Cintas (NasdaqGS:CTAS) Appoints Scott Garula As New CFO

Cintas (NasdaqGS:CTAS) recently experienced a 10% price increase over the last week, coinciding with significant announcements and market dynamics. The company declared a quarterly cash dividend of $0.39 per share, continuing its long-standing tradition of returning capital to shareholders. Moreover, the appointment of Scott Garula as the new CFO might have added confidence in the management transition. Additionally, broader market conditions saw tech and bank stocks lead gains, with the market rising by 7% during the same period. These factors during an overall positive market trend likely supported Cintas's share price increase.

You should learn about the 1 risk we've spotted with Cintas.

Rare earth metals are the new gold rush. Find out which 21 stocks are leading the charge.

The recent developments at Cintas, including the quarterly cash dividend announcement and the appointment of a new CFO, align with ongoing efforts to enhance shareholder value and maintain managerial stability. These factors likely contributed to the recent 10% price increase. Over the longer term, Cintas shares have delivered very large total returns of 354.59% over the past five years, reflecting robust performance and shareholder gains.

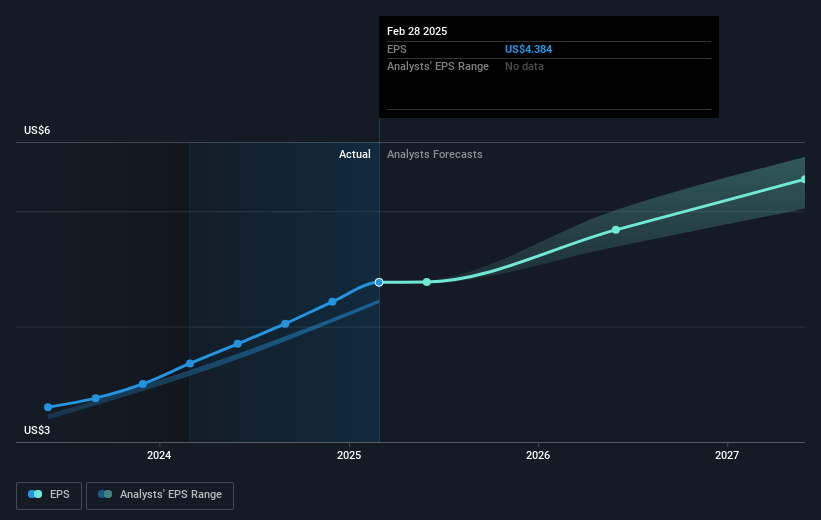

In the past year, Cintas outperformed the broader US market, which saw returns of 5.9%, indicating strong competitiveness in its industry. The abovementioned operational initiatives and increased emphasis on technology investments, like SAP and SmartTruck, could uplift revenue and earnings forecasts. Analysts are optimistic, forecasting an earnings increase to US$2.3 billion by April 2028, up from US$1.77 billion today.

While Cintas shares have recently risen to US$190.11, they remain 8.1% below the analyst consensus price target of US$206.85. This difference suggests potential upside, particularly if operational improvements materialize and forecasted growth aligns with market expectations. Investors should remain vigilant of any shifts in market conditions or company-specific risks that could impact these forecasts.

Unlock comprehensive insights into our analysis of Cintas stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cintas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10