Insiders Could Have Profited By Holding onto Sunac China Holdings Shares Despite 14% Drop

Despite the fact that Sunac China Holdings Limited's (HKG:1918) value has dropped 14% in the last week insiders who sold CN¥164m worth of stock in the past 12 months have had less success. Given that the average selling price of CN¥6.00 is still lower than the current share price, insiders would probably have been better off keeping their shares.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

Check out our latest analysis for Sunac China Holdings

The Last 12 Months Of Insider Transactions At Sunac China Holdings

In the last twelve months, the biggest single sale by an insider was when the Founder & Executive Chairman, Hongbin Sun, sold HK$164m worth of shares at a price of HK$6.00 per share. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. It's of some comfort that this sale was conducted at a price well above the current share price, which is HK$1.79. So it may not tell us anything about how insiders feel about the current share price. Hongbin Sun was the only individual insider to sell shares in the last twelve months.

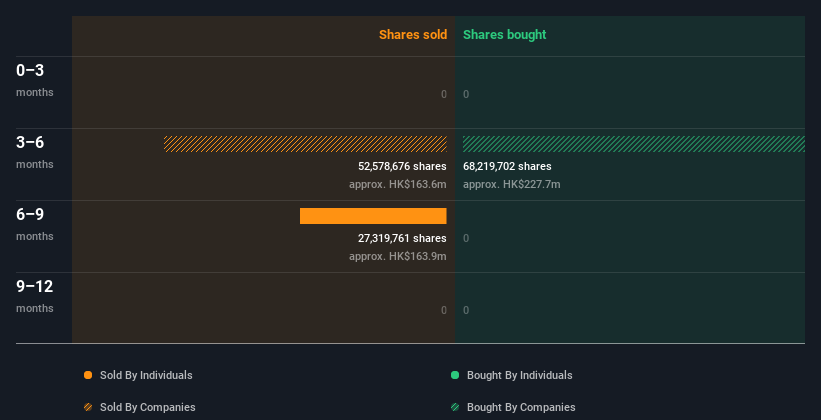

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Sunac China Holdings insiders own 26% of the company, currently worth about HK$4.6b based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Sunac China Holdings Insiders?

There haven't been any insider transactions in the last three months -- that doesn't mean much. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Sunac China Holdings insider transactions don't fill us with confidence. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 3 warning signs for Sunac China Holdings (of which 2 make us uncomfortable!) you should know about.

But note: Sunac China Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10