US Market's Undiscovered Gems for April 2025

As the U.S. market experiences heightened volatility, with major indices like the Dow and Nasdaq seeing significant fluctuations due to tariff uncertainties, investors are keenly observing how these dynamics impact small-cap stocks. In this environment, identifying promising opportunities involves looking for companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| First IC | 38.58% | 9.04% | 14.76% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Click here to see the full list of 286 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Unity Bancorp (NasdaqGM:UNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Unity Bancorp, Inc. is the bank holding company for Unity Bank, offering commercial and retail banking services, with a market capitalization of $414.57 million.

Operations: Unity Bancorp generates revenue primarily from its commercial banking segment, which reported $103.13 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

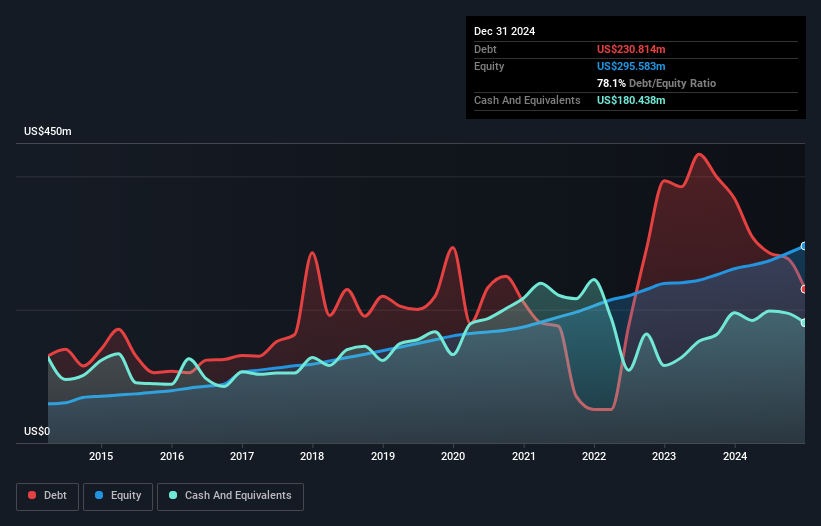

Unity Bancorp, with assets of $2.7 billion and equity of $295.6 million, showcases a robust financial position. Its total deposits stand at $2.1 billion against loans of $2.2 billion, complemented by a net interest margin of 4.2%. The bank holds an appropriate bad loan allowance at 0.6% and maintains high-quality earnings while its liabilities are primarily low-risk customer deposits (89%). Despite recent executive changes, the company increased its dividend by 8% to $0.14 per share, reflecting confidence in future growth prospects as earnings are forecasted to grow annually by 14%.

- Delve into the full analysis health report here for a deeper understanding of Unity Bancorp.

Learn about Unity Bancorp's historical performance.

Cricut (NasdaqGS:CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. is a company that designs, markets, and distributes a creativity platform for making professional-looking handmade goods across various regions worldwide, with a market cap of approximately $1.06 billion.

