ASX Penny Stocks Spotlight: American Rare Earths And 2 Other Promising Picks

As Australian shares experience a significant upswing, with the market opening as much as 6.7% higher today, investors are keenly watching for opportunities amidst fluctuating economic conditions. Despite the vintage connotations of "penny stocks," these investments continue to attract attention for their potential value and growth prospects. By focusing on companies with strong financials and clear growth paths, investors can uncover promising opportunities among smaller or newer firms.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.57 | A$122.48M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.02 | A$149.09M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.69 | A$956.54M | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.29 | A$60.85M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.29 | A$353.79M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.57 | A$109.85M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.05 | A$144.72M | ✅ 3 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.58 | A$417.55M | ✅ 5 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.31 | A$1.06B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.335 | A$39.31M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 984 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

American Rare Earths (ASX:ARR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: American Rare Earths Limited focuses on the exploration and development of mineral resources in Australia and the United States, with a market cap of A$137 million.

Operations: American Rare Earths Limited does not report specific revenue segments.

Market Cap: A$137M

American Rare Earths Limited, with a market cap of A$137 million, is pre-revenue and focuses on mineral exploration in Australia and the U.S. The company recently announced significant progress at its Halleck Creek Project in Wyoming, which now boasts a JORC-compliant resource of 2.63 billion tonnes. This positions it as one of the largest rare earth deposits in North America. Despite being debt-free and having sufficient cash runway for over a year, ARR remains unprofitable with increasing losses over five years. Ongoing metallurgical tests aim to optimize processing efficiency at Halleck Creek, enhancing its strategic potential.

- Get an in-depth perspective on American Rare Earths' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into American Rare Earths' track record.

Atlas Pearls (ASX:ATP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atlas Pearls Limited is engaged in the production and sale of South Sea pearls in Australia and Indonesia, with a market capitalization of A$58.82 million.

Operations: The company's revenue is derived from the sale of loose pearls, generating A$30.03 million in Australia and A$27.74 million in Indonesia.

Market Cap: A$58.82M

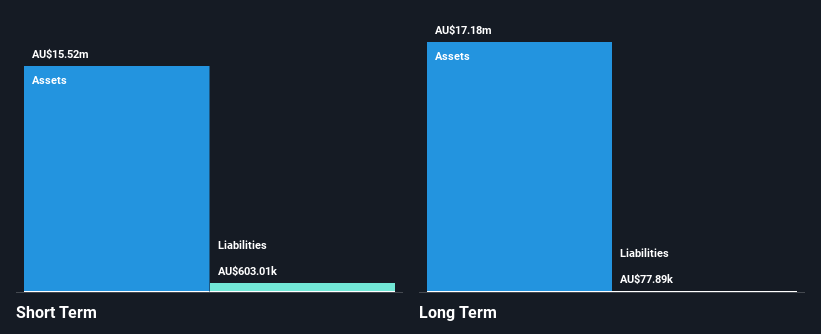

Atlas Pearls Limited, with a market cap of A$58.82 million, is engaged in the production and sale of South Sea pearls across Australia and Indonesia. Despite recent negative earnings growth, the company maintains strong financials with short-term assets exceeding both short and long-term liabilities. The management team is experienced, averaging 12.3 years in tenure. Although its dividend yield appears high at 19.33%, it isn't well covered by free cash flows, raising questions about sustainability. Atlas's debt levels are low and well-covered by cash flow, while its price-to-earnings ratio suggests it may be undervalued relative to the broader Australian market.

- Navigate through the intricacies of Atlas Pearls with our comprehensive balance sheet health report here.

- Learn about Atlas Pearls' historical performance here.

Myeco Group (ASX:MCO)

Simply Wall St Financial Health Rating: ★★★★★☆

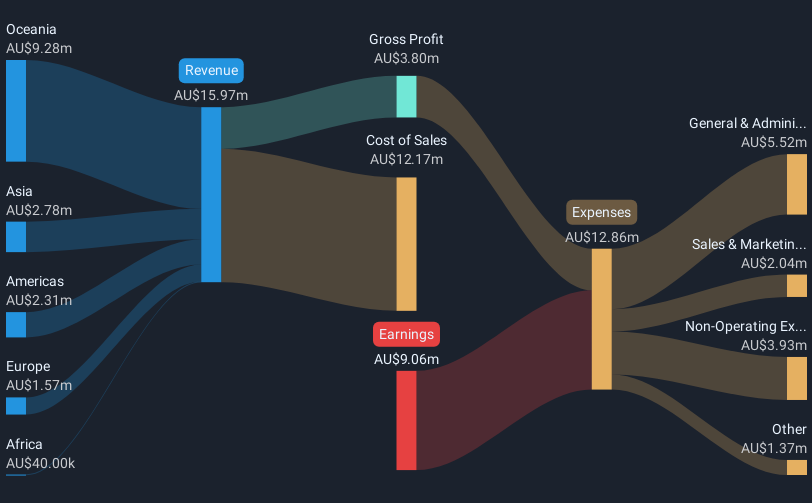

Overview: Myeco Group Ltd, along with its subsidiaries, focuses on the development, manufacturing, and sale of sustainable packaging materials across Oceanic regions, Asia, the United States, Europe, and Africa with a market cap of A$11.34 million.

