Asian Market Highlights 3 Stocks That May Be Trading Below Estimated Value

Amid escalating trade tensions between the U.S. and China, Asian markets have been under pressure, with indices reflecting the broader impact of these geopolitical developments on global economic growth. Despite this volatility, investors are increasingly focusing on identifying stocks that may be trading below their estimated value as potential opportunities arise in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.92 | CN¥53.13 | 49.3% |

| RACCOON HOLDINGS (TSE:3031) | ¥855.00 | ¥1705.77 | 49.9% |

| Nishi-Nippon Financial Holdings (TSE:7189) | ¥1844.00 | ¥3655.42 | 49.6% |

| People & Technology (KOSDAQ:A137400) | ₩39250.00 | ₩77062.66 | 49.1% |

| Micro-Star International (TWSE:2377) | NT$133.50 | NT$265.53 | 49.7% |

| Bairong (SEHK:6608) | HK$6.85 | HK$13.51 | 49.3% |

| AeroEdge (TSE:7409) | ¥1895.00 | ¥3726.08 | 49.1% |

| BIKE O (TSE:3377) | ¥373.00 | ¥730.90 | 49% |

| World Fitness Services (TWSE:2762) | NT$80.00 | NT$156.52 | 48.9% |

| giftee (TSE:4449) | ¥1485.00 | ¥2960.11 | 49.8% |

Click here to see the full list of 264 stocks from our Undervalued Asian Stocks Based On Cash Flows screener.

Let's uncover some gems from our specialized screener.

BYD (SEHK:1211)

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally, with a market cap of HK$1.15 trillion.

Operations: The company's revenue segments include CN¥620.73 billion from automobiles and related products, and CN¥179.13 billion from mobile handset components, assembly service, and other products.

