This Heavy Minerals Insider Reduced Their Stake By 16%

From what we can see, insiders were net sellers in Heavy Minerals Limited's (ASX:HVY ) during the past 12 months. That is, insiders sold the stock in greater numbers than they purchased it.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for Heavy Minerals

Heavy Minerals Insider Transactions Over The Last Year

Notably, that recent sale by Kenneth Hall is the biggest insider sale of Heavy Minerals shares that we've seen in the last year. That means that an insider was selling shares at around the current price of AU$0.27. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

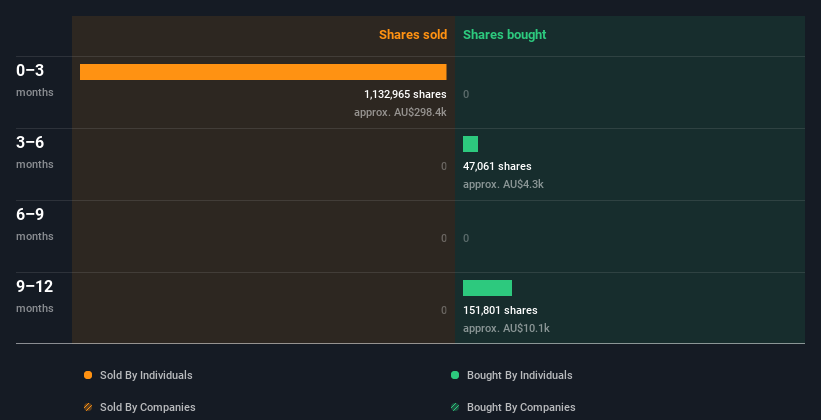

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insiders At Heavy Minerals Have Sold Stock Recently

The last three months saw significant insider selling at Heavy Minerals. In total, insider Kenneth Hall dumped AU$302k worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Heavy Minerals insiders own about AU$6.1m worth of shares. That equates to 33% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Heavy Minerals Insiders?

An insider hasn't bought Heavy Minerals stock in the last three months, but there was some selling. Zooming out, the longer term picture doesn't give us much comfort. While insiders do own shares, they don't own a heap, and they have been selling. We're in no rush to buy! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To that end, you should learn about the 6 warning signs we've spotted with Heavy Minerals (including 2 which are significant).

But note: Heavy Minerals may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Heavy Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10