Operations: The company generates revenue of A$15.97 million from its segments involving polyethylene films and renewable resource-based resins and finished products.

Market Cap: A$11.34M

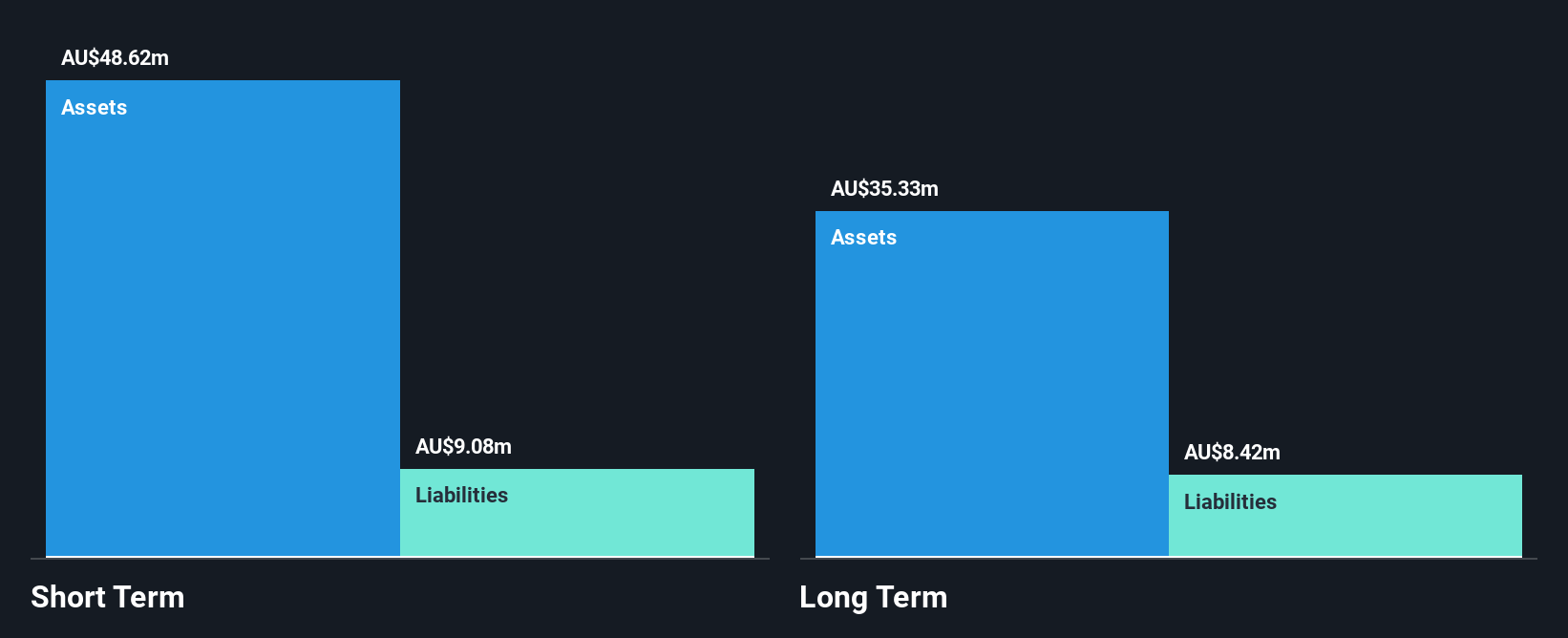

Myeco Group Ltd, with a market cap of A$11.34 million, focuses on sustainable packaging materials and reported half-year sales of A$7.72 million, up from A$6.19 million the previous year. Despite this growth in sales, the company remains unprofitable with a net loss of A$2.68 million for the same period. The firm is undertaking strategic repositioning and operational restructuring to reduce costs and enhance production flexibility through partnerships aligned with anticipated sales growth. Myeco's short-term assets exceed liabilities, providing some financial stability despite its high volatility and negative return on equity at -78.97%.

- Dive into the specifics of Myeco Group here with our thorough balance sheet health report.

- Understand Myeco Group's track record by examining our performance history report.

Where To Now?

- Gain an insight into the universe of 984 ASX Penny Stocks by clicking here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Atlas Pearls, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10