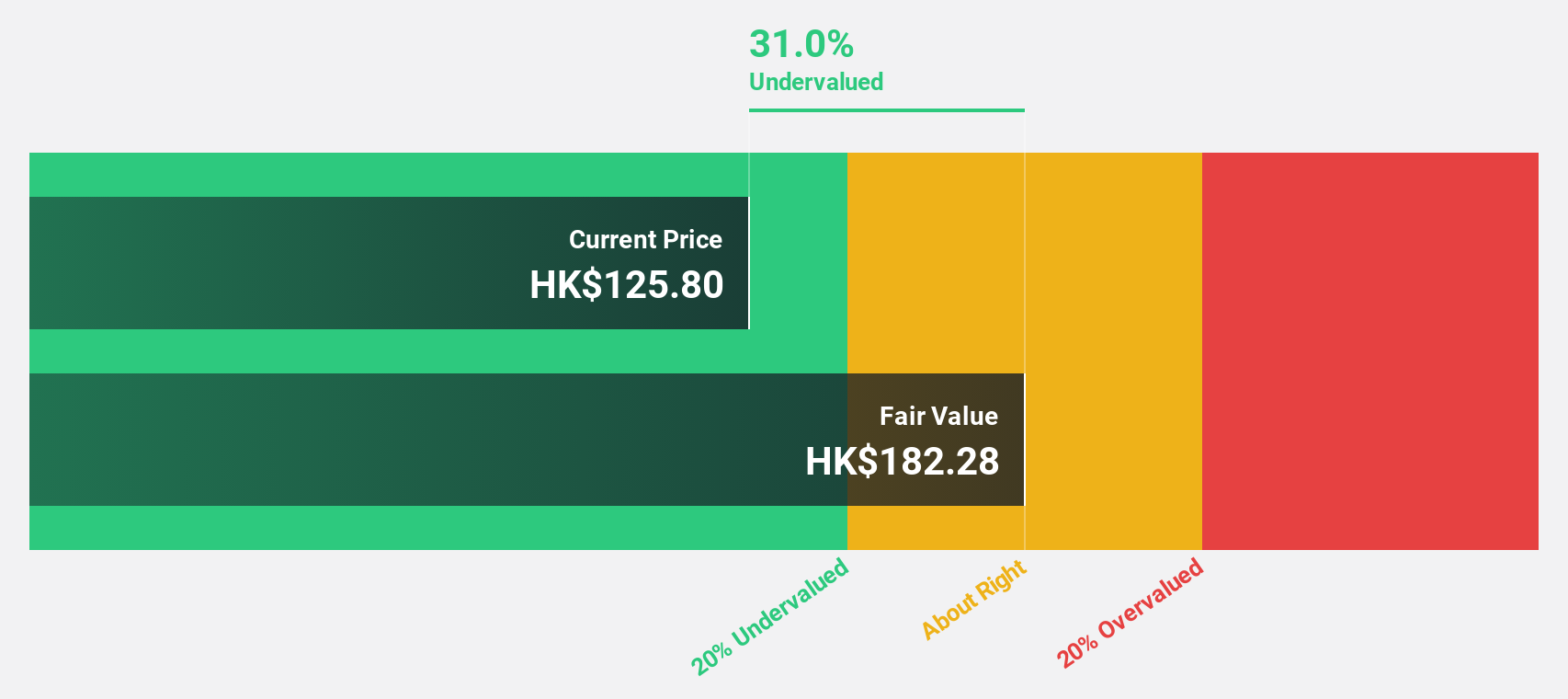

Estimated Discount To Fair Value: 29.2%

BYD Company Limited appears undervalued based on cash flows, trading at 29.2% below its estimated fair value of HK$530.72 per share. The company recently reported a significant increase in net profit guidance for Q1 2025, driven by record sales in the new energy vehicle sector and enhanced profitability from economies of scale and vertical integration. Despite slower forecasted revenue growth compared to peers, BYD's earnings are expected to outpace the Hong Kong market average.

- Our earnings growth report unveils the potential for significant increases in BYD's future results.

- Unlock comprehensive insights into our analysis of BYD stock in this financial health report.

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company focused on the research, development, manufacture, and sale of bioactive material-based beauty and health products in China, with a market cap of HK$77.28 billion.

Operations: The company generates CN¥5.54 billion in revenue from its bioactive material-based beauty and health products segment in China.

