern zone and suggests the mineralisation might continue deeper. The drilling is ongoing, with assay results expected in a couple of weeks.

Eclipse Metals (ASX:EPM) rose as Boss Energy (ASX:BOE) secured a deal for its Liverpool uranium project in the Northern Territory. Boss has an option to earn up to 80% of the project by investing $250,000 in exploration over the next year, with a total commitment of $8 million over the next seven years.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ANR | Anatara Ls Ltd | 0.011 | -73% | 26,643,731 | $8,321,965 |

| CYQ | Cycliq Group Ltd | 0.003 | -38% | 4,306,738 | $1,842,067 |

| CR9 | Corellares | 0.002 | -33% | 97,865 | $1,403,230 |

| GTR | Gti Energy Ltd | 0.002 | -33% | 2,460,993 | $8,963,849 |

| HCD | Hydrocarbon | 0.002 | -33% | 100,000 | $3,234,328 |

| JAY | Jayride Group | 0.002 | -33% | 200,000 | $715,737 |

| MEL | Metgasco Ltd | 0.003 | -25% | 20,000 | $5,830,347 |

| MOM | Moab Minerals Ltd | 0.002 | -25% | 268,333 | $3,467,332 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 38,075,706 | $6,716,008 |

| PIL | Peppermint Inv Ltd | 0.003 | -25% | 209,449 | $8,845,917 |

| TFL | Tasfoods Ltd | 0.007 | -22% | 4,087,034 | $3,933,860 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 22,000 | $5,932,817 |

| AUK | Aumake Limited | 0.004 | -20% | 2,884,504 | $15,053,461 |

| CAV | Carnavale Resources | 0.004 | -20% | 4,504,581 | $20,451,092 |

| QXR | Qx Resources Limited | 0.004 | -20% | 124,000 | $6,550,389 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 2,043,533 | $22,646,967 |

| CLA | Celsius Resource Ltd | 0.009 | -18% | 3,837,682 | $29,361,623 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 356,121 | $9,518,072 |

| GES | Genesis Resources | 0.010 | -17% | 326,706 | $9,394,096 |

| PKO | Peako Limited | 0.003 | -17% | 145,581 | $4,463,226 |

| WBE | Whitebark Energy | 0.005 | -17% | 6,001 | $1,849,255 |

| PXX | Polarx Limited | 0.006 | -14% | 3,697,671 | $16,628,507 |

| SKK | Stakk Limited | 0.006 | -14% | 280,000 | $14,525,558 |

| T3D | 333D Limited | 0.006 | -14% | 16,356 | $1,233,284 |

| TON | Triton Min Ltd | 0.006 | -14% | 577,370 | $10,978,721 |

Anatara Lifesciences (ASX:ANR)‘ stock price plunged after disappointing news about its GaRP-IBS trial. The trial’s Stage 2 results are in, and it looks like the primary goal – reducing IBS symptoms significantly compared to a placebo – won’t be met, even though secondary goals might still show improvement. As a result, the company has paused recruitment and is waiting for the final results, expected soon.

Johns Lyng Group (ASX:JLG) plunged 12% after news broke that it would be booted from the ASX 200 in the upcoming quarterly rebalancing. It’s been a tough few months for the buildings repairer, with shares down almost 30% in the past six months.

IN CASE YOU MISSED IT

Koonenberry Gold (ASX: KNB) and Newmont have kicked off drilling at the Fairholme joint venture in the Lachlan Fold Belt, NSW, targeting copper-gold prospects similar to Northparkes. While Koonenberry holds the majority stake, Newmont, through its subsidiary, is funding the drilling effort.

Trek Metals’ (ASX:TKM) detailed assays have upgraded the Zahn and Coogan prospects at its Christmas Creek project, identifying large-scale drill targets alongside the high-grade Martin prospect. The company aims to begin drilling in May 2025, focusing on these newly defined structures with potential for significant gold mineralisation.

Impact Minerals (ASX:IPT) is acquiring 675km² of land around the Broken Hill mine, expanding its holding to 1770km². The $275,000 share-based deal aligns with the company’s strategy to uncover a potential large copper deposit beneath the historic silver-lead-zinc mine.

Brightstar Resources (ASX:BTR) has started processing ore from its Second Fortune mine as it works toward generating cash flow from its Laverton gold projects. The company aims to become a multi-mine gold producer amid a record gold bull market.

At Stockhead, we tell it like it is. While Koonenberry Gold, Trek Metals, Impact Minerals and Brightstar Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10