Best Buy (NYSE:BBY) Sees 11% Dip Following $475M Goodwill Impairment Charge

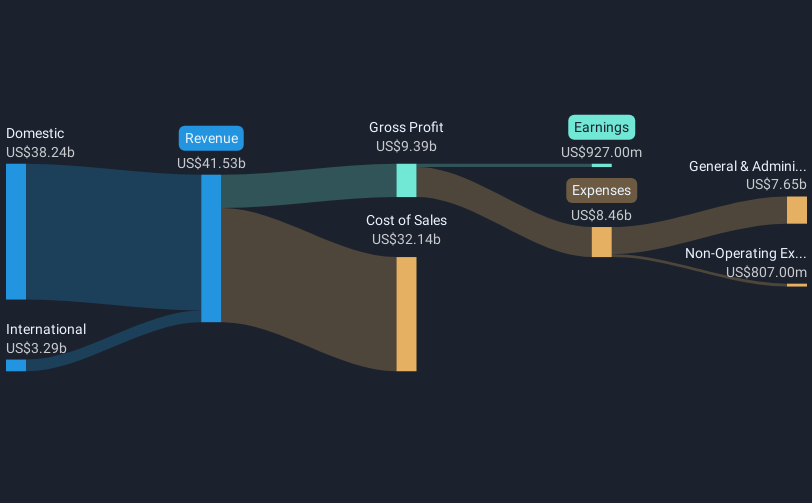

Best Buy (NYSE:BBY) experienced a 10.56% drop in its share price last week, coinciding with its recent earnings announcement. The company reported a decline in both sales and net income for the fourth quarter, along with a goodwill impairment charge of $475 million related to its health unit. Additionally, Best Buy's guidance for fiscal year 2026 suggested a slight decline in first-quarter comparable sales. The impact of these financial disclosures likely overshadowed positive movements in the broader market, as the S&P 500 and Nasdaq both experienced gains following a correction earlier in the week. Despite a slight increase in its dividend, Best Buy faced a challenging market environment as a strong tech sector rally led by companies like Nvidia and Palantir didn't extend to the retailer. Overall, these factors contributed to Best Buy's notable share price decline despite a generally positive market sentiment late in the week.

The valuation report we've compiled suggests that Best Buy's current price could be quite moderate.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Over the past five years, Best Buy has delivered a total shareholder return of 53.50%, benefiting in part from consistent dividend increases and strategic stock buybacks. Notably, the company announced a 5% dividend increase in mid-2024, followed by a further 1% rise in early 2025, highlighting a commitment to returning value to shareholders. Additionally, Best Buy repurchased nearly $1.72 billion worth of shares from its buyback program, which ended in early 2025, further enhancing shareholder returns during this period.

However, the last year has presented challenges, with Best Buy underperforming the U.S. Specialty Retail industry. Key issues included a $475 million goodwill impairment related to its health unit, as reported in March 2025, and declining earnings, with net income falling from $460 million to $117 million for Q4 2025. Despite a sound return on equity and attractive dividend yield, these financial difficulties and a slower growth forecast than the broader market have influenced its recent stock performance.

Already own Best Buy? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Buy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10