SNCR Jumps 28% in a Month: Should You Buy, Sell or Hold the Stock?

Synchronoss Technologies SNCR shares have jumped 28.2% over the past month, outperforming the Zacks Computer & Technology sector and the Internet - Software industry’s declines of 8.4 % and 12.4%, respectively.

SNCR stock's price movement has been driven by strong cloud subscriber growth, which drove a 6.8% year-over-year revenue increase in the fourth quarter of 2024. Contract extensions and product launches have strengthened investor confidence, highlighting the company's financial stability and strategic momentum.

Contracts Extension & Product Launch Drive SNCR’s Growth

Synchronoss has extended key contracts with AT&T T and SFR, strengthening its position in the cloud services market. The three-year AT&T extension, running through 2027, ensures continued use of the Synchronoss personal cloud platform, enabling secure content backup and sharing. The SFR extension expands SNCR’s presence in Europe, highlighting growing demand for its cloud solutions.

Synchronoss secured long-term partnerships with Verizon VZ through 2030 and SoftBank through 2028, reinforcing its position in the cloud services market. These agreements ensure steady revenues, broaden its global footprint and support ongoing innovation, creating a strong foundation for sustained growth and future expansion.

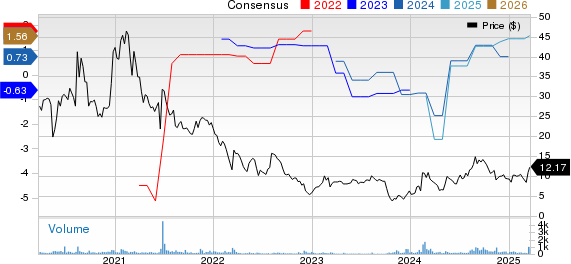

Synchronoss Technologies, Inc. Price and Consensus

Synchronoss Technologies, Inc. price-consensus-chart | Synchronoss Technologies, Inc. Quote

In March 2025, SNCR unveiled Capsyl Cloud, a turnkey personal cloud platform designed for mobile operators and broadband service providers. This solution enables rapid deployment of secure and scalable cloud services, enhancing user engagement and creating revenue opportunities.

Synchronoss Revolutionizes Cloud Storage With AI

SNCR is enhancing its personal cloud platform with artificial intelligence to elevate user experience and drive business growth.

A key feature of this innovation is the AI-powered "Genius" tool, which automatically optimizes photos by adjusting lighting, color balance and other elements. It also offers creative filters like ocean and watercolor, enabling effortless, high-quality edits.

Beyond user convenience, AI strengthens security by proactively detecting and mitigating potential threats, ensuring robust data protection. With AI integration, Synchronoss elevates platform capabilities and strengthens its leadership in cloud-based digital services.

SNCR Faces Intense Rivalry in Personal Cloud

The personal cloud market is highly competitive, driven by rapid technological advancements, evolving industry standards and product innovations. Synchronoss faces strong competition from major OTT service and platform providers like Apple AAPL, Google, Dropbox, Microsoft and Amazon, all offering deeply integrated cloud services within their ecosystems.

To compete with global tech giants, SNCR provides a suite of solutions that seamlessly connect subscribers, networks and content for an enhanced user experience. Its white-label cloud offerings enable telecom operators to deliver branded services, fostering stronger customer relationships and differentiation in a competitive market.

Synchronoss’s Revenue & Earnings Estimates Show Mixed Trend

The Zacks Consensus Estimate for first-quarter 2025 revenues is pegged at $42.11 million, implying a 2% year-over-year decline.

The Zacks Consensus Estimate for first-quarter 2025 earnings is pegged at 29 cents per share, up by a penny over the past 30 days. The consensus mark suggests a year-over-year decrease of 34.09%.

The Zacks Consensus Estimate for 2025 revenues is pegged at $174.40 million, indicating a year-over-year growth of 0.46%.

The consensus mark for 2025 earnings is pegged at $1.58 per share, up by 8.2% over the past 30 days, implying a year-over-year decline of 3.07%.

Zacks Rank

Currently, SNCR carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AT&T Inc. (T) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Synchronoss Technologies, Inc. (SNCR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10