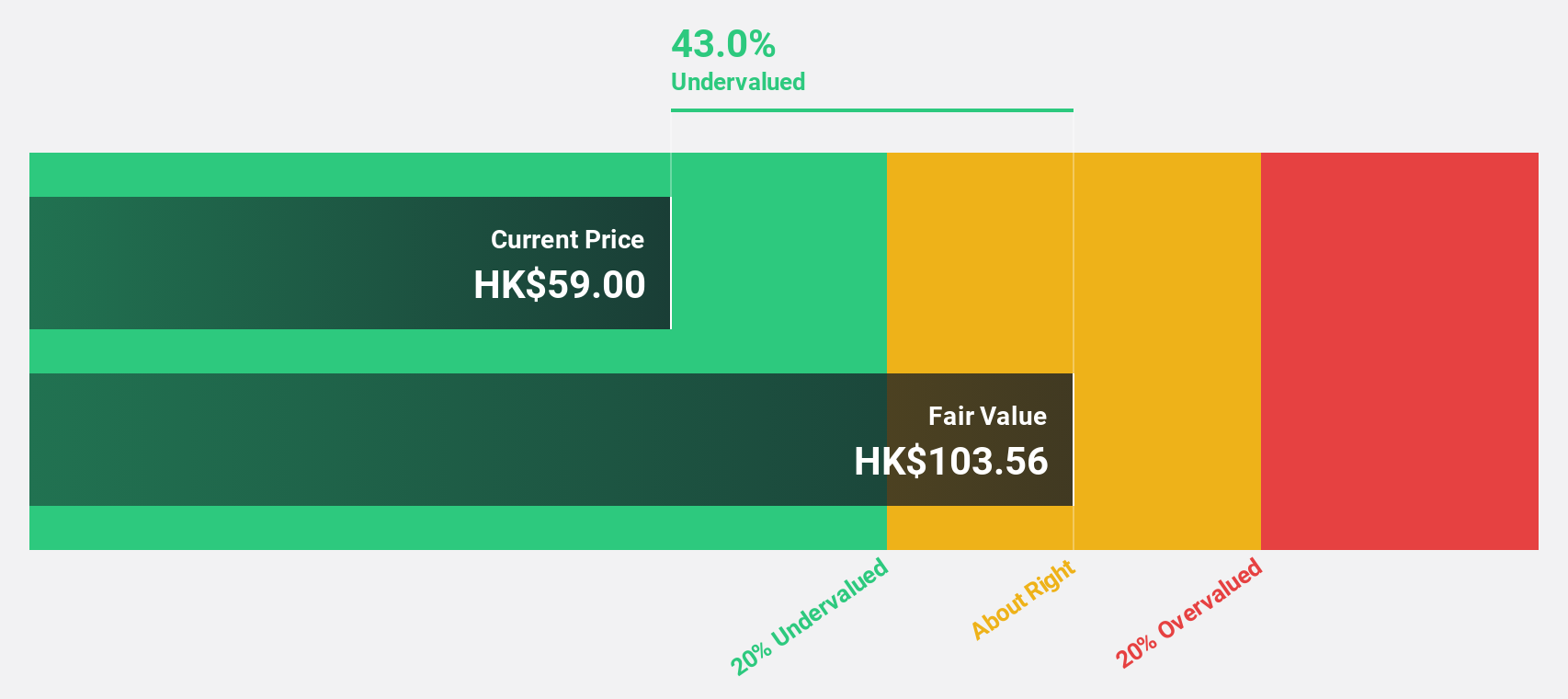

Estimated Discount To Fair Value: 25.9%

Giant Biogene Holding is trading at HK$76, significantly below its estimated fair value of HK$102.59, suggesting it is undervalued based on cash flows. The company reported robust earnings growth for 2024, with net income rising to CNY 2.06 billion from CNY 1.45 billion the previous year. With revenue forecasted to grow at 22.4% annually and earnings expected to increase by over 20% per year, Giant Biogene demonstrates strong financial prospects amidst a favorable market position in Asia.

- The growth report we've compiled suggests that Giant Biogene Holding's future prospects could be on the up.

- Click here to discover the nuances of Giant Biogene Holding with our detailed financial health report.

BYD Electronic (International) (SEHK:285)

Overview: BYD Electronic (International) Company Limited is an investment holding company focused on the design, manufacture, assembly, and sale of mobile handset components and modules both in China and globally, with a market cap of HK$76.50 billion.

Operations: The company generates revenue of CN¥177.31 billion from its operations in the manufacture, assembly, and sale of mobile handset components and modules.

Estimated Discount To Fair Value: 36.2%

BYD Electronic (International) is trading at HK$33.95, significantly below its estimated fair value of HK$53.21, highlighting its undervaluation based on cash flows. The company reported an increase in net income to CNY 4.27 billion for 2024, with earnings per share rising to CNY 1.89 from CNY 1.79 the previous year. Despite a volatile share price recently, earnings are forecasted to grow significantly at over 20% annually, exceeding the Hong Kong market average growth rate.

- According our earnings growth report, there's an indication that BYD Electronic (International) might be ready to expand.

- Take a closer look at BYD Electronic (International)'s balance sheet health here in our report.

Turning Ideas Into Actions

- Embark on your investment journey to our 264 Undervalued Asian Stocks Based On Cash Flows selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Giant Biogene Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

免責聲明:投資有風險,本文並非投資建議,以上內容不應被視為任何金融產品的購買或出售要約、建議或邀請,作者或其他用戶的任何相關討論、評論或帖子也不應被視為此類內容。本文僅供一般參考,不考慮您的個人投資目標、財務狀況或需求。TTM對信息的準確性和完整性不承擔任何責任或保證,投資者應自行研究並在投資前尋求專業建議。

熱議股票

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10