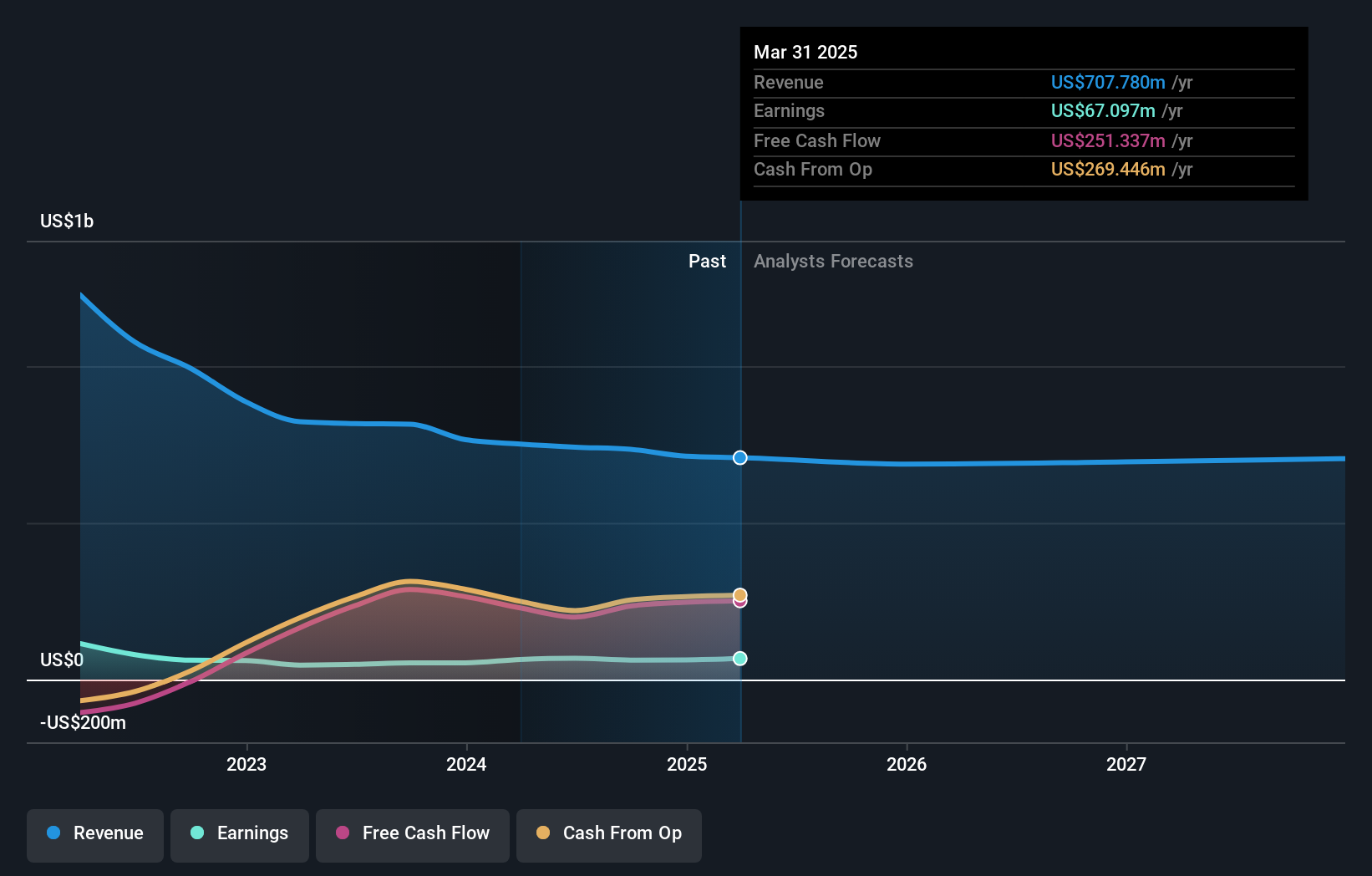

Operations: Cricut generates revenue from three main segments: Platform ($312.98 million), Connected Machines ($192.44 million), and Accessories and Materials ($207.12 million). The company's revenue streams highlight a diverse income model, with the Platform segment contributing the most significantly to overall sales.

Cricut has been making waves with its innovative products and solid financials. The company, debt-free since reducing its debt-to-equity ratio from 45.7% five years ago, showcases high-quality earnings and trades at a significant discount of 74.4% below estimated fair value. Despite a challenging five-year period with earnings declining annually by 21.4%, Cricut saw a robust recovery last year with a 17.1% growth in earnings, outpacing the Consumer Durables industry’s average of 5.5%. Recent product launches like the Cricut Explore® 4 and Maker® 4 highlight its commitment to innovation, offering faster speeds and enhanced user experiences at competitive prices (US$249.99 for Explore® 4 and US$399.99 for Maker® 4). The company also completed share repurchases worth US$27.18 million in the latest buyback program, reflecting confidence in its market position amidst evolving consumer preferences.

- Click here and access our complete health analysis report to understand the dynamics of Cricut.

Review our historical performance report to gain insights into Cricut's's past performance.

Gibraltar Industries (NasdaqGS:ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and provides products and services across the residential, renewable energy, agtech, and infrastructure markets both in the United States and internationally, with a market capitalization of approximately $1.71 billion.

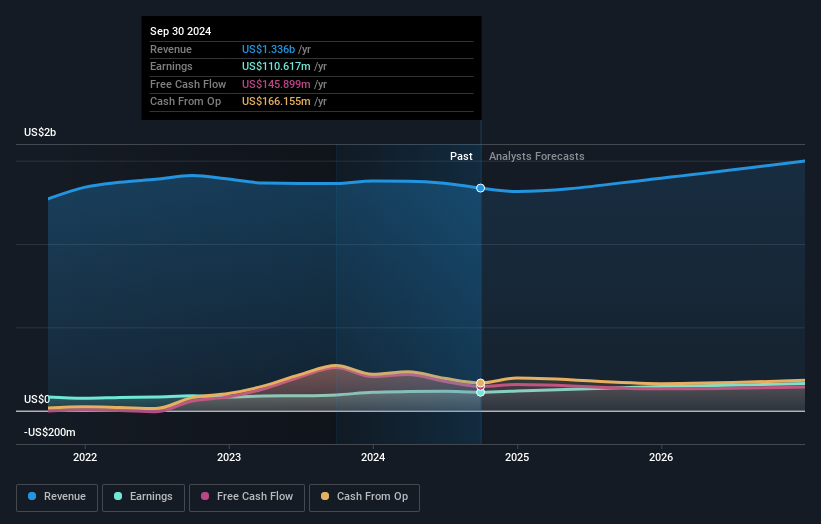

Operations: Gibraltar Industries generates revenue primarily from its residential segment, contributing $782.52 million, followed by renewables at $285.41 million. The agtech and infrastructure segments add $152.81 million and $88.03 million, respectively, to the total revenue stream.

Gibraltar Industries, an intriguing player in its field, is trading at 37.7% below its estimated fair value and is debt-free, which enhances its financial stability. Over the past year, earnings grew by 24.3%, outperforming the building industry's -5.8%. The company reported net income of US$46 million for Q4 2024 compared to US$19 million a year ago, with basic EPS rising from $0.64 to $1.52. Despite facing challenges like renewables operational issues and tariff costs, Gibraltar's strategic moves in renewables and Agtech are expected to drive growth with projected annual revenue growth of 7.5%.

- Gibraltar Industries' growth is fueled by strategic acquisitions and innovation in renewables. Click here to explore the full narrative on Gibraltar Industries.

Key Takeaways

- Click here to access our complete index of 286 US Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Unity Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10